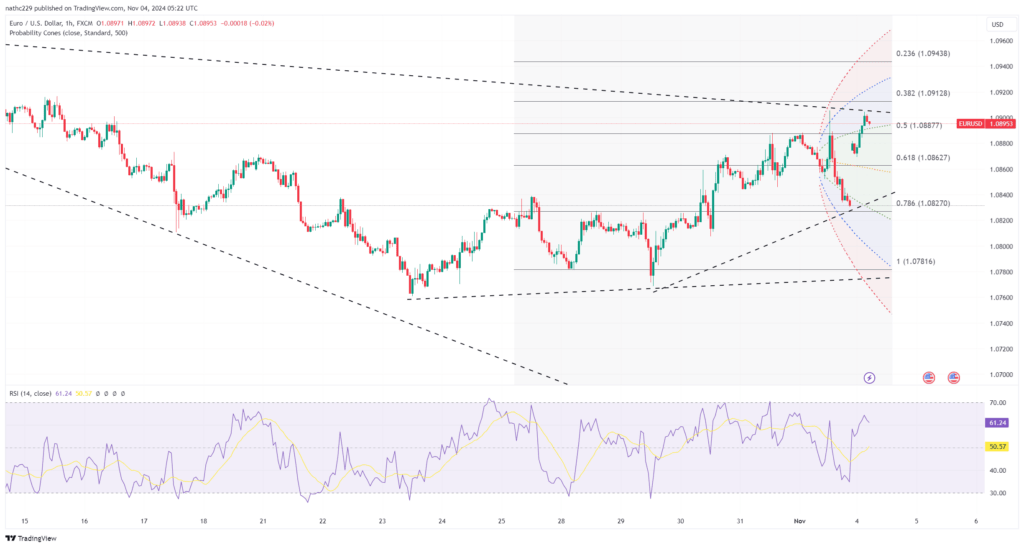

EUR/USD kicked off the week with a solid gain, trading up 0.6% as a weaker dollar provided support to the pair, which reached above its 21-day moving average. The early rally consolidated and extended into the European session, highlighting positive momentum on daily charts and contracting Bollinger bands, which may suggest a breakout in either direction. The coiling 5, 10, and 21-day moving averages indicate a neutral technical setup; however, a close above the 1.0869 21-DMA could shift sentiment in favor of bulls, targeting a test of 1.0934, the 38.2% retracement of the September-October decline. Key support lies at 1.0783, aligned with the 78.6% retracement of the June-September rise, providing a strong foundation for further upward moves if maintained.

Technically, the EUR/USD setup suggests cautious optimism. Positive daily momentum studies and a break above the 21-DMA indicate bullish potential, but a broader bullish trend requires consolidation above key resistance levels. Key resistance levels include the 1.0869 21-DMA, which would open the path to 1.0934. Meanwhile, immediate downside protection remains around the 1.0783 level, where strong historical support resides. For the week, large option expiries at 1.0850 (477 million) and 1.0900 (1.17 billion) on November 4th may also influence price action as traders navigate multiple event risks.

This week is packed with high-impact events, which could drive EUR/USD in either direction. The U.S. election on Tuesday and a highly anticipated FOMC rate decision on Thursday will dominate market sentiment, with expectations for a 25-basis-point Fed rate cut potentially adding volatility. The Eurozone calendar is also busy, featuring German and Eurozone factory orders, final October PMIs, and retail sales data. The confluence of events across major economies, including China’s fiscal policy announcement and rate decisions in the U.K. and Australia, means that EUR/USD will likely see elevated volatility. Bulls may hold an edge in the short term, but fundamental developments in the U.S. and global economic data could easily shift the market’s direction.