EUR/USD Surges Amid Volatile Session Following Robust U.S. Jobs Data

The EUR/USD experienced a highly volatile session, opening around 1.0825 in New York and fluctuating significantly between 1.0796 and 1.08415 after the release of U.S. employment data. The non-farm payroll (NFP) report exceeded expectations with a reading of 206k, surpassing the forecast of 190k. However, previous months saw downward revisions, with May’s figure adjusted to 218k from 272k and April’s to 108k from 165k. Additionally, the unemployment rate rose to 4.1% from 4.0%, contrary to the expected 4.0%. This mix of revised figures and increased unemployment led to a sharp decline in U.S. Treasury yields, narrowing yield spreads and exerting pressure on the U.S. dollar. Consequently, the EUR/USD traded higher, closing near 1.0830 in the late New York afternoon, up 0.13%.

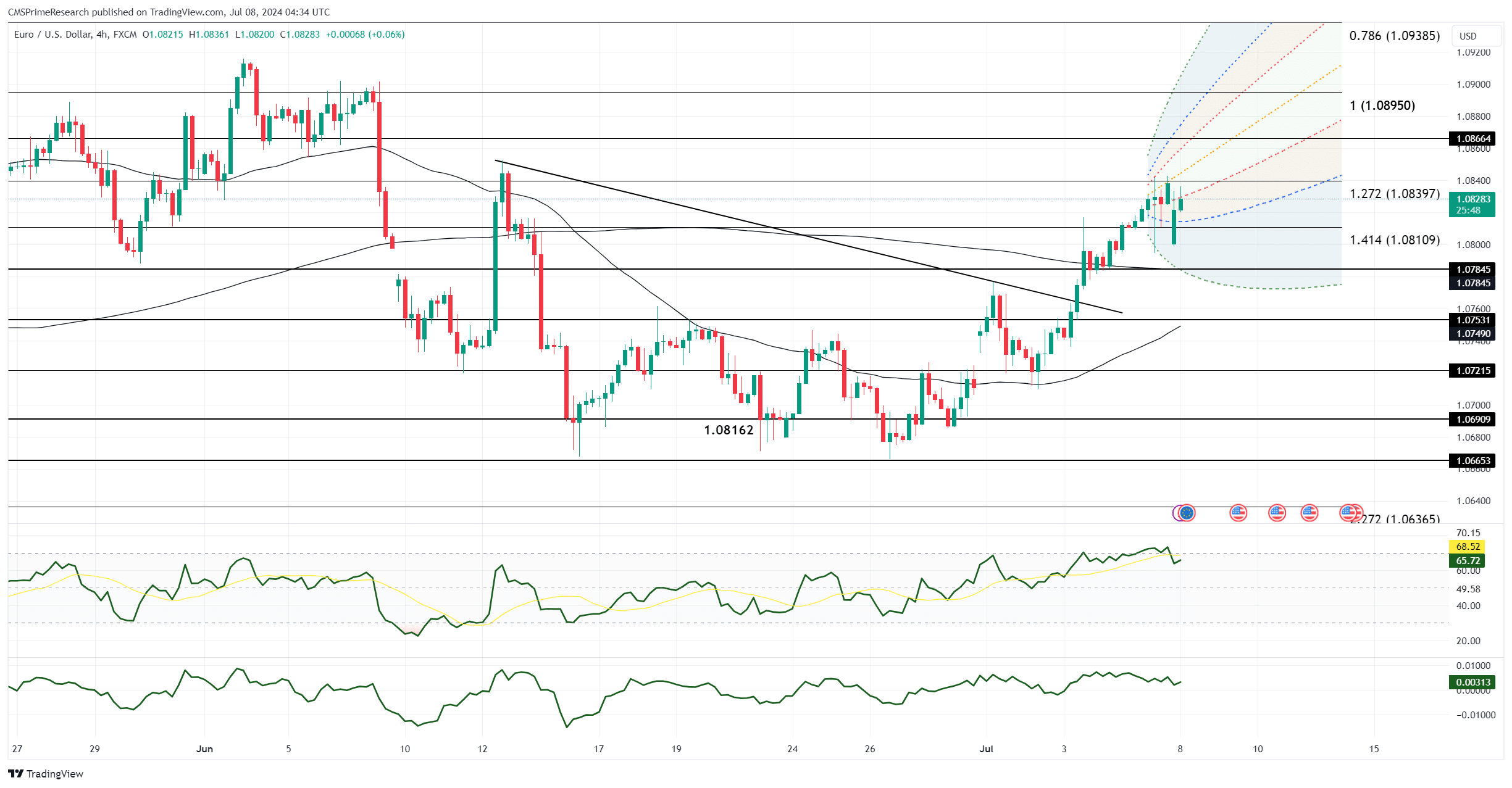

Stock and gold gains further contributed to the dollar’s weakness. Technically, the outlook for EUR/USD remains positive, with rising Relative Strength Indexes (RSIs) and the pair trading above both the cloud and the 200-day moving average, which provides support. Looking forward, key risks for EUR/USD include Fed Chair Powell’s testimony, and upcoming U.S. June CPI, PPI, and University of Michigan consumer sentiment reports.

EUR/USD climbed above the daily cloud, reaching a 17-session high near 1.0850 on Friday. The mixed U.S. employment data suggests the Federal Reserve might adopt a less restrictive stance. With June NFP figures higher than expected but previous months revised downward and unemployment ticking up, the market anticipates a potential shift in Fed policy. Treasury yields fell sharply on the news, reinforcing expectations that the Fed may cut rates by a total of 50 basis points in 2024, with investors potentially pricing in more aggressive cuts in 2025. December 2025 SOFR futures reached a three-week high, indicating that the U.S. economy might be slowing, prompting the Fed to consider a dovish stance.

The dollar’s yield advantage over the euro has diminished as the German-U.S. 2-year yield spreads tightened near key resistance at -170 basis points. With these developments, EUR/USD bears may face a challenging and turbulent road ahead.