USD/JPY Remains Under Pressure as Stocks and Yields Slide; 146.50 Support Eyed

USD/JPY continues to trade under pressure amid persistent declines in U.S. equities and Treasury yields, reflecting cautious market sentiment driven by ongoing tariff threats, geopolitical uncertainties, and lingering concerns around the U.S. debt ceiling. The yen’s strength has been further bolstered by hedging-related flows, with the latest CFTC positioning data showing a record net long yen position. Notably, corporate treasuries and institutional accounts classified under hedging activities have driven this increase, suggesting a more sustainable, non-speculative demand for yen. This hedging-driven demand provides significant support for continued yen appreciation, especially if U.S. economic indicators remain weak.

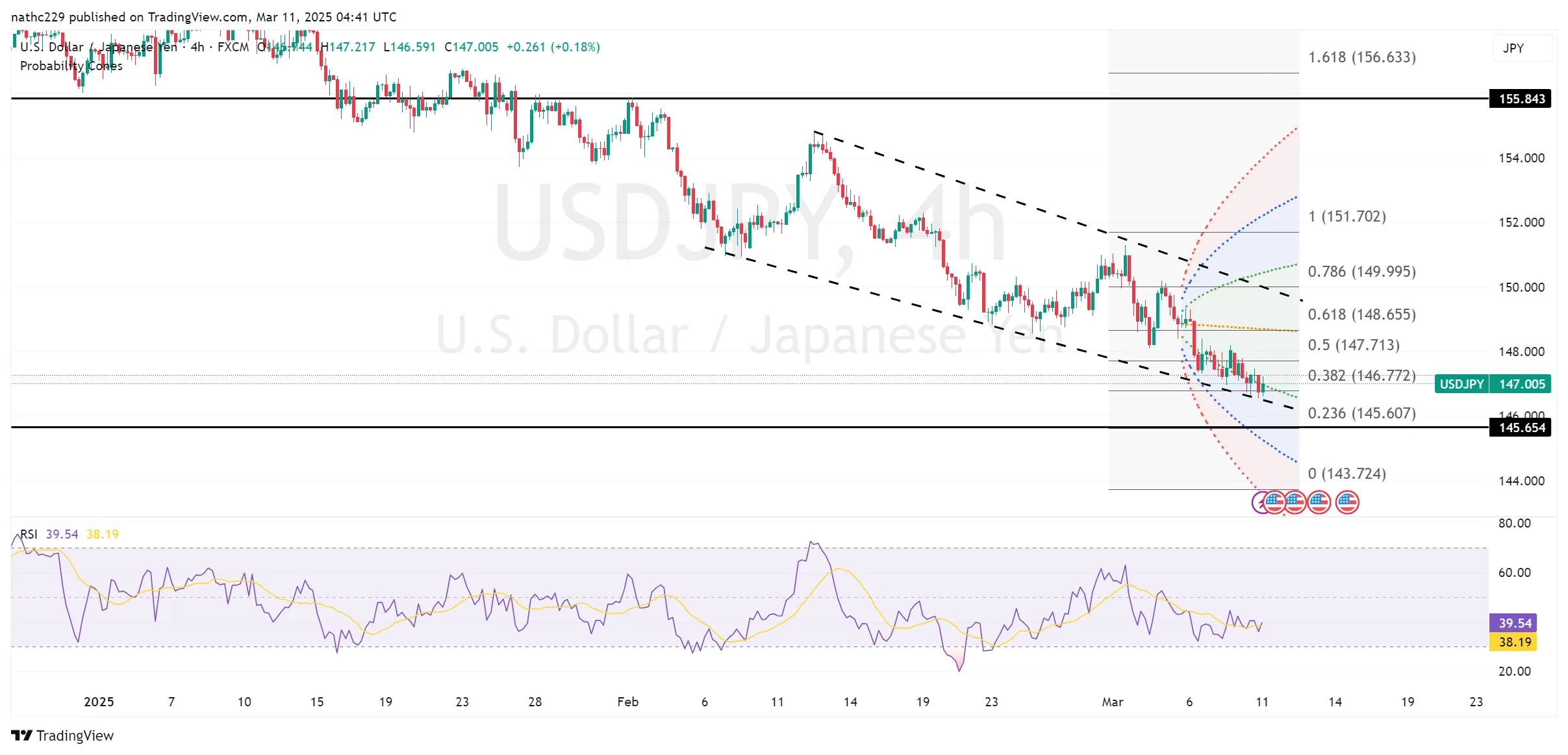

Technically, USD/JPY faces immediate support at the lower Bollinger band at 146.75, closely followed by the critical October 2 high at 146.52. A sustained break below 146.52 would likely accelerate bearish momentum, exposing deeper declines toward psychological support around the 145.00 handle. On the upside, initial resistance is seen at Friday’s high of 148.20, followed by stronger resistance at 148.56 (February 25 low) and the falling 9-day exponential moving average currently near 148.20. Short-term intraday charts indicate continued bearish pressure, with a clear descending trend line visible near 147.50-148.00, further capping potential rebounds.

In the week ahead, key U.S. economic data, including JOLTS, jobless claims, and upcoming inflation reports, will be crucial for USD/JPY direction. Should data further confirm U.S. economic weakness, Treasury yields are likely to remain suppressed, reinforcing yen strength. Additionally, BOJ-related commentary and geopolitical developments around tariffs and the U.S. budget could intensify risk aversion, further supporting yen demand. For now, technical indicators strongly suggest continued bearish bias, with potential rallies likely to encounter significant selling pressure near resistance at 148.20-148.56.