Bitcoin Price Movement

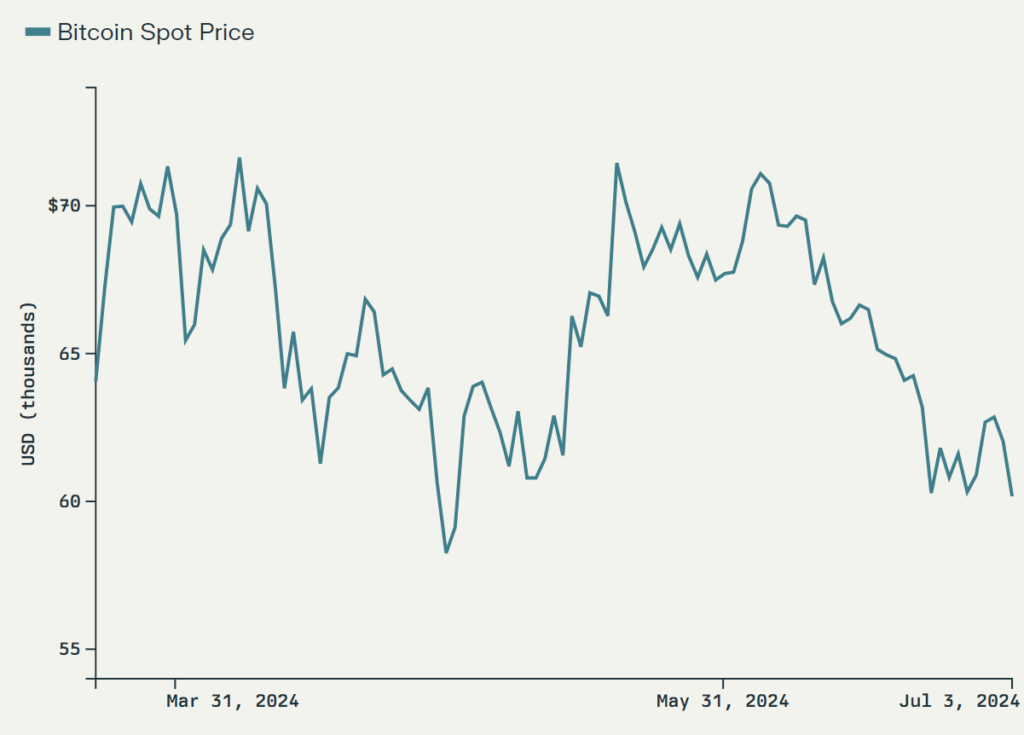

- Bitcoin (BTC) has experienced a sharp drop, falling below the crucial $60,000 level.

- BTC lost its 200-day moving average support for the first time in 10 months, with prices reaching lows of $57,885 on Bitstamp.

- The 200-day moving average currently sits at $58,400.

- Market Correction: Bitcoin has experienced a sharp drop, falling below the crucial $60,000 level and losing its 200-day moving average support for the first time in 10 months.

- Spot Selling Pressure: “Spot selling” has been identified as the main driver of the recent downtrend.

Market Catalysts and Factors

- Mt. Gox Creditor Repayments: Expected later in July, this could create selling pressure as creditors may look to book profits.

- US-based Spot Bitcoin ETFs: These have registered $14.8 billion in net inflows since their January launch, potentially providing buying support.

- Macro Economic Factors:

- The bond market is pricing in a 64.7% chance of Fed interest rate cuts by November 2024.

- Upcoming U.S. unemployment data releases and Fed Chair Jerome Powell’s speech could trigger market volatility.

- Institutional Interest: There was a $130 million institutional inflow in a single day, the highest since early June, following over $900 million in outflows during June.

- Seasonal Trends: July is historically a bullish month for Bitcoin with a median return of 9%.

Altcoin Performance

- Solana (SOL) has been a notable performer, gaining more than 3%.

- Solana’s rise is attributed to recent ETF filing by VanEck and the success of pump.fun, a Solana protocol for creating memecoins.

- Telegram-backed Toncoin has also seen gains of more than 3%.

- Other altcoins like Cardano (ADA) and Uniswap (UNI) have seen bearish trends, with significant drops in price.

Market Sentiment

- The crypto market is experiencing a significant slide, raising questions about whether this is a correction or the end of the bull market.

- There’s considerable uncertainty in the short term, particularly due to the unpredictable impact of Mt. Gox creditor actions.

- The Crypto Fear and Greed Index has shown upticks toward “greed” over the weekend, but the full impact of recent market movements may not yet be reflected.

Potential Catalysts for Bitcoin’s price movement in the Second Half of 2024

several potential catalysts could influence Bitcoin’s price movement in the second half of 2024:

- Macroeconomic Factors:

- Expected Federal Reserve interest rate cuts: The bond market is pricing in a 64.7% chance of Fed interest rate cuts by November 2024. Historically, cryptocurrencies tend to perform better in low interest rate environments.

- Upcoming U.S. unemployment data releases and Federal Reserve Chair Jerome Powell’s speeches could trigger market volatility.

