USD/JPY continued its upward trend, reaching a new high of 155.625 on Wednesday as a strong dollar and rising U.S. Treasury yields keep the yen under pressure. The recent hawkish remarks from Dallas Fed President Lorie Logan reinforced the market’s view of a resilient U.S. economy and persistent inflation pressures, supporting expectations that the Fed funds rate may be nearing a neutral level. Logan’s comments follow similar optimistic assessments by Fed Chair Jerome Powell, bolstering a “Goldilocks” economic outlook where growth and inflation are balanced, allowing yields to rise without dampening market sentiment. This backdrop weakens the yen, with little expectation for intervention as USD/JPY approaches key psychological resistance levels.

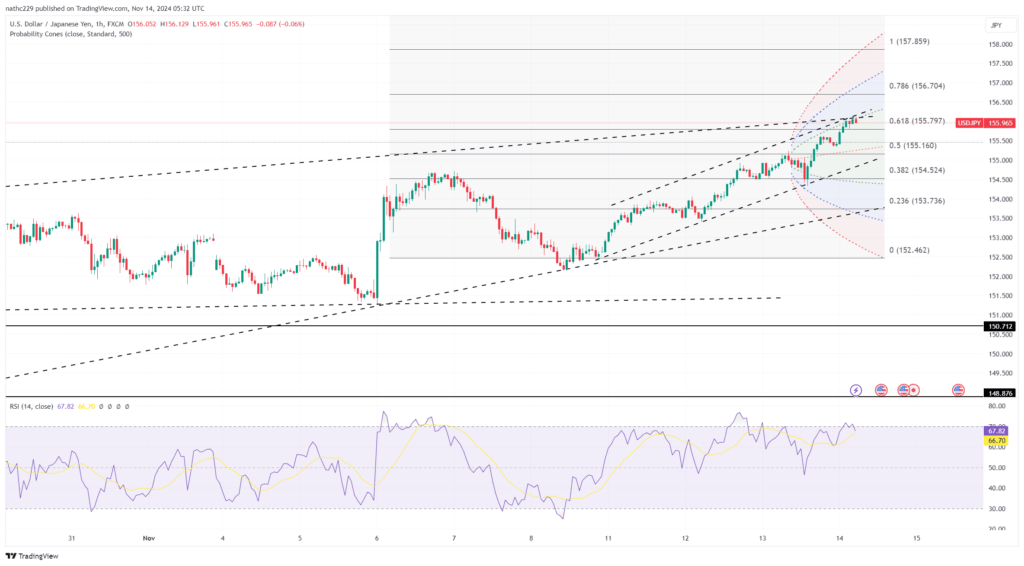

Technically, USD/JPY’s climb above the 155 level and its position near the upper Bollinger Band at 155.52 indicate the potential for additional gains. Nearby support levels include the Nov. 6 high at 154.70 and the Oct. 28 high of 153.88, with a close above the Bollinger Band reinforcing the bullish sentiment. While the pair is stretched relative to its Ichimoku cloud top at 147.40, any sustained dollar momentum suggests that a reversal lower would require a significant catalyst, such as a drop below the 200-day moving average at 151.78.

Looking ahead, USD/JPY may continue its upward trajectory as long as Fed hawkishness and dollar strength persist. Further commentary from Fed officials and U.S. jobless claims data on Thursday could provide additional insight into the U.S. economic outlook and fuel volatility, but for now, the dollar’s robust position suggests limited downside risks for USD/JPY.