EUR/USD Rallies as US Economic Data Weakens, Eyes on June Payrolls

EUR/USD climbed as the latest U.S. economic data hinted at a possible slowdown. The New York session opened near 1.0755 after trading at 1.0736 overnight, extending its rally. The pair surged following weaker-than-expected ADP employment figures, jobless claims, and ISM non-manufacturing data, all indicating a softening U.S. economy. U.S. 10-year Treasury yields fell sharply, narrowing the yield spread between U.S. and German bonds, adding pressure on the dollar as USD/CNH traded down to 7.2924.

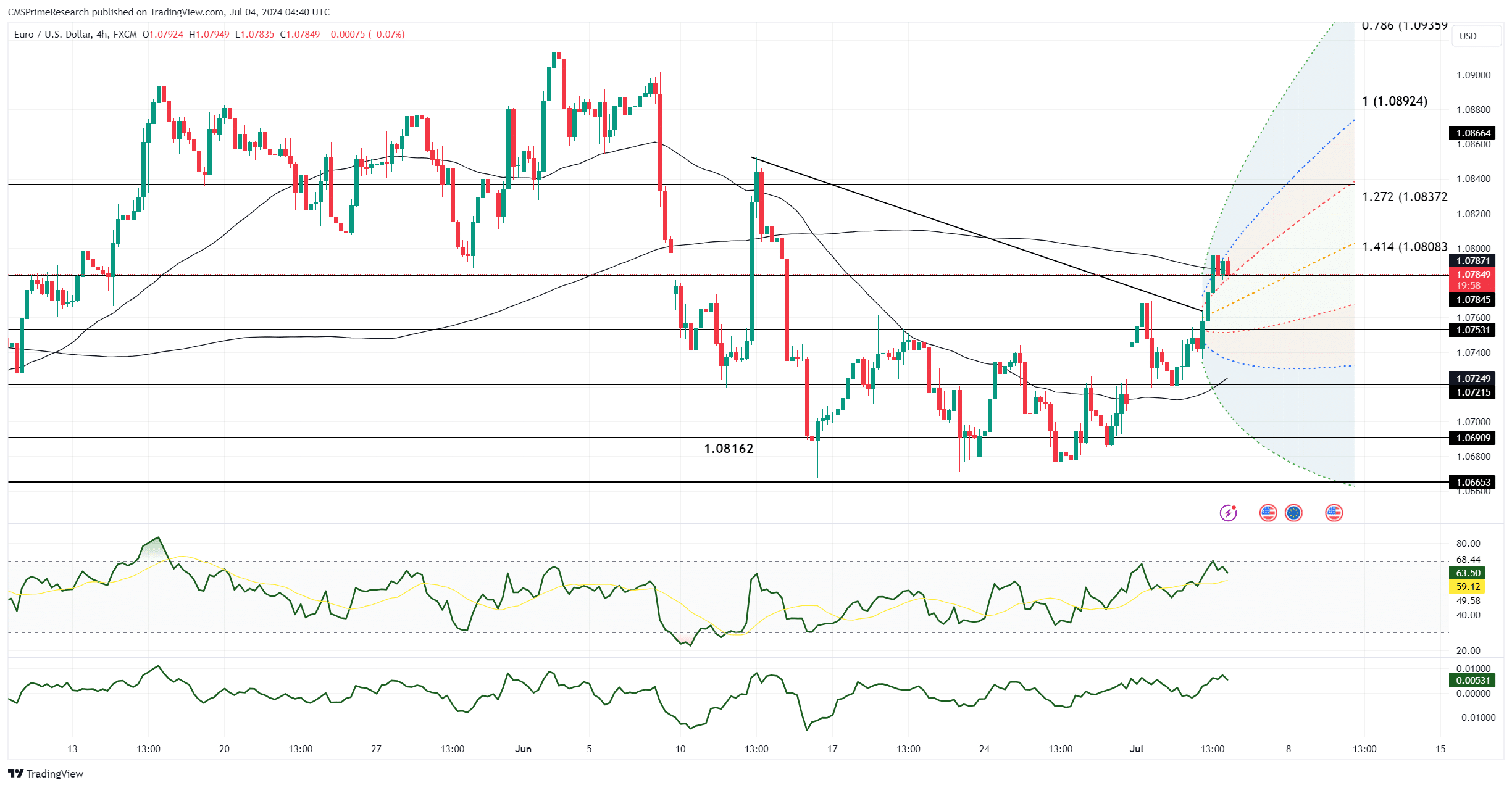

The dollar faced further weight from rallies in equities and gold. EUR/USD pierced the 200-day moving average (200-DMA) and the top of the daily cloud, trading as high as 1.0817 before dipping. A late-day bounce in the dollar saw EUR/USD slip just below 1.0790. Technical indicators are leaning bullish with rising Relative Strength Indexes (RSIs) and the pair trading above the 55-DMA and the base of the daily cloud.

Attention is now on the U.S. June payroll report. If the report is downbeat, it could lead to further dollar weakness. EUR/USD reached a three-week high after breaking the 200-DMA and daily cloud top, with investors potentially more confident in upside risks following recent U.S. data and comments from Fed Chair Jerome Powell. June ADP data indicated slowing payroll growth, while weekly and continuing claims suggested rising joblessness. The June ISM non-manufacturing index further highlighted economic challenges, with a headline PMI of 48.8, below the contraction threshold of 50, compared to estimates of 52.5 and May’s 53.8. Services employment contracted further, printing at 46.1 versus May’s 47.1, while prices paid dropped to 56.3 from 58.1.

This data suggests the Fed might adopt a less restrictive stance moving forward. U.S. yields dropped sharply, and the dollar’s yield advantage over the euro decreased as the German-U.S. spread hit its tightest since June 7. Investors now speculate that the Fed may be poised to cut rates by 50 basis points in 2024, especially after Powell noted signs of resuming disinflation. EUR/USD longs are now targeting June’s monthly high and potentially the March high. A disappointing June payroll report could see these targets met.