EUR/USD Faces Volatility Amid Shifts in U.S. Employment Data and Technical Levels

EUR/USD Faces Volatility Amid Shifts in U.S. Employment Data and Technical Levels

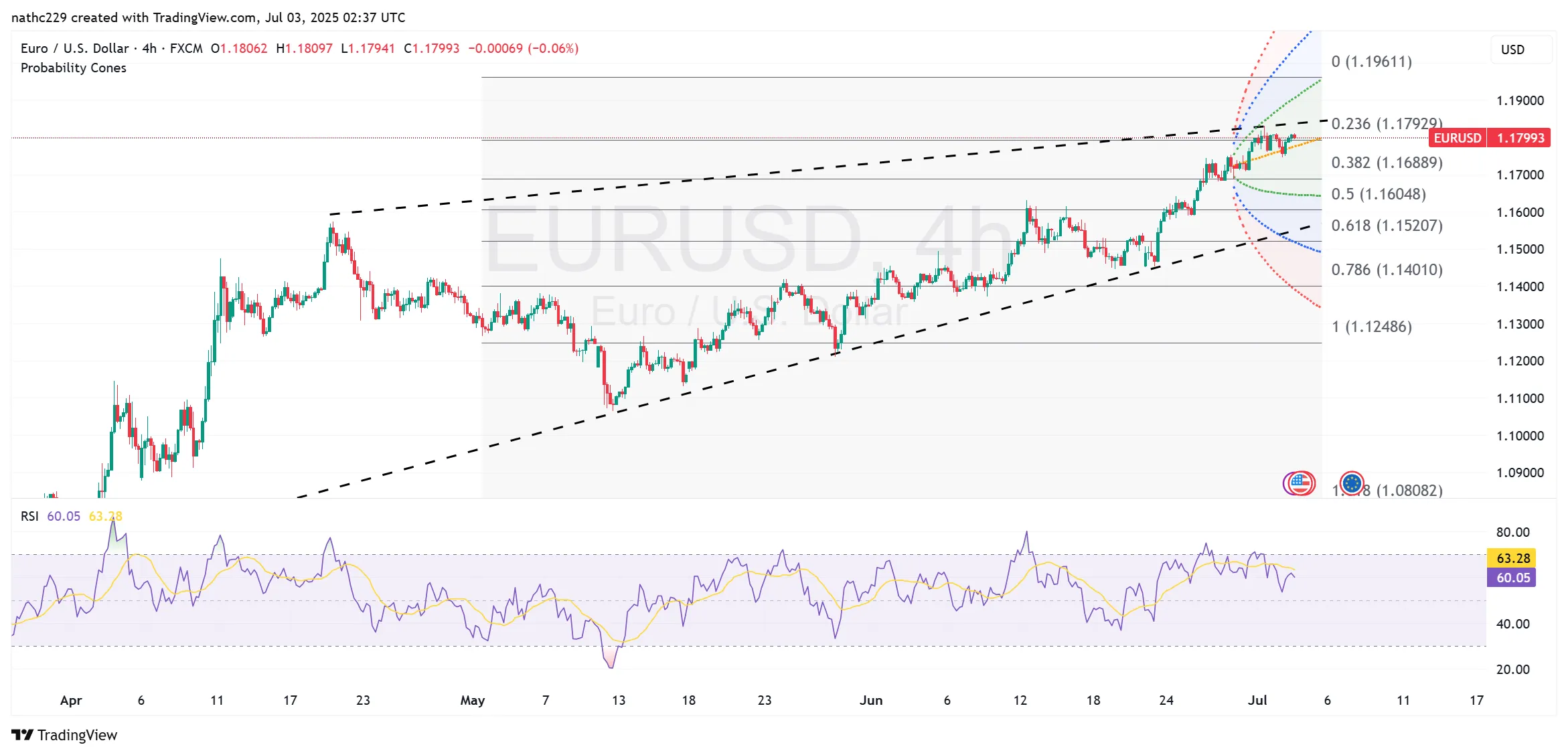

EUR/USD recently experienced increased volatility, highlighting the currency pair’s sensitivity to key economic indicators, particularly U.S. employment data. The surprising June ADP employment report has temporarily softened bearish momentum, but the upcoming non-farm payrolls and jobless claims figures remain crucial in determining short-term market direction. Technical indicators suggest cautious optimism for bulls, but heightened market positioning could pose downside risks.

