USD/JPY surged higher, propelled by a combination of rising U.S. Treasury yields, strong U.S. economic data, and supportive comments from Japan’s Prime Minister Ishiba. The pair rallied after the release of solid ADP employment data, which reinforced the narrative of a resilient U.S. labor market. This contributed to a spike in Treasury yields, making the dollar more attractive relative to the yen. Adding to the upward momentum, Ishiba reiterated his commitment to maintaining accommodative monetary policy during a meeting with Bank of Japan Governor Ueda, further weakening the yen.

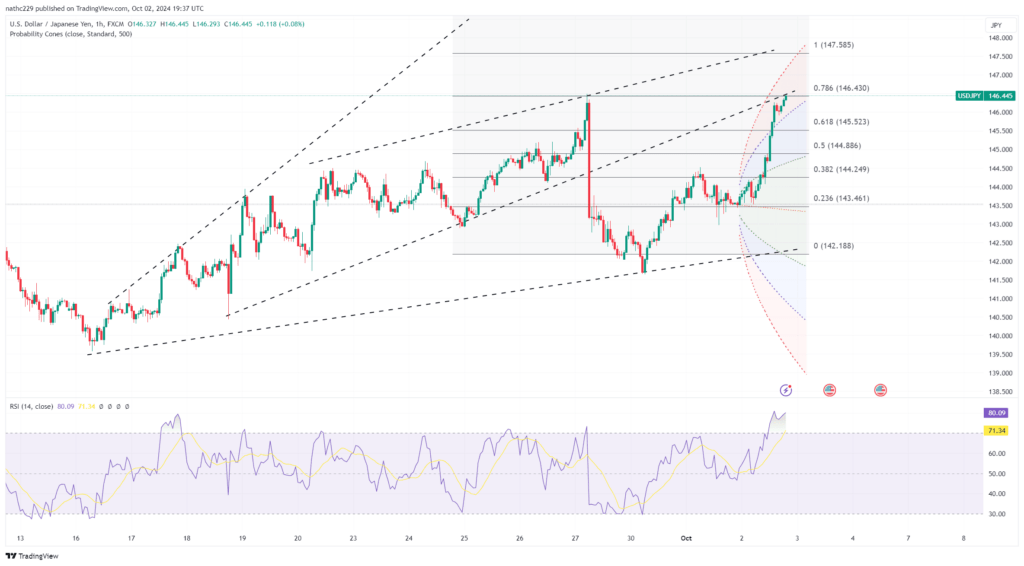

Technically, USD/JPY is pushing towards the key resistance level of 146, as the pair approaches the upper end of its narrow Bollinger range. A close above this level would signal further upside potential, with the next target being the Sept. 27 high of 146.495, set during the LDP leadership elections. Additionally, shifts in gamma related to option expiries above 145, as well as fix-related buying as a new quarter begins, have fueled the rally. U.S. futures markets have shown increased yen bullishness around these levels since mid-August, suggesting that traders may see this as a critical inflection point for the pair.

Looking ahead, USD/JPY remains poised for further gains, especially if U.S. economic data continues to impress and Treasury yields remain elevated. The pair’s rally is supported by both fundamental and technical factors, with Ishiba’s dovish monetary stance providing a tailwind for dollar strength. Traders will closely monitor any shifts in U.S. bond yields and Japanese monetary policy signals, as these factors could determine whether USD/JPY breaks through the 146.495 resistance level or faces a pullback from its current highs.