Introduction:

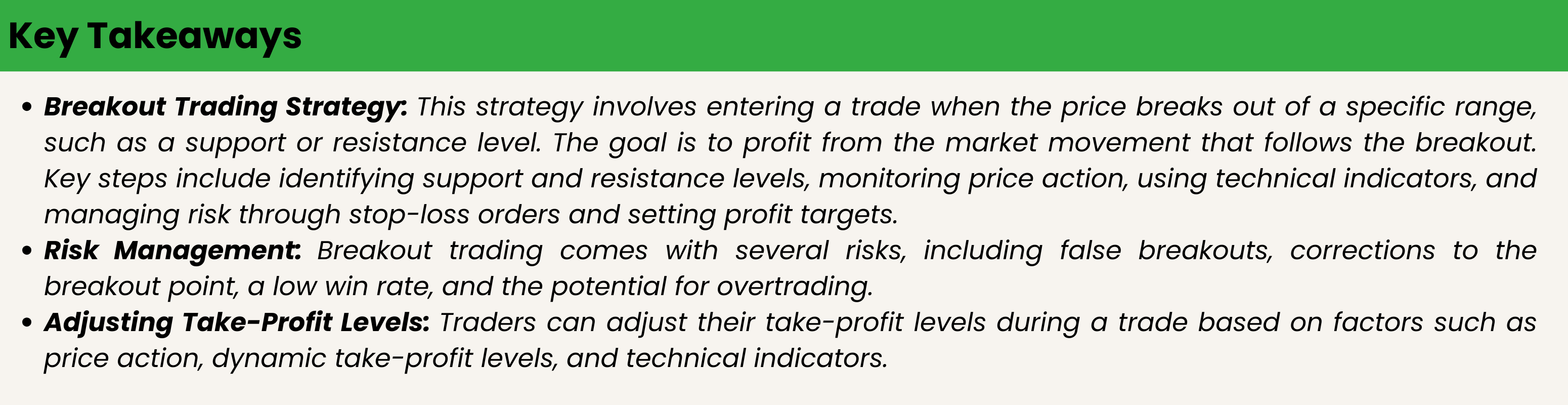

The strategy of breakout trading in the Forex market involves entering a trade when the price breaks out of a specific range, such as a support or resistance level. The aim is to enter the trade promptly after the price successfully breaks out of its range and take advantage of the subsequent market movement. Traders can execute trades by closely observing price movements or by placing buy stop and sell stop orders.

To effectively employ the breakout trading strategy, it is important to:

1. Identify levels of support and resistance; Determine where prices tend to halt and reverse. These levels serve as strong signals indicating potential breakouts.

2. Observe breaches in resistance or support levels: A breach in resistance may suggest that the price has momentum for further upward movement, while a break in support could indicate potential downward trends.

3. Monitor price action: Keep a close watch on how prices are behaving to confirm whether the breakout is genuine or not. It can also be helpful to set up alerts that will notify you when prices approach your monitored level.

4. Utilize technical indicators: Some traders employ tools such as the Ichimoku Cloud or the Relative Strength Index (RSI) to validate breakout signals and avoid false indications.

5. Implement risk management: Place a stop loss order below the breakout point for long positions or above it for short positions. This precautionary measure helps mitigate potential losses if the breakout fails.

6. Establish profit targets: Determine your exit strategy by analyzing support and resistance levels, along with other factors like market conditions and your trading approach.

Keep in mind that breakout trading tends to be favored by short term traders who seek to capitalize on swift market movements within a limited timeframe. By following these guidelines and applying effective risk management techniques, you can enhance your probability of achieving success in breakout trading within the Forex market.

Common Risks to trading Breakouts:

The breakout trading strategy in the Forex market involves entering a trade when the price breaks out of a specific range, such as surpassing a support or resistance level. The objective is to enter the trade promptly once the price successfully breaks out of its range and profit from subsequent market movements.

