Yen's Gains Fragile Ahead of BoJ Meeting Amid Policy Uncertainty

On Monday, the yen saw gains, but these advances may remain tentative until the forex market receives clearer indications from the Bank of Japan (BoJ) about potential rate hikes ahead of their July 31 policy meeting. Under Governor Kazuo Ueda’s leadership, there have been media reports suggesting possible BoJ policy changes before official announcements, although recent signals have been mixed. Bloomberg reported that BoJ officials are worried about weak consumer spending, which complicates their decision on raising rates, while others fear missing a crucial window for a hike. This uncertainty significantly challenges the yen’s strength.

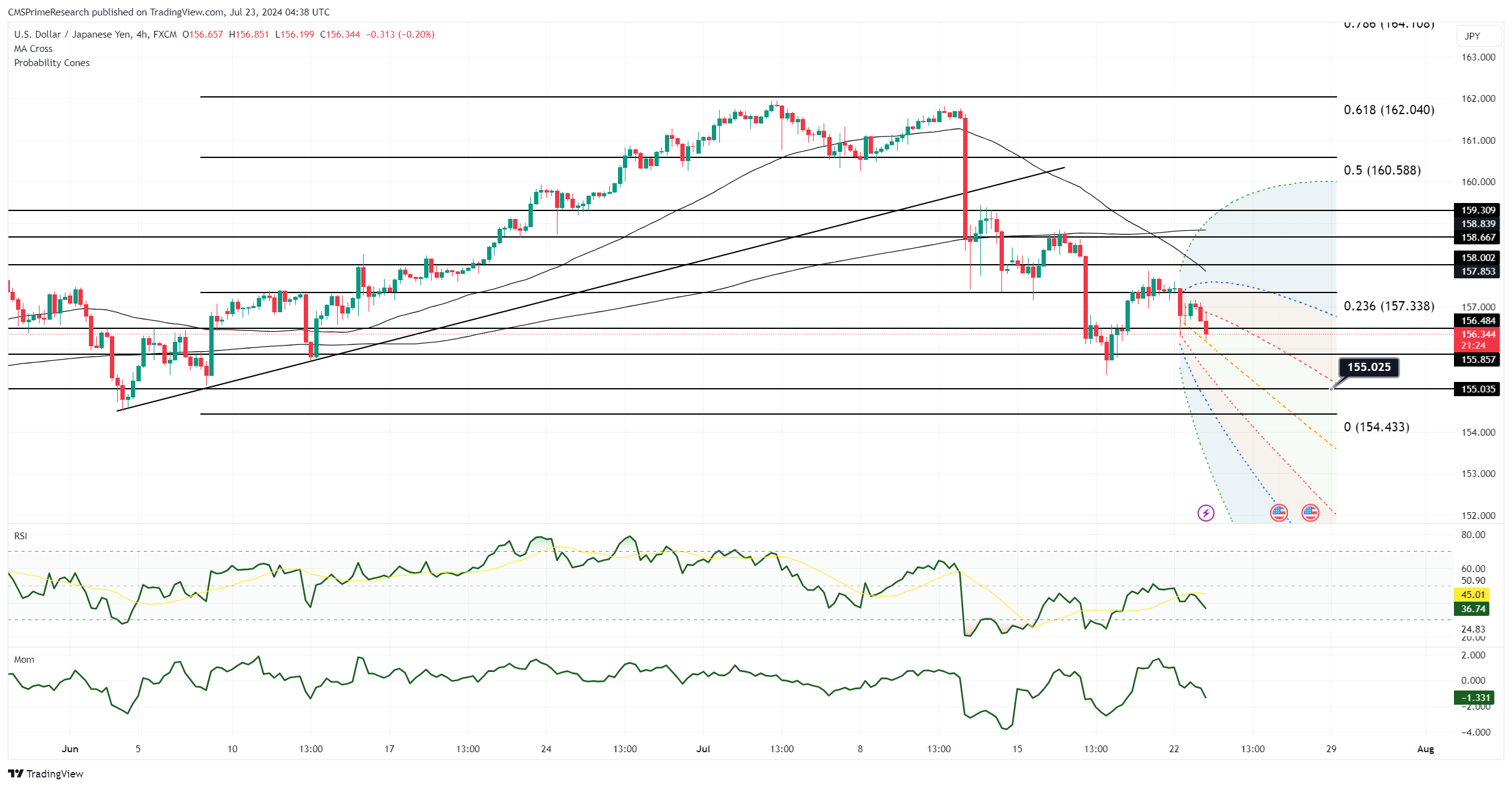

The BoJ’s cautious stance on policy normalization makes it difficult for the yen to maintain its gains against the higher-yielding dollar. As a result, the outlook for USD/JPY remains skewed to the upside. Currently, the pair is trading between the 100-day and 55-day moving averages at 155.28-157.81. As yields continue to rise, USD/JPY is likely to follow an upward trend. Bulls need a daily close above the 55-DMA to reduce downside pressure; failing to achieve this could leave room for a test of the 155.00-30 range.

Recently, the yen performed well across the board, with USD/JPY down 0.26%. However, rising yields pulled the yen off its peak levels. For now, USD/JPY remains confined between its 100-DMA and 55-DMA, ranging from 155.28 to 157.82. A significant data release, such as U.S. PMIs, might be needed to break this range. A close above the 55-DMA would open the path towards 159.00-50, whereas staying below this level keeps the possibility of testing the 155.00-30 area.

Key Levels to Watch: : 155,156,160,158