GBP/USD traded near flat in New York, showing a slight -0.04% dip at 1.27, as the early slide moderated in the face of slightly softer U.S. Treasury yields. The pair bounced off the overnight low of 1.2630, reflecting a possible exhaustion of Trump-driven dollar strength as market appetite for the greenback may begin to ebb into year-end. Traders have been focused on the potential for Trump trades to drive USD demand; however, with sterling approaching key technical supports and a more hawkish UK rate outlook extending into 2025 compared to the Fed, sterling bears may start questioning just how low GBP/USD can go.

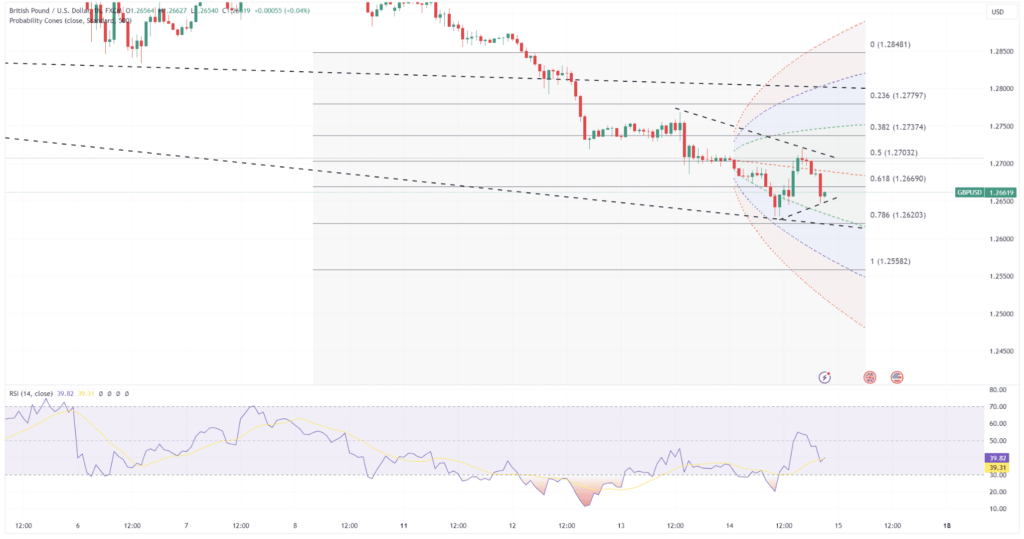

Technically, sterling remains at a critical juncture. The support at 1.2679, aligned with the rising 10-hour moving average (HMA), has provided a cushion, with further support at the Thursday low of 1.2630 and the daily low of 1.2613 from June 27. Resistance stands at 1.2720, Thursday’s daily high, with additional pressure points at 1.2757, the lower 30-day Bollinger Band, and 1.2820, the former support now turned resistance at the 200-day moving average.

Moving forward, the sustainability of Trump-driven trades and U.S. dollar strength will be key for GBP/USD’s trajectory. Should the appetite for the dollar soften into the end of the year, we may see a stronger rebound in GBP/USD, especially if UK rates continue to hold a premium over U.S. rates in 2025 projections.