Technical Analysis

EUR/USD began trading near 1.1770 in the New York session after reaching an overnight high of 1.1810 on EBS. Initially, the currency pair faced selling pressure, declining to an intraday low of 1.1747, driven by stronger U.S. yields and broad-based dollar buying. The surprising negative ADP employment data—showing a decline of 33,000 jobs against expectations of a 95,000-job increase—caused a notable shift, softening yields and reducing demand for the dollar, subsequently allowing EUR/USD to rally.

However, despite this mid-session recovery, EUR/USD failed to hold all its gains, settling around 1.1800 by the afternoon, down slightly by 0.05% on the day. Immediate technical resistance remains near the recent high at 1.1810, with further upside challenges at 1.1850 and the key psychological level at 1.1900.

Support levels are closely watched at the intraday low of 1.1747, followed by deeper supports at 1.1700 and the 10-day moving average currently near 1.1680. The recent formation of a daily long-legged doji candlestick indicates market indecision, suggesting that traders should be cautious around current levels, particularly ahead of major economic releases.

The Relative Strength Index (RSI) on daily charts continues to trend upward, signaling potential bullish sentiment but also highlighting risks of near-term overextension, especially given the sharp gains of over 3.8% in June.

Economic Indicators and Market Factors

The unexpectedly weak June ADP employment report significantly altered market expectations, casting doubt on the strength of the U.S. labor market recovery. This report showed a substantial loss of 33,000 jobs compared to market expectations of a gain, significantly revising May’s figure downward as well. These developments have reduced U.S. yields and the attractiveness of the dollar, benefiting EUR/USD in the short term.

Looking ahead, traders are closely focused on upcoming U.S. non-farm payrolls and jobless claims data. Strong labor market data could swiftly reverse recent dollar weakness, reasserting bearish pressures on EUR/USD. Conversely, another round of disappointing employment figures could further undermine dollar strength, propelling EUR/USD towards higher resistance zones.

The narrowing of U.S.-Germany yield spreads following weak U.S. data points is another crucial factor bolstering EUR/USD. Continued tightening in these yield differentials would provide additional upward momentum for the euro, reinforcing bullish sentiment.

Risks and Market Sentiment

Despite recent bullish sentiment, EUR/USD faces significant downside risks. Heavily stretched long positioning, reflected in substantial June gains, indicates vulnerability to profit-taking and potential reversals, especially if U.S. economic data proves stronger than expected.

Additionally, overbought conditions indicated by daily and monthly RSIs pose technical risks, suggesting that a corrective move or consolidation could occur imminently, particularly near key resistance levels.

Geopolitical developments, especially ongoing trade negotiations and broader market sentiment shifts, also represent potential volatility triggers. Traders must remain vigilant, as sudden shifts in risk appetite could swiftly alter currency dynamics.

Trading Strategies

Traders with bullish exposure should closely monitor critical resistance levels at 1.1810, 1.1850, and 1.1900, ensuring protective stop-losses below immediate supports at 1.1747 and 1.1700. Given the significant long positioning, a cautious approach is advisable to mitigate risks of sharp reversals.

Bearish traders may seek clear confirmation of a reversal or sustained break below the immediate support at 1.1747 before initiating new short positions. Confirmation of strengthening U.S. economic indicators or a hawkish shift in Fed rhetoric would provide a robust bearish catalyst.

Conclusion

EUR/USD remains subject to substantial short-term volatility driven by crucial economic data and market positioning dynamics. While recent technical and fundamental developments support cautious bullishness, traders must remain prepared for rapid shifts, especially in light of key upcoming employment data releases