USD/JPY Pressured by Risk Aversion, but Long Positioning Caps Yen Gains

USD/JPY remains under downside pressure as deteriorating risk sentiment and falling Treasury yields continue to benefit the yen as a safe-haven currency. Following weaker-than-expected U.S. ISM data and President Trump’s tariff-related remarks on Ukraine and Zelenskiy, equity markets have slumped, pulling Treasury yields lower. USD/JPY traded down near session lows around 149.94 after earlier hitting resistance at 151.30. Although downward momentum has intensified, technical support at the February 24 high of 149.86 has held firm so far, suggesting further bearish moves may be somewhat contained until additional catalysts emerge.

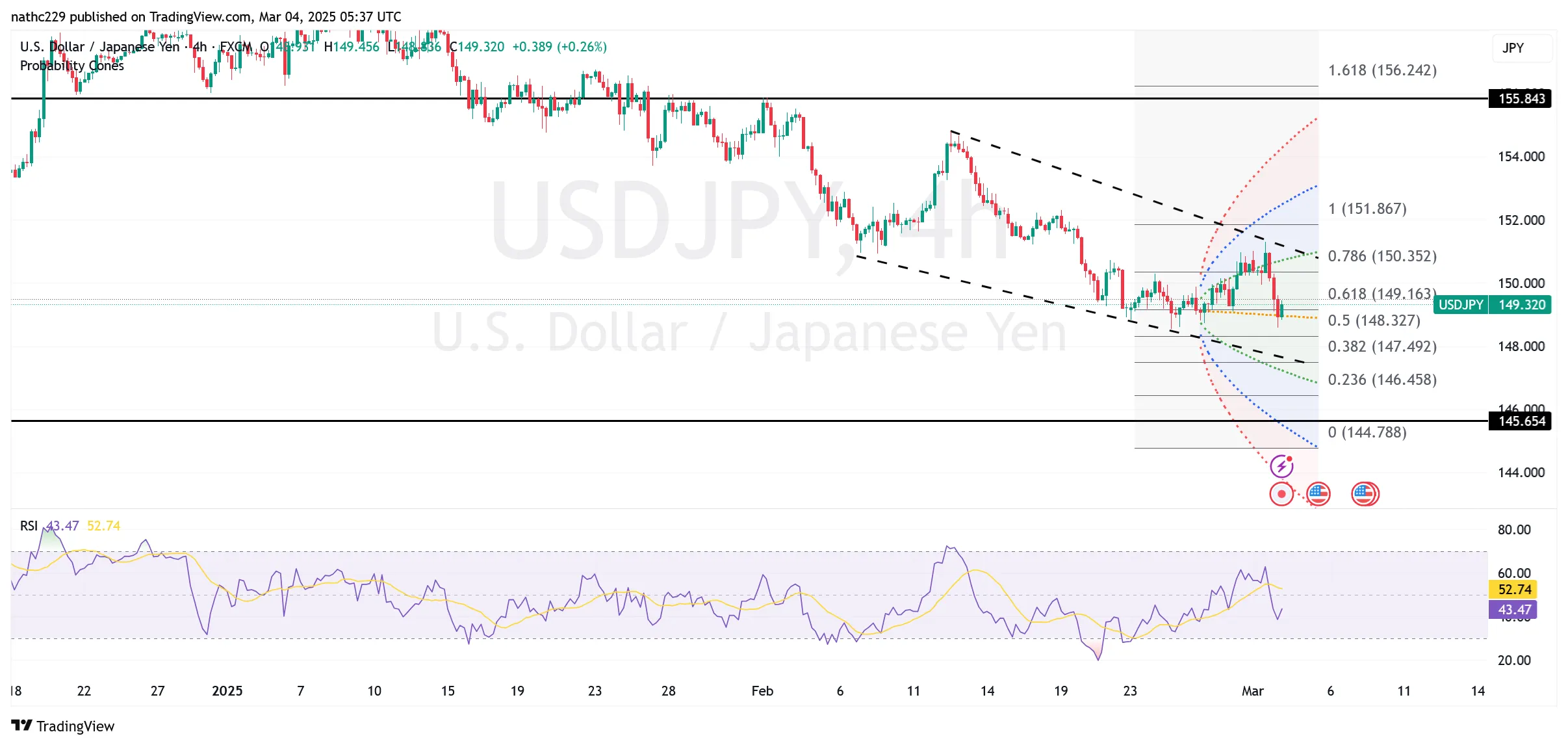

Technically, the pair maintains a bearish short-term bias as it trades below key resistance levels at 151.11 (weekly Ichimoku cloud base) and the daily high at 151.30. Momentum indicators signal further downside potential with RSI and MACD bearish. However, a significant obstacle remains near the 100-week moving average at 148.55, which could stall deeper declines in the short term. Below this, the September 3 high at 147.20 offers significant additional support. Resistance to any corrective rebound lies first at 151.11 (weekly cloud base), followed by stronger resistance at 151.80 (21-day moving average).

Positioning data from the CFTC continues to reflect strong yen bullish sentiment, with net yen longs at record highs. Despite recent trimming of these positions, investors remain predominantly bullish on yen, suggesting limited scope for a significant short-covering bounce in USD/JPY. However, the positioning data also indicates extreme market positioning, which could limit further yen appreciation in the absence of fresh negative catalysts. Traders will closely monitor the upcoming BOJ communications, U.S. tariff deadlines, and key U.S. data including the ISM and non-farm payrolls, which could dictate near-term sentiment and either strengthen the yen’s bullish stance or trigger a corrective rebound.