However, there are certain risks associated with this strategy, which include:

1. False breakouts: False breakouts occur when the price temporarily moves beyond an established support or resistance level but then retraces back within its previous range. This can lead to losses for traders who enter positions based on the breakout, only to witness the price reversing its direction.

2. Corrections to breakout point: Following a breakout, it is possible for the price to retrace back to the initial breakout point before continuing in its original direction. This can result in traders prematurely exiting their positions either at a small profit or even at a loss due to concerns about another false breakout occurring.

3. Low win rate: Breakout trading often exhibits a low win rate since many breakouts may not be successful in sustaining their momentum. Traders need to be prepared for potential losing trades and effectively manage their risk accordingly.

4. Overtrading: Breakout trading has the potential of leading traders, particularly novices, into overtrading where they may feel tempted to chase every possible breakout opportunity.This could lead to higher trading expenses and a decrease in overall profitability.

To minimize these risks, it is advisable for traders to implement effective risk management strategies, such as placing stop loss orders and using technical indicators to validate breakouts. Moreover, traders should exercise patience and wait for clear confirmation of a legitimate breakout before initiating a trade.

Risk Management in Breakout Trading:

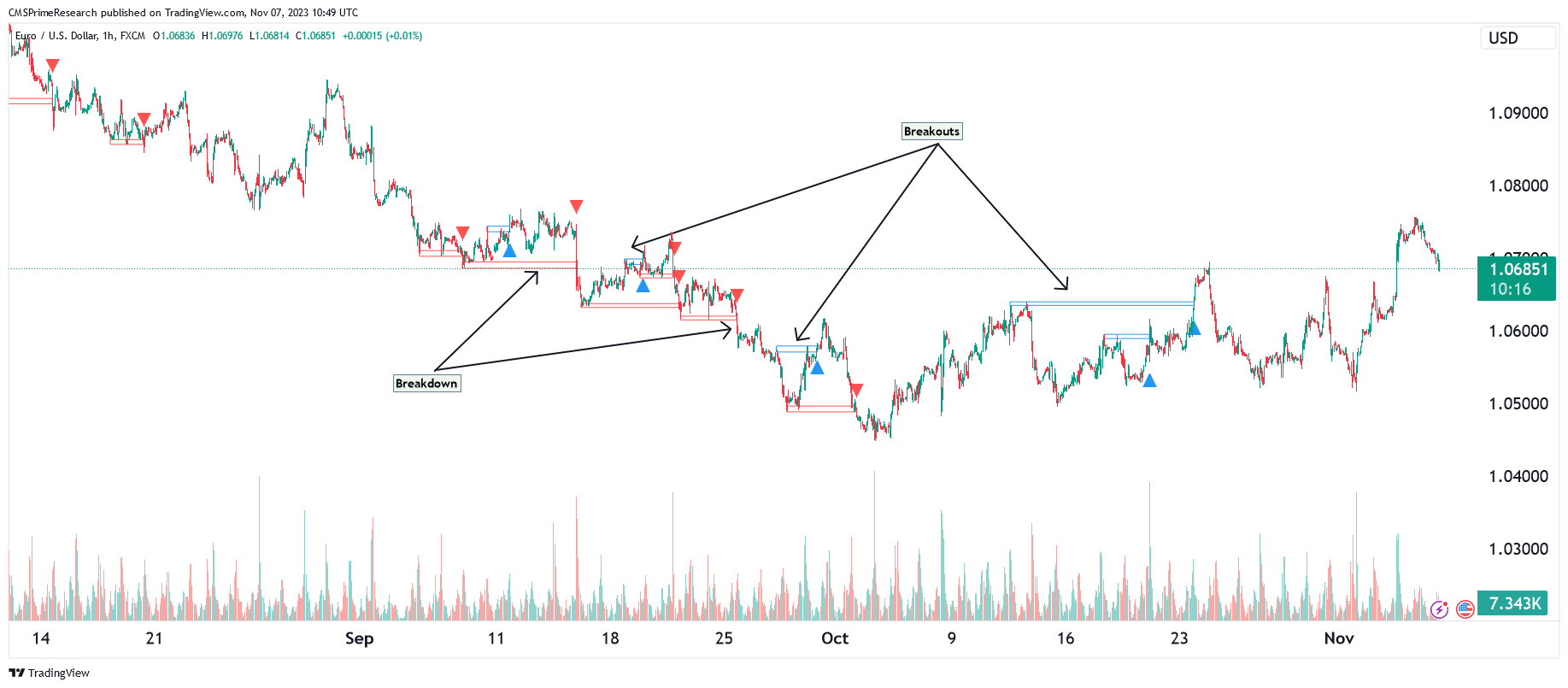

To effectively handle the risks involved in trading breakouts in the currency market, it is important to follow these guidelines:

1. Determine the support and resistance levels: It is crucial to identify the points at which prices tend to halt and reverse. These levels serve as strong indicators of potential breakout points.

2. Watch for breaches in resistance or support levels: A breach in resistance suggests that prices may have the momentum to rise further, while a break in support indicates that prices could potentially decline even more.

3. Keep an eye on price action: Continuously monitor how prices are behaving to confirm the validity of a breakout. You can also set up alerts that will notify you when prices approach your monitored level.

4. Utilize technical indicators: Some traders rely on indicators such as the Ichimoku Cloud or Relative Strength Index (RSI) to verify breakouts and avoid false signals.

5. Implement risk management strategies: For long positions, place a stop loss order below the breakout level and for short positions, place it above the breakout level. This helps minimize losses if the breakout does not materialize as expected.

To improve your chances of success in breakout trading within the Forex market, it is crucial to establish profit targets. This involves assessing support and resistance levels, market conditions and your trading strategy to determine the ideal exit point for a trade. Additionally, practicing effective risk management will further enhance your potential for success.

