EUR/USD Inches Higher Amid Weak U.S. Retail Sales, French Election Uncertainty Looms

The EUR/USD pair saw a slight uptick on Tuesday, but bullish momentum remained muted despite disappointing U.S. retail sales data. This tepid response suggests that uncertainties surrounding the upcoming French elections are weighing on the market, while technical indicators point towards a bearish trend for the euro.

Fundamental Analysis:

May’s U.S. retail sales figures fell short of expectations, and April’s data was revised downward. While the core retail control component met expectations for May, April’s figure was revised from -0.3% to -0.5%. This miss, combined with the downward revision, suggests slower economic growth in the U.S. As a result, U.S. 10-year Treasury yields (US10YT=RR) dropped, narrowing the yield spread between German and U.S. 2-year bonds. Investors are now pricing in two 25 basis points (bps) Federal Reserve rate cuts in 2024, deviating from the single move suggested by policymakers’ latest projections. Despite these developments, the EUR/USD pair exhibited only a modestly bullish reaction.

Looking ahead, the initial round of France’s elections on June 30 is adding to market uncertainty. Concerns about the potential government, policy shifts, and a possible budget crisis are likely to intensify as the election date approaches. This political uncertainty may limit EUR/USD bullish activity, favoring a bearish outlook.

Technical Analysis:

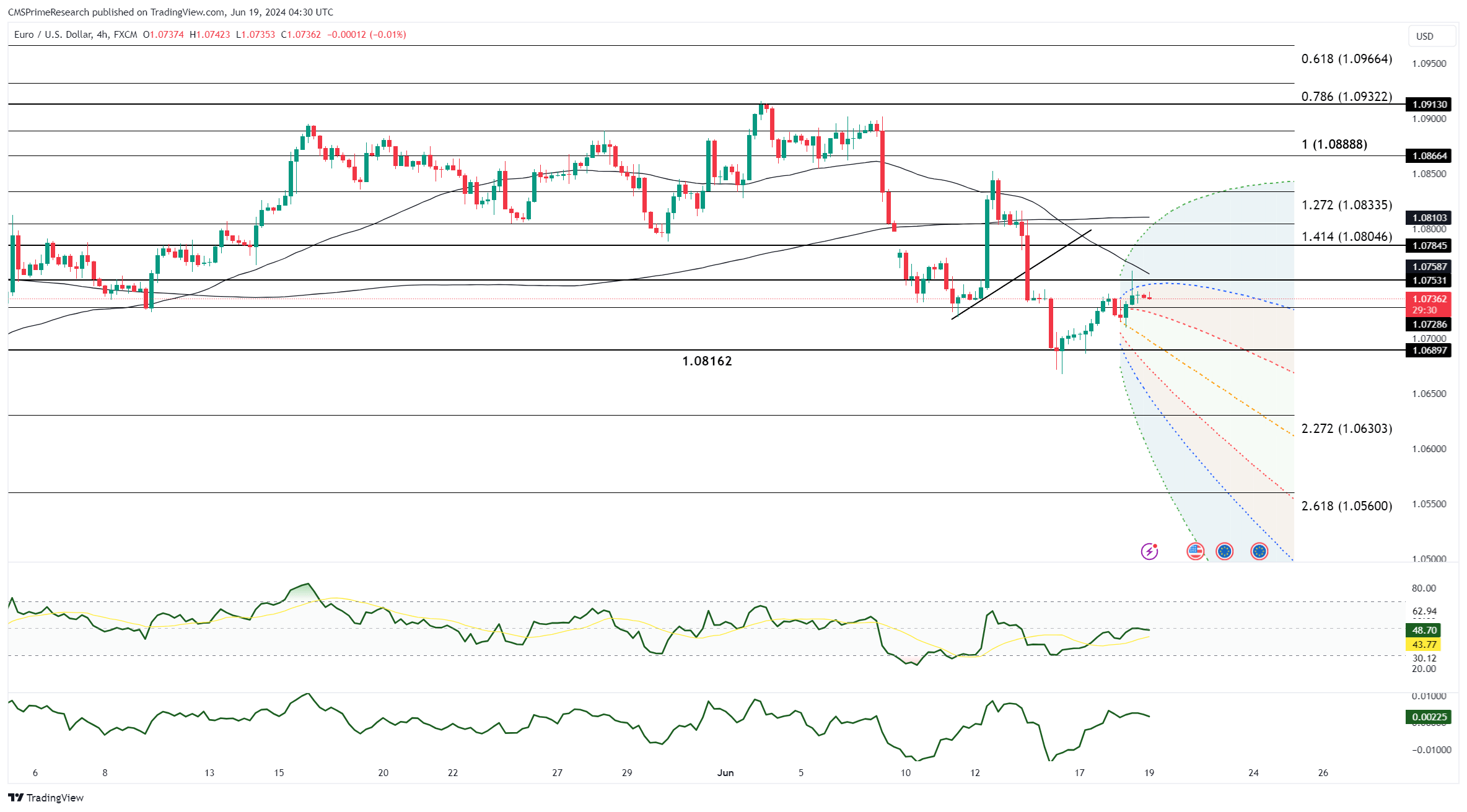

Technical indicators suggest downside risks for EUR/USD. Both daily and monthly Relative Strength Indexes (RSIs) are declining, indicating downward momentum. The EUR/USD pair is currently consolidating after a decline from its high on June 4, which may lead to a continuation of the downtrend. The pair’s failure to stay above the daily cloud and various moving averages suggests difficulty in sustaining upward gains. A return to April’s low before the election is possible.

- EUR/USD upward momentum failed to materialize despite the U.S. retail sales miss.

- The pair reached 1.0720 in early New York trading after hitting 1.07610 in Asian trading overnight.

- May’s U.S. retail sales figures missed estimates, indicating potential consumer weakening.

- EUR/USD pierced the daily cloud base, rallied to 1.07617, but then pulled back.

- Slowed USD selling pushed EUR/USD towards 1.0730 late in the day.

- By New York’s afternoon, EUR/USD was up by +0.03%, forming a daily doji candle. The doji, combined with falling monthly RSIs, signals potential concern for long positions.

- Remarks from Fed officials Kashkari, Barkin, and Daly could influence market sentiment on Wednesday.

In conclusion, both fundamental and technical factors point to a bearish outlook for EUR/USD amid U.S. economic data and the upcoming French political events.