USD/JPY Bears Maintain Control Amid Rising Tariff Risks

USD/JPY remains under bearish pressure amid growing uncertainties tied to tariff threats from Washington, despite briefly rebounding above 150.00 following President Trump’s renewed tariff announcements targeting Mexico, Canada, and China. The pair settled near the psychological 150 level after reaching a daily high of 150.16, indicating short-covering amid increased algorithmic trading volumes toward the February close. However, the broader risk-off sentiment driven by tariff concerns continues to favor yen strength, notably illustrated by sharp declines in yen-crosses, with AUD/JPY marking its lowest close since early August at 93.36.

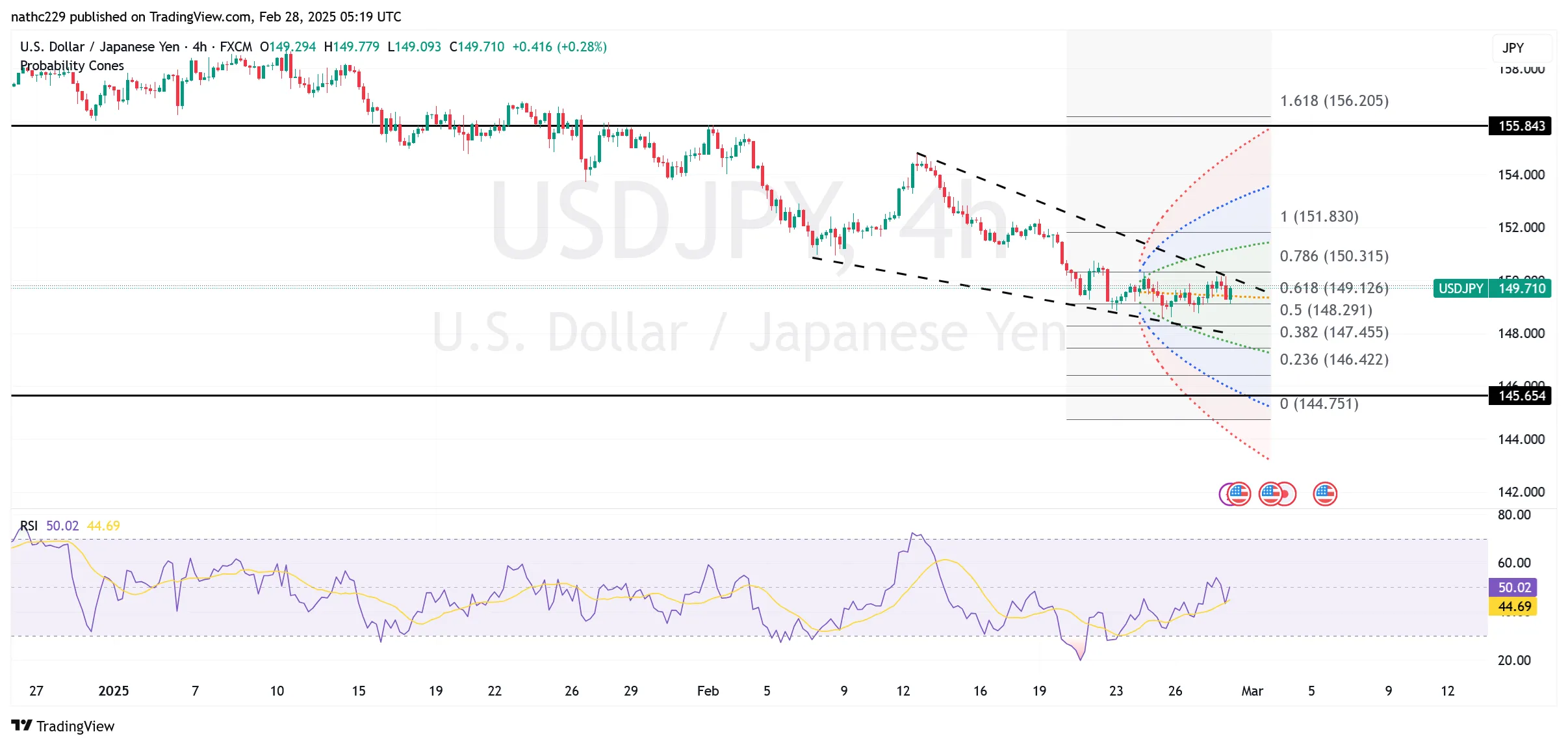

From a technical standpoint, USD/JPY’s recent upward move has encountered significant resistance near the 9-day EMA at 150.20, with further resistance levels positioned at 150.93 (February 7 low) and 151.11 (weekly Ichimoku cloud bottom). These resistance points will likely cap any short-term rallies unless market sentiment improves substantially. On the downside, key support lies near the recent low at 148.56 (February 25 low), reinforced by the 100-week moving average at 148.55. A breach of this zone could quickly expose the pair to deeper losses toward the September 3 high at 147.20.

The near-term outlook for USD/JPY will depend heavily on upcoming economic data, including the U.S. PCE inflation report, ISM manufacturing survey, and employment figures. Tokyo CPI data will also play a significant role in guiding market expectations for potential Bank of Japan tightening. Should equities weaken further in response to disappointing economic releases, the risk-off scenario could intensify, prompting renewed yen buying. As long as tariff-driven uncertainty persists, bears are likely to maintain control, with the key pivot area between 148.50-152 determining the next significant directional move.