USD/JPY Bears Pause as Yen Demand Softens Amid Mixed Signals

USD/JPY has stabilized after its recent sell-off, trading in a subdued range near 147.50-148.00, as traders assess conflicting factors influencing the yen. The yen’s recent strength, primarily driven by risk aversion stemming from tariff threats, appears to have lost some momentum as positioning in yen longs becomes stretched. Though BOJ Governor Ueda’s commitment to reducing policy accommodation and sustained haven flows have supported yen strength, excessive yen longs and potential intervention risks from Japanese officials have capped further appreciation, leading to declining volatility across tenors.

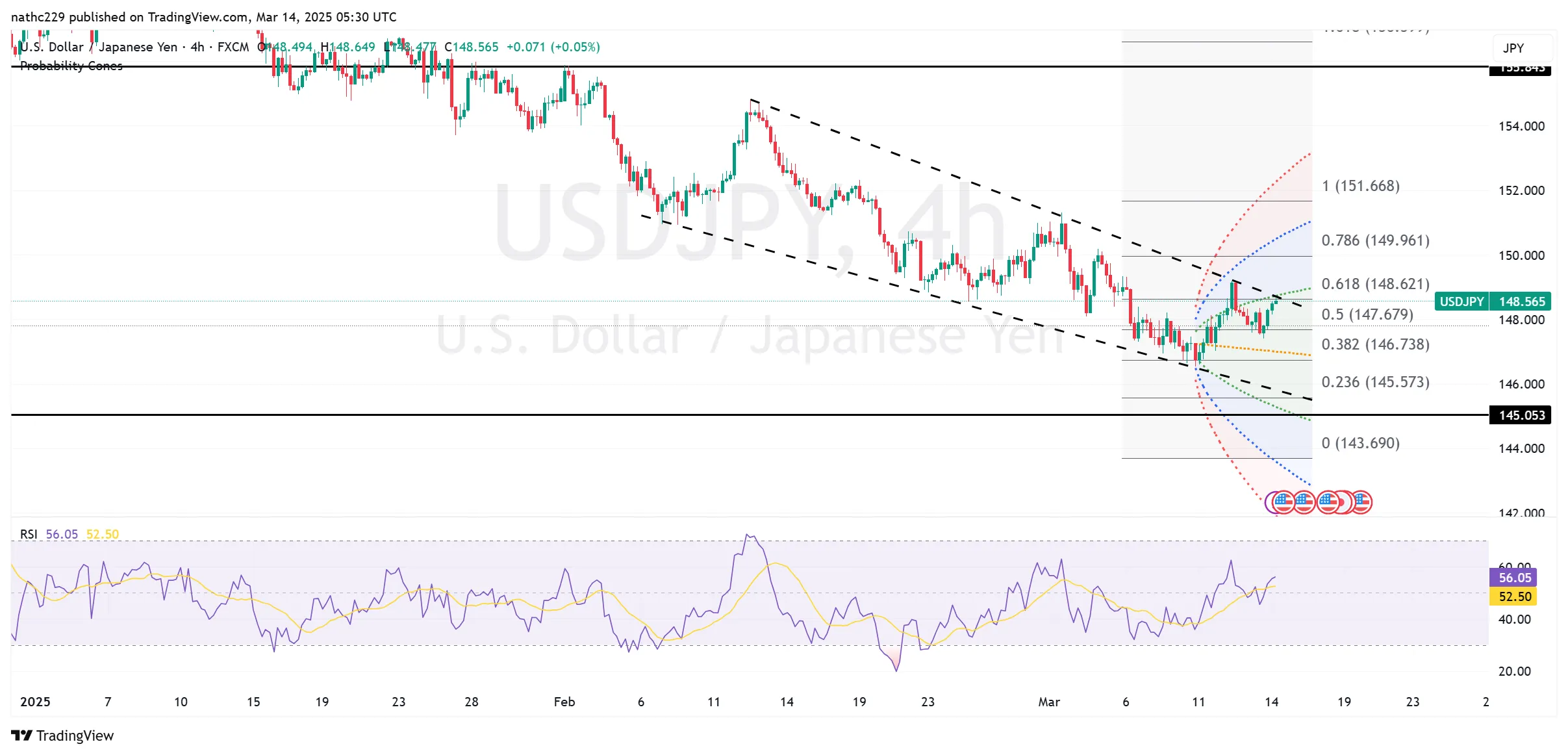

Technically, USD/JPY faces strong short-term resistance near the descending trendline at approximately 148.38, closely aligning with the 9-day EMA at 148.38. A sustained move above this area would open room toward 149.53, the February 26 high, potentially altering short-term bearish sentiment. On the downside, the immediate key support is at the lower Bollinger Band at 146.75, followed closely by the October 2 high at 146.52. A decisive break of these levels could extend the recent bearish momentum towards 145.00.

In the short term, USD/JPY will likely remain range-bound, with traders closely monitoring developments from next week’s Bank of Japan meeting and U.S. tariff implementation. Although lower volatility currently favors a limited price range, an unexpected shift in risk sentiment—particularly from tariff-related rhetoric—could trigger a fresh directional move. Until a decisive break occurs either above resistance near 149.20 or below support at 146.52, USD/JPY will likely consolidate recent losses, with market participants cautious ahead of upcoming policy clarity from both U.S. and Japanese authorities.