GBP/USD continued to trade cautiously below the 1.30 level on Monday, pressured by broad U.S. dollar strength amid rising U.S. Treasury yields. The pair slipped to a low of 1.2978 as long-term U.S. yields surged by 10 basis points, strengthening the dollar across the board. With the BoE set to release a series of comments from key policymakers this week, sterling traders remain cautious, particularly given the divergence between the Bank of England’s dovish stance and the Federal Reserve’s gradual dialing back of rate cut expectations. The focus remains on Governor Andrew Bailey’s comments on Tuesday and the more hawkish Catherine Mann on Thursday, as traders search for clues on the BoE’s rate path.

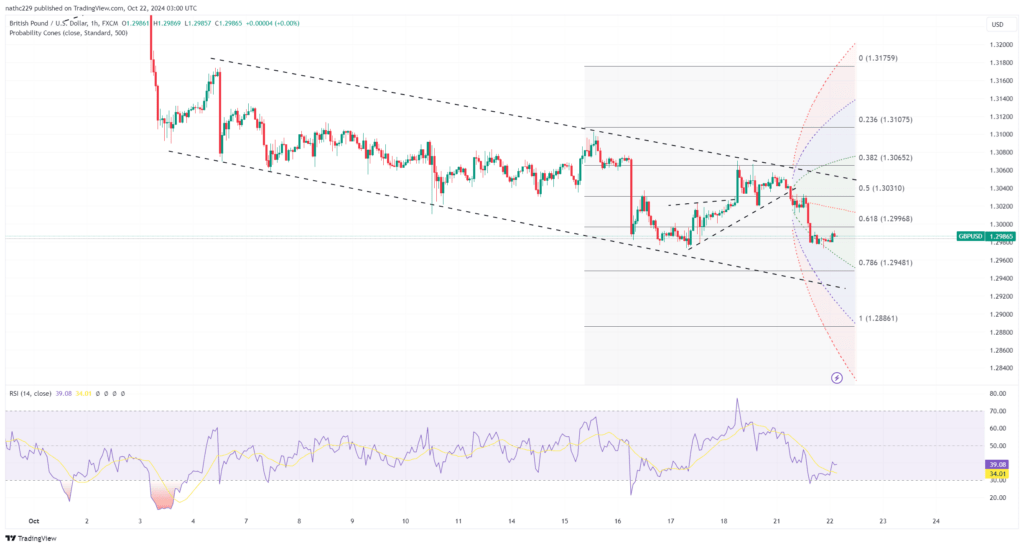

Technically, GBP/USD faces immediate support at 1.2975, the October 17 low, with further downside risk if this level is breached. Below this, key support comes in at the daily cloud base of 1.2967 and the 200-day moving average (DMA) at 1.2798. The pair’s bearish momentum is reinforced by the falling 10-day moving average at 1.3052, which continues to cap upside attempts. Resistance levels are seen at 1.3010, the 10-hour moving average (HMA), followed by Monday’s high of 1.3058 and the rising 55-DMA at 1.3099. Given the weak technicals, any dovish surprises from BoE officials could accelerate the pair’s descent towards the 1.2900 region.

Looking ahead, sterling’s trajectory will likely be driven by a combination of BoE commentary and U.S. election sentiment, particularly given the rise in dollar-friendly Trump trades amid the former president’s poll gains. If upcoming UK data, such as flash PMIs, and BoE speeches point to a faster pace of rate cuts, GBP/USD could see further unwinding of long positions. On the flip side, any hawkish surprises from BoE members, particularly Catherine Mann, may provide short-term relief for sterling bulls, though sustained recovery above the 1.3050 region remains challenging in the current environment of U.S. dollar strength.