What are the Various Stop Loss and Profi Target Levels:

1. Support and resistance levels: These key levels often serve as points where price movement halts and reverses. To protect a long position, set your stop loss order slightly below the breakout level; for a short position, place it slightly above. Determining your take profit target can involve analyzing support and resistance levels, along with other factors like market conditions and your overall trading strategy.

2. Percentage based stop loss: This approach involves setting a stop loss at a specific percentage below the entry price for long positions or above it for short positions. By doing so, you limit potential losses to a predetermined percentage of your investment.

3. Moving average based stop loss: Another technique employed by traders is setting stop loss orders just below longer term moving average prices rather than shorter term ones. This method utilizes moving averages as indicators to determine suitable exit points.

4. To effectively manage risk and maximize profits in breakout trading, it is crucial to set appropriate stop loss and take profit levels. One method is to use the market’s volatility as a guide, such as employing the Average True Range (ATR) indicator. For a long position, you can place a stop loss at a certain multiple of the ATR value below the entry price, while for a short position, it can be placed above the entry price.

Always remember that implementing these levels and practicing sound risk management are key factors in improving your chances of success in the Forex market.

Conclusion

The strategy involves entering a trade when the price breaks out of a specific range, such as a support or resistance level, with the aim of profiting from the subsequent market movement. Key steps in this strategy include identifying support and resistance levels, monitoring price action, using technical indicators, and managing risk through stop-loss orders and setting profit targets.

However, the strategy comes with risks such as false breakouts, corrections to the breakout point, a low win rate, and the potential for overtrading. To mitigate these risks, traders should practice good risk management, such as setting stop-loss orders and using technical indicators to confirm breakouts.

Setting stop-loss and take-profit levels is crucial for managing risk and maximizing profits. Common stop-loss levels include support and resistance levels, percentage-based stop-loss, moving average-based stop-loss, and volatility-based stop-loss. Take-profit levels can be adjusted during a trade based on factors such as price action, dynamic take-profit levels, and technical indicators.

In conclusion, while the breakout trading strategy can be profitable, it requires careful risk management and a thorough understanding of market dynamics. Traders should be prepared for the possibility of losing trades and manage their risk accordingly.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.