Introduction

In the changing world of investment evaluating performance is crucial, for both investors and newcomers. This becomes more important when dealing with the often volatile currency markets. In this article we will explore three measures of risk adjusted performance – the Sortino Ratio, the Omega Ratio and the Tail Ratio – and their significance in relation to currency markets.

These ratios provide insights into how different investment strategies manage currency risk while aiming to maximize returns. Whether you’re a Thai investor navigating emerging markets or a global trader dealing with the intricacies of currency hedging these metrics can serve as your guiding tool. We will delve into each ratio explaining its calculation method and highlighting its applications, in the currency market. By the end of this article you’ll have an understanding of how these ratios can assist you in making informed decisions and achieving your investment objectives.

Sortino Ratio

The Sortino Ratio is a measure used to assess the performance of investment portfolios by considering the impact of risk. It is similar, to the Sharpe Ratio. Focuses on penalizing return variances, which makes it more suitable for investors who are concerned about potential losses (Chamber, Lu, 2016). In currency markets the Sortino Ratio can be applied to evaluate the performance of investment strategies involving currencies and their associated risks.

To calculate the Sortino Ratio you need to determine how much the portfolios return exceeds the risk rate and divide it by the deviation of negative returns (which represents downside deviation). A higher Sortino Ratio indicates risk adjusted performance indicating that an investment strategy is generating returns relative to downside risk.

A study conducted by Tanatuch and A. A. Borochkin in 2017 found that in currency markets the Sortino Ratio can be used to evaluate investment strategies such as currency hedging, crosshedging and trading in emerging or frontier markets. By comparing Sortino Ratios across strategies investors can identify which approach is most effective, in managing currency risk and maximizing risk adjusted returns.

According to Tanatuchs research they discovered that Thai investors could employ a hedging strategy to decrease currency risk and enhance risk adjusted returns from their investments, in emerging markets. They used performance metrics, including the Sortino Ratio to assess the efficacy of this strategy in reducing risk and increasing resilience to uncertainties.

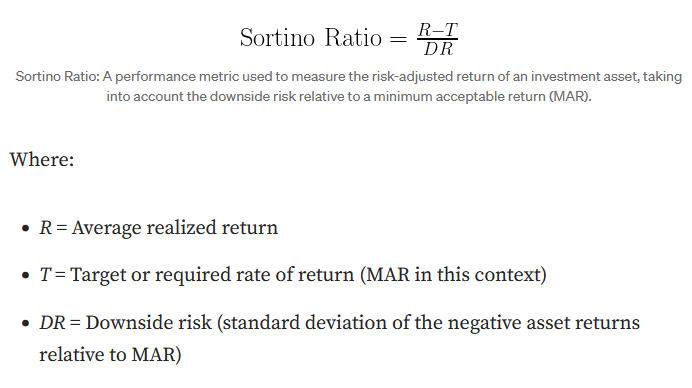

The chart displays the Rolling 1-Year Sortino Ratio for the stock “EURUSD,” while considering a Minimum Acceptable Return (MAR) set at 0%. This graphical representation provides a comparison between the current Sortino Ratio and its one-year moving average and mean values. In doing so, it offers insights into how the stock’s performance is adjusted for risk, particularly focusing on the downside volatility that investors want to avoid. This data helps investors and analysts assess how the currency’s returns align with their risk tolerance and expectations, emphasizing the management of unwanted downside variability.

To summarize the Sortino Ratio proves valuable in evaluating investment strategies within currency markets as it specifically focuses on risk. This enables investors to determine the approach, for managing currency risk and maximizing returns while considering risk factors.

Omega Ratio

The Omega Ratio serves as a measure to evaluate investment portfolios in terms of their potential, for both negative outcomes relative to a predetermined benchmark. It has gained popularity across markets and investment strategies including currency markets. Specifically in the realm of currency trading the Omega Ratio proves useful in assessing the performance of investment approaches and portfolios that involve currencies with their respective associated risks.

To calculate the Omega Ratio one must divide the probability weighted gains by the probability weighted losses while considering a predefined benchmark return. A higher Omega Ratio indicates performance as it signifies that an investment strategy generates returns per unit of downside risk.

