EUR/USD attempted a recovery on Thursday, aided by cautious comments from ECB policymaker Joachim Nagel, who advised against premature rate cuts despite eurozone inflation nearing target levels. Nagel’s remarks lent some support to EUR/USD as he warned against cutting rates too soon, reaffirming the ECB’s commitment to controlling inflation. However, the positive impact on the euro was short-lived, as markets remain focused on the diverging economic trajectories and yield differentials favoring the dollar. Interest rate spreads between German and U.S. yields widened to their largest gap since late April, while terminal rate differentials for the Fed and ECB grew to -161.5bps, reinforcing expectations that the ECB will cut rates more aggressively than the Fed.

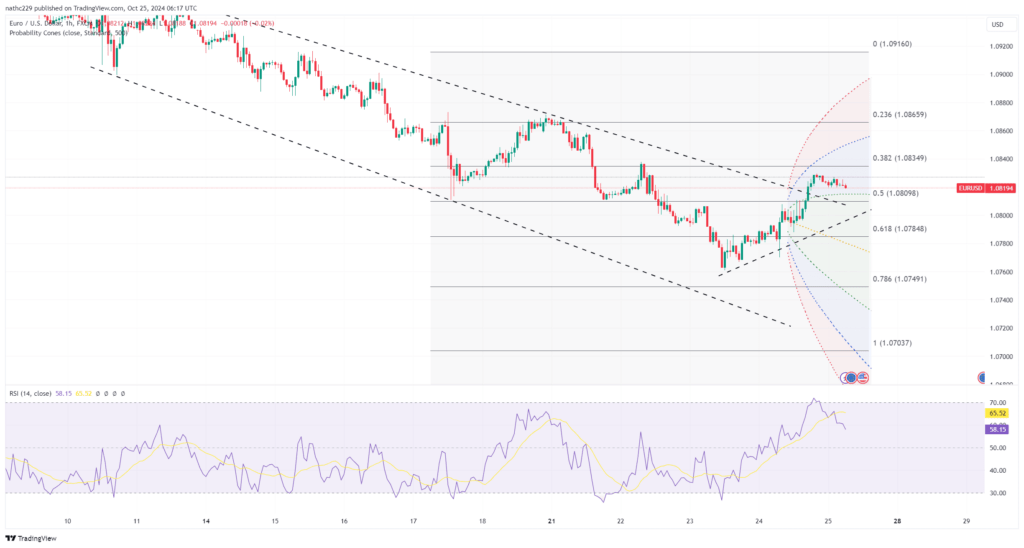

Technically, EUR/USD showed a minor bounce from its 1.0788 low but struggled to maintain momentum as it approached the 5-day moving average at 1.0817. The daily RSI has turned up from oversold levels, suggesting the potential for a short-term rebound. However, bearish indicators persist, with the pair trading below its 200-day moving average, and the monthly RSI remains in a downtrend. These factors suggest that any rally may be limited, especially if U.S. economic data continues to outperform eurozone data. Key resistance lies near the 1.0820 level, and a failure to hold above this area could signal a resumption of the downtrend.

Looking ahead, EUR/USD is vulnerable to further downside pressures as interest rate differentials and economic data continue to favor the dollar. With German Ifo and U.S. durable goods data scheduled for release on Friday, as well as a speech by Boston Fed President Collins, market participants may see renewed downside risks if U.S. data beats expectations. Although a short-term bounce could continue, the overall trend remains bearish as long as EUR/USD stays below key technical levels and economic conditions favor the greenback.