- Institutional Adoption:

- Continued inflows into U.S.-based spot Bitcoin ETFs: These have already registered $14.8 billion in net inflows since their January launch.

- Potential approval of spot Ethereum ETFs: This could have spillover effects on the broader crypto market, including Bitcoin.

- Increasing institutional interest: There was a $130 million institutional inflow in a single day recently, the highest since early June.

- Regulatory Developments:

- Ongoing regulatory clarity in the U.S. and EU (through MiCA) could provide a more stable environment for Bitcoin investments.

- Any significant regulatory changes or announcements, particularly in the U.S., could cause major price shifts.

- Upcoming Events:

- U.S. Presidential Election (November 2024): Standard Chartered Bank predicts Bitcoin could reach $100,000 by the time of the U.S. presidential election.

- Bitcoin 2024 Conference (July 25-27, 2024): Major crypto conferences often coincide with increased market activity.

- Mt. Gox Creditor Repayments:

- Expected later in July 2024, this could create significant selling pressure as creditors may look to book profits.

- Technological Developments:

- Continued adoption of Bitcoin in various technological applications, including decentralized finance (DeFi) and Web3 developments.

- Market Sentiment:

- The crypto market’s reaction to the recent price drop and potential recovery could influence future price movements.

- Global Economic Conditions:

- Any major shifts in global economic conditions or geopolitical events could impact Bitcoin as a potential safe-haven asset.

- Corporate Adoption:

- Announcements of major companies adopting Bitcoin or blockchain technology could drive prices up.

- Mining Dynamics:

- The aftermath of the April 2024 Bitcoin halving event could continue to influence supply dynamics and potentially impact price.

It’s important to note that the cryptocurrency market is highly volatile and unpredictable. While these factors could potentially influence Bitcoin’s price, the actual impact may vary, and unforeseen events could also play a significant role in price movements.

Risk Factors to Consider

The recent sharp drop in Bitcoin’s price, falling below the crucial $60,000 level and losing its 200-day moving average support, raises significant concerns for investors. Key risk factors include the potential selling pressure from Mt. Gox creditor repayments expected later in July, which could flood the market with additional Bitcoin as creditors look to book profits. Furthermore, the macroeconomic environment adds another layer of uncertainty; while the bond market anticipates a 64.7% chance of Federal Reserve interest rate cuts by November 2024, unexpected shifts in unemployment data or Federal Reserve communications could trigger further market volatility.

Institutional interest remains a double-edged sword. While there has been substantial inflow into U.S.-based spot Bitcoin ETFs and a notable single-day institutional inflow of $130 million, these factors could either stabilize or destabilize the market depending on broader economic conditions. Seasonal trends suggest that July is typically a bullish month for Bitcoin, but the prevailing market sentiment is currently weighed down by fears of a more significant market correction. This atmosphere of uncertainty is compounded by the regulatory landscape, where ongoing developments in the U.S. and EU could either provide clarity and stability or lead to sudden market disruptions.

SWOT Analysis of Bitcoin’s Current Market Situation

Strengths:

- Institutional Adoption: The influx of $14.8 billion into U.S.-based spot Bitcoin ETFs since January 2024 reflects strong institutional confidence in Bitcoin’s potential. This significant investment provides a solid foundation for market stability and growth.

- Historical Performance: Historically, July has been a bullish month for Bitcoin, offering a median return of 9%. This seasonal trend might bolster investor confidence in a potential recovery.

- Technological Integration: Continued adoption of Bitcoin in decentralized finance (DeFi) and Web3 applications demonstrates its growing utility and integration into the broader digital economy.

Weaknesses:

- Market Volatility: The sharp drop below $60,000 and the loss of the 200-day moving average indicate inherent market volatility, which poses a significant risk to investors looking for stability.

- Regulatory Uncertainty: The lack of clear regulatory frameworks in major markets like the U.S. and the EU creates an environment of uncertainty, potentially deterring new investments and causing market instability.

- Spot Selling Pressure: The primary driver of the recent downtrend has been identified as “spot selling,” which suggests a lack of strong buying support to counterbalance the selling pressure.

Opportunities:

- Potential Rate Cuts: The bond market’s prediction of a 64.7% chance of Fed interest rate cuts by November 2024 could create a more favorable environment for Bitcoin, as lower interest rates historically benefit cryptocurrencies.

- Institutional and Corporate Adoption: Increasing institutional inflows and potential announcements of major companies adopting Bitcoin or blockchain technology could drive significant price appreciation.

- Regulatory Clarity: Positive regulatory developments, such as the approval of spot Ethereum ETFs or clearer guidelines in the U.S. and EU, could create a more stable and attractive investment environment.

Threats:

- Mt. Gox Creditor Repayments: The impending repayments could introduce substantial selling pressure, potentially driving prices down further as creditors liquidate their holdings.

- Economic and Geopolitical Instability: Major shifts in global economic conditions or geopolitical events could negatively impact Bitcoin, despite its reputation as a safe-haven asset.

- Market Sentiment: The current bearish sentiment and fear of a prolonged correction could lead to reduced investor confidence and further price declines, challenging Bitcoin’s resilience in the short term.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.