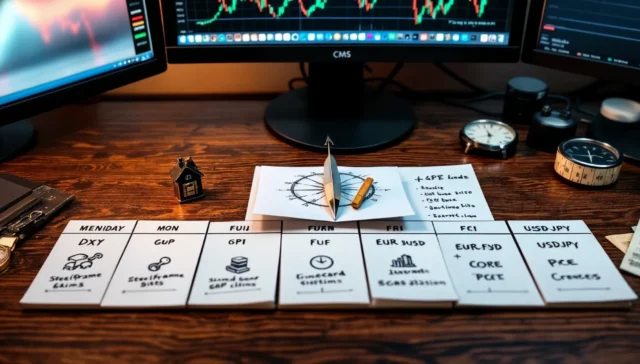

Week Ahead: U.S. Jobs Report and Fed Signals to Dominate

A Market on Edge After Jackson Hole The new trading week, from September 1 to 6, 2025, opens with the dollar under pressure after Powell’s

Adding {{itemName}} to cart

Added {{itemName}} to cart