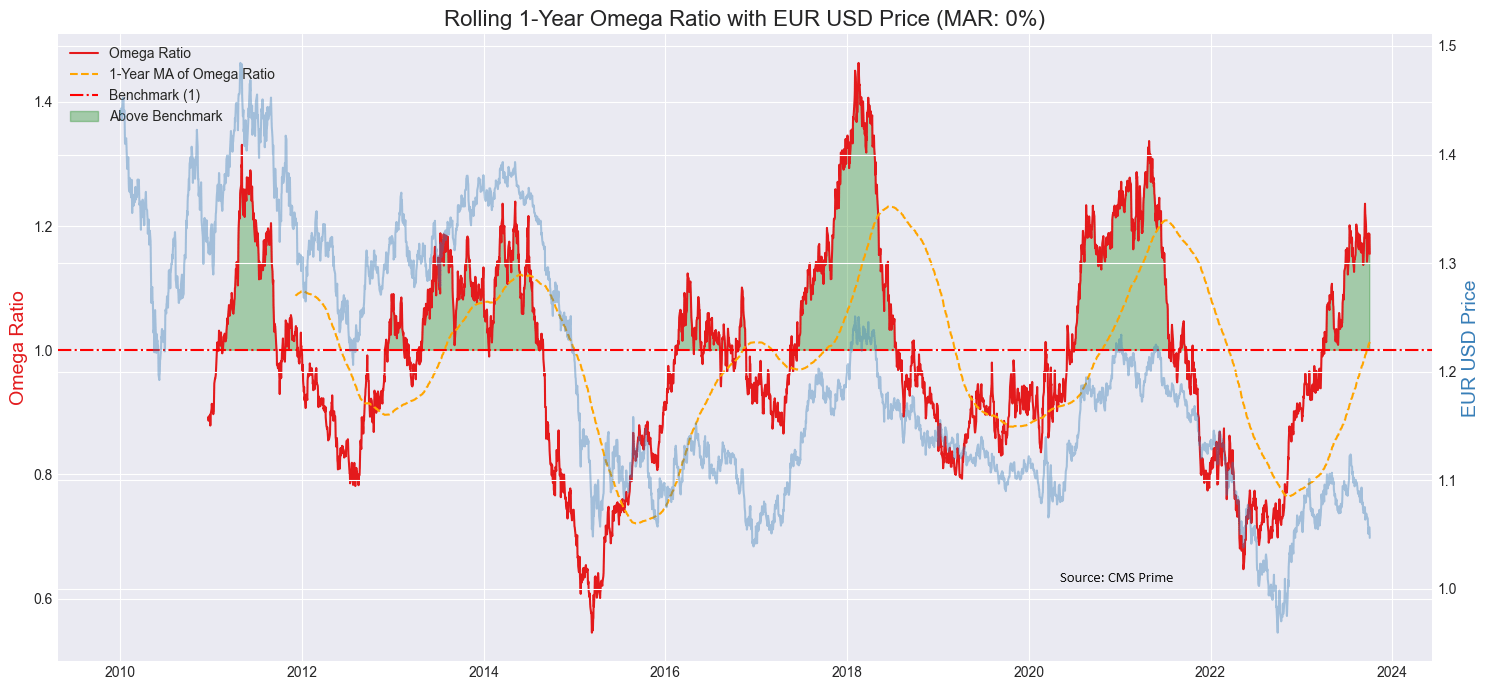

The chart illustrates the Rolling 1-Year Omega Ratio for the “EURUSD” currency pair, with a Minimum Acceptable Return (MAR) set at 0%. Within the chart, you’ll notice a green-shaded area that indicates time periods when the investment return justified the level of risk taken, as measured against the MAR threshold. Additionally, there’s a one-year moving average represented by an orange dashed line, providing a smoothed and averaged view of how the Omega Ratio has evolved over time. This information helps investors and analysts identify when the currency pair delivered returns that were in line with or exceeded the risk associated with the chosen benchmark MAR of 0%.

In currency markets the Omega Ratio can be employed to evaluate investment strategies such as currency hedging, crosshedging and trading in emerging or frontier markets. By comparing the Omega Ratios of strategies investors can determine which approach is most effective in managing currency risk and maximizing returns while considering risk adjustment.

In conclusion the Omega Ratio serves as a tool for evaluating investment strategies within currency markets due to its focus on both downside potential. This enables investors to identify approaches, for managing currency risk and achieving risk adjusted returns.

Tail Ratio

The Tail Ratio serves as a measure to assess the performance of investment portfolios. It focuses on the ratio, between returns and extreme negative returns. This measure proves valuable when evaluating investment strategies in markets with tailed return distributions like currency markets. In the realm of currency markets the Tail Ratio allows for evaluating investment strategies and portfolios involving currencies and associated risks.

To calculate the Tail Ratio one must divide the sum of returns exceeding a predetermined threshold (such as the percentile) by the sum of returns below another predetermined threshold (like the 5th percentile). A higher Tail Ratio indicates performance signifying that an investment strategy generates extreme positive returns compared to extreme negative returns.

In currency markets specifically investors can leverage the Tail Ratio to assess investment strategies such as currency hedging, crosshedging or trading in emerging or frontier markets. By comparing Tail Ratios across strategies investors can identify which approach proves effective, for managing currency risk and maximizing risk adjusted returns.

