EUR/USD extended its decline to a fresh two-month low, falling to 1.0811 after a brief rally to 1.0874 following the European Central Bank’s (ECB) 25 basis point rate cut. The widely anticipated cut did little to support the euro as sellers emerged, spurred by stronger-than-expected U.S. retail sales and the Philadelphia Fed business index, which pointed to continued economic resilience in the U.S. Additionally, rising U.S. 10-year Treasury yields and a widening U.S.-German yield spread further fueled bearish sentiment, with thoughts of cautious Fed rate cuts reinforcing the U.S. dollar’s strength. EUR/USD bears pushed the pair lower during ECB President Christine Lagarde’s press conference, where she highlighted weaker-than-expected economic activity in the eurozone, sparking concerns about more aggressive rate cuts from the ECB.

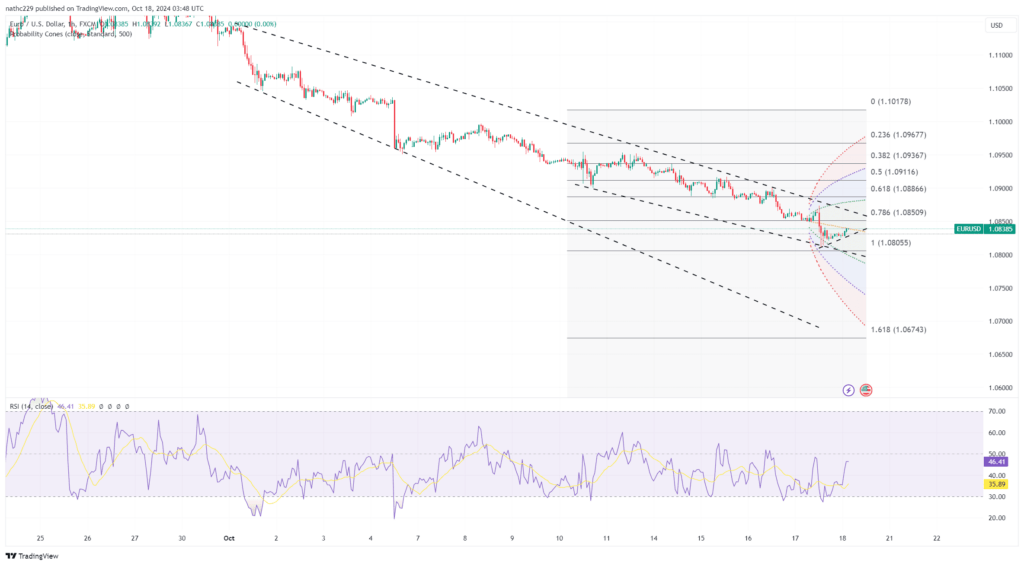

Technically, EUR/USD remains firmly in bearish territory, with the pair trading below both its 5-day and 200-day moving averages. The pair’s inability to hold gains above 1.0870 after the ECB meeting underscores the growing bearish momentum, while falling daily and monthly RSI readings indicate that downward pressure is likely to persist. Key support lies in the 1.0775-1.0800 range, which has thus far provided a temporary floor for the pair. However, with the widening yield spread and diverging economic outlooks between the U.S. and eurozone, a break below this support could trigger a further slide toward the October 2023 monthly low.

Looking ahead, the path for EUR/USD remains fraught with downside risks. Economic growth concerns at the ECB, combined with upbeat U.S. data, suggest that the euro may struggle to regain momentum in the near term. The 1.0775-1.0800 support zone is a critical area to watch, as a decisive break below this level could accelerate the pair’s decline. Meanwhile, traders will also be eyeing upcoming Chinese Q3 GDP and September retail sales data, which could introduce volatility during Asian trading and further influence EUR/USD’s trajectory. For now, the technical picture remains bearish, with EUR/USD bears firmly in control.