USD/JPY appears poised to retest its 2024 high of 161.96, bolstered by favorable U.S. election outcomes and expectations for continued dollar strength. Despite profit-taking, the pair has maintained an upward trajectory, with key resistance forming near the 155 pivot level, a psychological barrier that may invite intervention from Japanese authorities. Although the intervention risk remains low, as indicated by subdued option convexity and IMM short yen positioning, rapid upward moves could still attract scrutiny. Japanese authorities remain cautious as USD/JPY approaches levels last seen during previous yen support efforts, yet the general sentiment leans toward limited intervention.

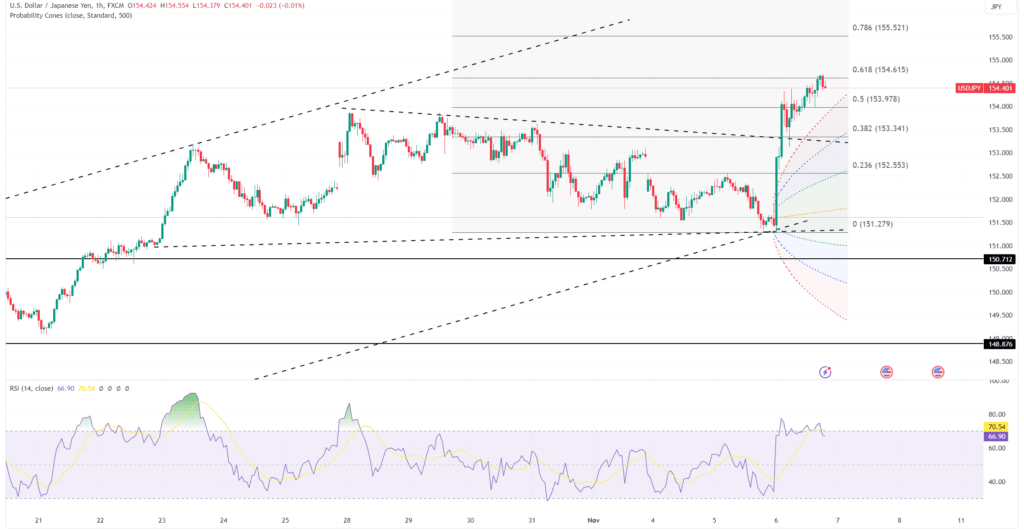

Technically, USD/JPY’s outlook is bullish, supported by strong momentum indicators and the recent clearing of key resistance levels. The path to 161.96 faces intermediate resistance near 155, but a sustained move above this level could reinforce the pair’s uptrend. Key support levels lie at the October 21 high of 150.58 and the October 4 high of 149.01, both critical in maintaining a bullish outlook. A drop below these supports would signal potential trend reversal, but for now, these levels act as solid bases for USD/JPY’s continued rise.

In the short term, USD/JPY may experience volatility ahead of the anticipated Fed rate cut, with potential dips likely seen as buying opportunities. The combination of U.S. exceptionalism and the seasonal trends that often favor the dollar in the final quarter may drive USD/JPY higher, with intervention risks viewed as a moderating force rather than a likely disruptor. The pair’s bullish bias remains intact unless it breaches the 150.58 support, though immediate gains may be tempered by profit-taking or intervention rumors as USD/JPY approaches the 155 level.