To sum it up the Tail Ratio proves to be an instrument, in assessing investment tactics in currency markets. By honing in on low returns it assists investors in pinpointing the most efficient method, for handling currency risk and maximizing returns that are adjusted for risk.

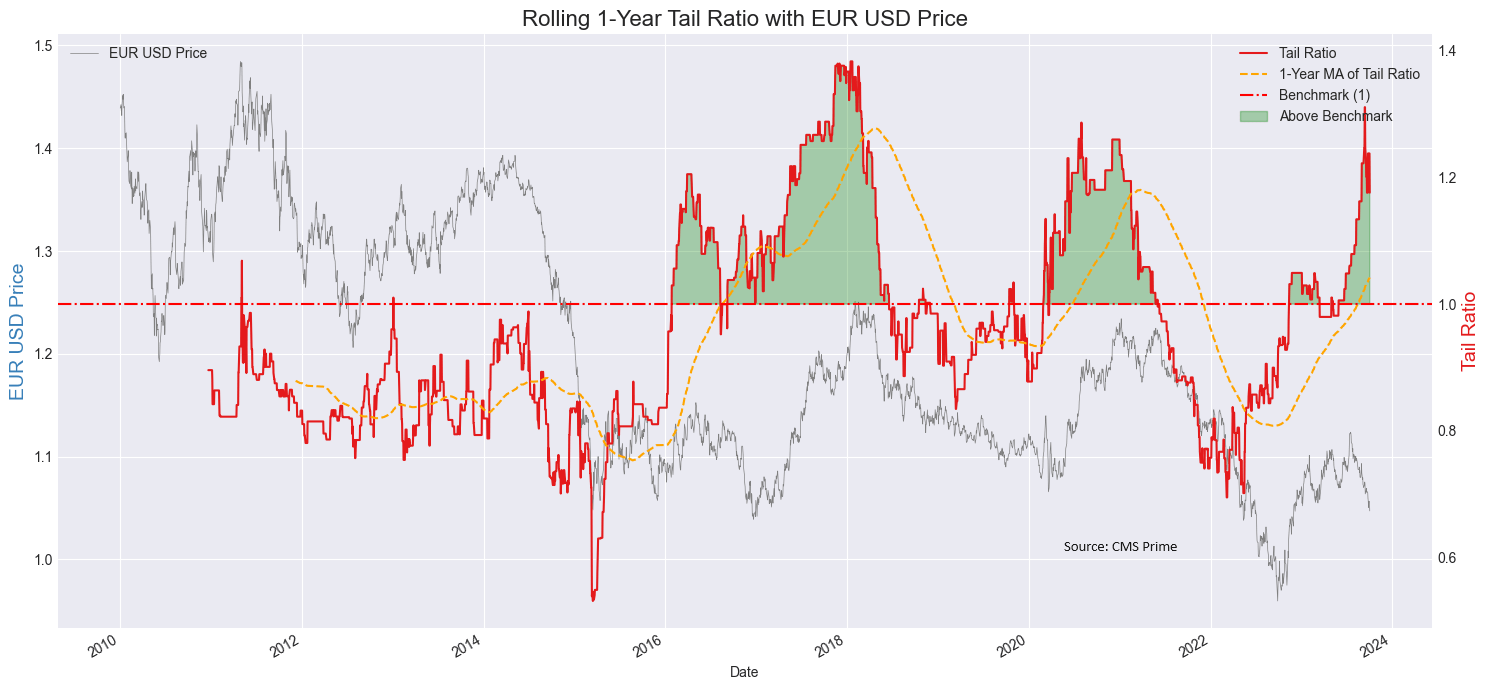

The chart displays the Rolling 1-Year Tail Ratio for the “EURUSD” currency pair, with the price movement of this pair in the background. The green-shaded area on the chart represents time periods when there were more instances of extreme positive returns compared to negative returns. In contrast, the orange dashed line on the chart offers a smoothed and averaged representation of the Tail Ratio, calculated over the same one-year timeframe. This information helps investors and analysts visualize when the currency pair had periods of exceptionally favorable returns relative to extreme losses.

Conclusion:

In conclusion, the Sortino Ratio, Omega Ratio, and Tail Ratio are valuable tools for evaluating investment strategies within currency markets. These ratios enable investors to assess the performance of investment portfolios by considering the impact of risk, downside potential, and extreme returns. By comparing these ratios across different strategies, investors can identify the most effective approach for managing currency risk and maximizing risk-adjusted returns. As financial markets continue to evolve, these measures will remain crucial in helping investors navigate the complex world of currency trading and make informed decisions to achieve their financial goals.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.