USD/JPY Under Persistent Pressure Amid Rising Economic Risks

USD/JPY remains on the defensive after hitting a fresh year-to-date low at 147.31, as persistent U.S. economic weakness and rising haven flows support the yen. Despite a modest intraday rebound, bearish sentiment is firmly intact, highlighted by Thursday’s U.S. employment data that showed layoffs surging to a four-year high, sending U.S. Treasury yields lower. Comments from Philadelphia Fed President Patrick Harker underscored increasing economic risks, reinforcing expectations of a potential Fed rate cut in May if Friday’s non-farm payrolls disappoint. Additionally, the delay of tariffs on Mexico only offered a brief respite for the dollar, emphasizing underlying market caution.

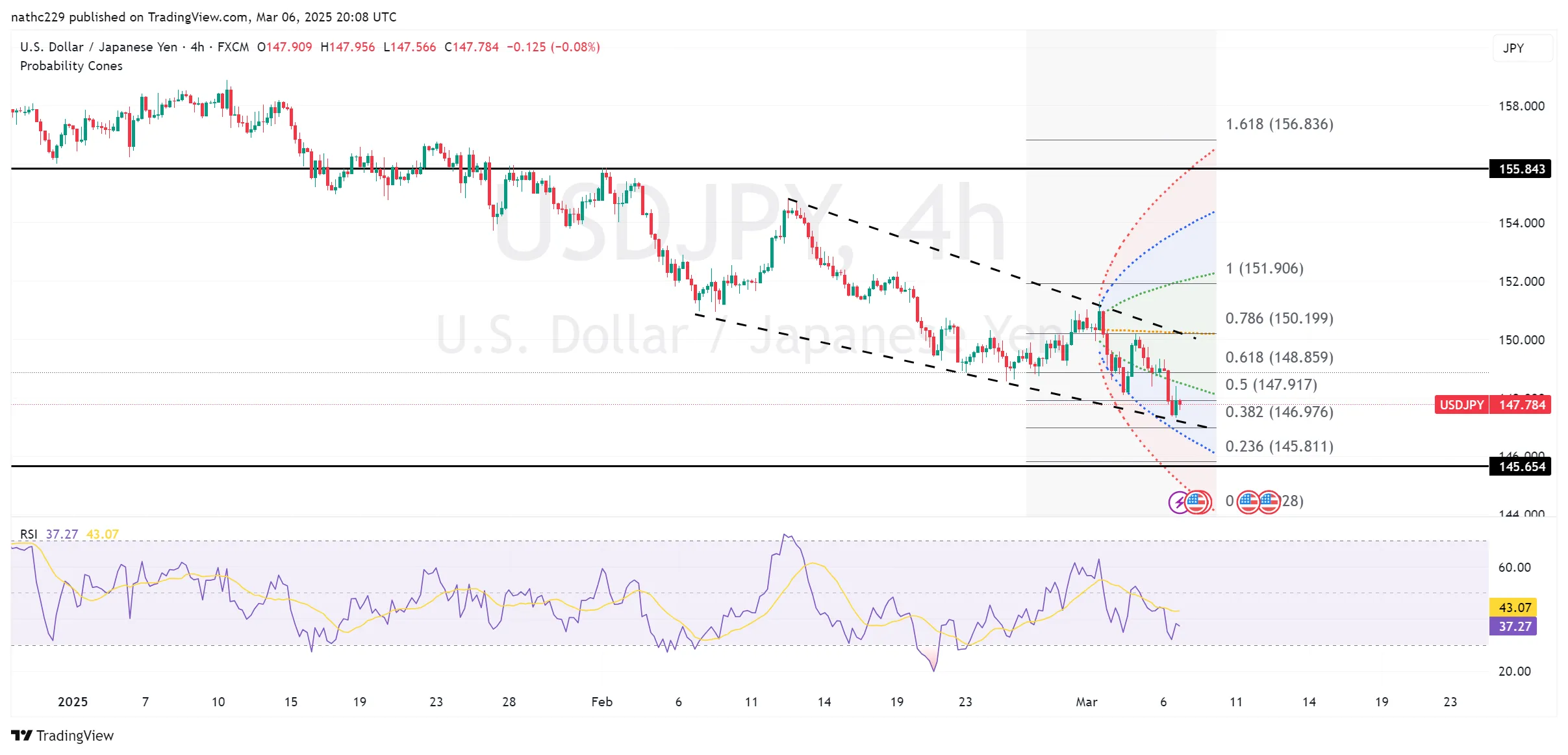

From a technical perspective, USD/JPY remains bearish after breaking decisively below critical support at 148.65 (December low) earlier this week. Short-term support now lies at the new 2025 low of 147.31, with a break potentially accelerating losses toward the September 3 high of 147.20, followed by the psychological support at 146.00. Immediate resistance stands at 149.12 (Thursday’s intraday high), then more significantly at 149.42, marked by the 9-day exponential moving average. Momentum indicators remain negative, with the RSI pointing lower and daily Bollinger Bands expanding downward, suggesting volatility could support further yen strength.

From a broader perspective, the bearish outlook for USD/JPY is reinforced by positioning data and the options market, with one-year risk reversals returning to their most bearish stance since October. Increasing concerns over global growth, persistent haven demand for the yen, and rising JGB yields are likely to attract additional passive yen buying. As long as the pair remains below the critical resistance level near 149.50, the technical bias strongly favors further yen gains and a potential move toward the mid-146 area if U.S. economic data continues to deteriorate.