USD/JPY held within a narrow trading range of 152.78-153.505 on Tuesday, as yen bears remain cautious ahead of Thursday’s Bank of Japan (BOJ) policy meeting. The pair’s gains were capped by month-end dollar sales and lower U.S. Treasury yields despite upbeat U.S. ADP and housing data. Futures open interest suggests that yen shorts have been building since USD/JPY broke above 150, driven by expectations of dovish BOJ policy. However, heightened volatility levels, with overnight yen volatility at 10.6%, and wide bid-ask spreads on one-day risk reversals reflect underlying concerns among investors who are wary of potential hawkish signals from BOJ Governor Kazuo Ueda, especially in light of the yen’s continued weakness and stabilizing global markets.

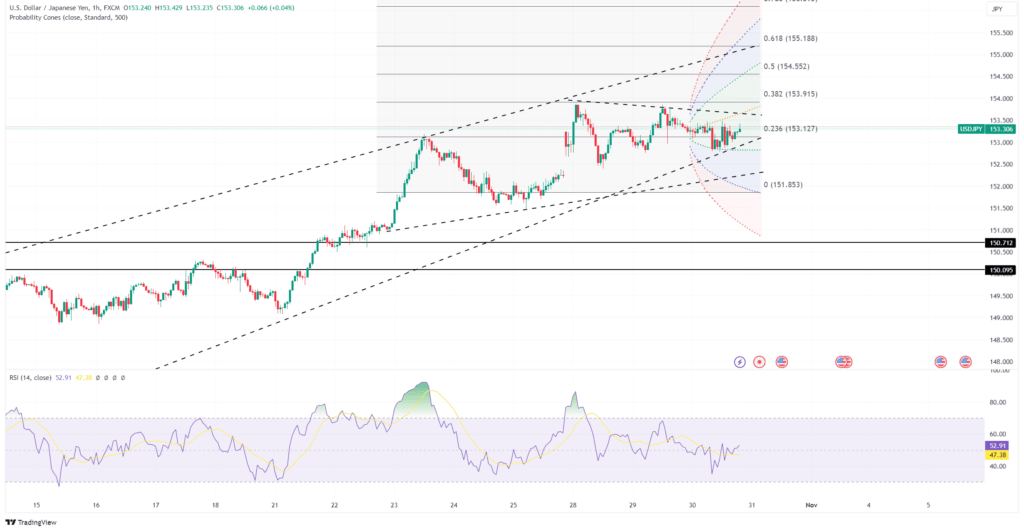

Technically, USD/JPY faces key resistance at the double-top near 153.87-153.88, with a break above potentially pushing the pair toward the psychological 154.00 level. Support is seen at 152.38, the October 24 high, followed by Tuesday’s low at 152.76. Should USD/JPY drop below these levels, further support lies at the pivotal 152.00 mark and the 200-day moving average at 151.50. While the technical picture remains broadly bullish, the elevated volatility and cautious sentiment ahead of the BOJ decision indicate potential for a pullback if Governor Ueda signals even a hint of hawkishness.

Looking forward, USD/JPY direction will hinge on Ueda’s messaging during Thursday’s policy announcement and press conference. Though the BOJ is widely expected to maintain its rate at 0.25%, investors are closely watching for any shift in tone, particularly as Ueda previously hinted at cautious tightening to account for global uncertainties. If Ueda maintains a dovish stance, yen shorts may find renewed confidence, pushing USD/JPY closer to 154.00. However, even subtle hawkish hints could prompt profit-taking among yen bears, creating downside pressure on the pair and potentially driving it toward the 152.00 level.