EUR/USD Edges Higher ECB's Interest Rate Decision

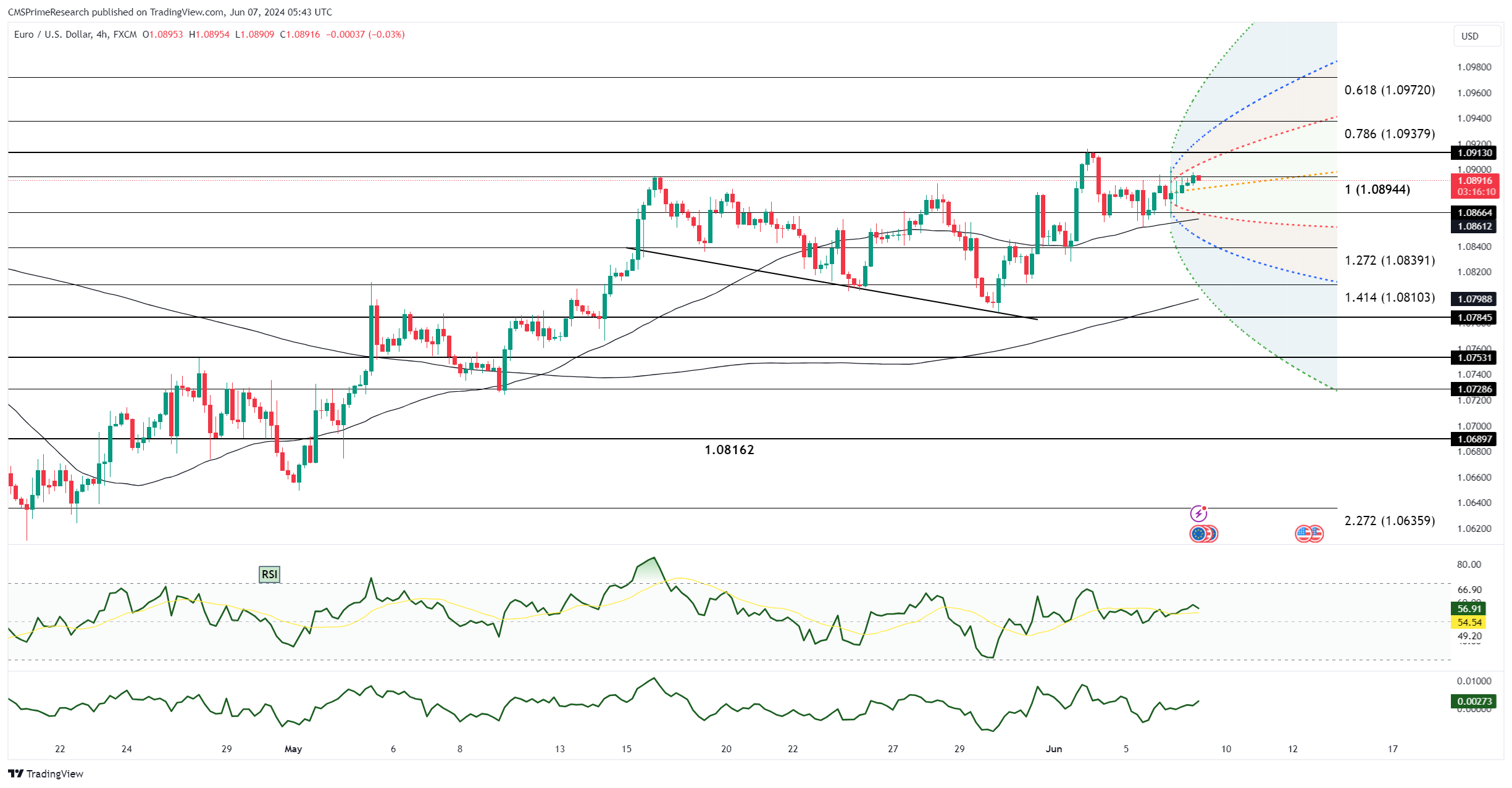

EUR/USD retreated from Thursday’s peak of 1.0902 following the European Central Bank’s (ECB) potentially premature rate cut. Despite this pullback, the pair remained modestly higher, supported by the widening bund-Treasury yield spreads. The increase in U.S. jobless claims has heightened anticipation for Friday’s critical payrolls data. Earlier, the pair pulled back from Tuesday’s high of 1.0916, finding support near the 10-day moving average (10-DMA). The current 2-year bund-Treasury yield spread is 47 basis points less negative than in April, indicating a potential shift in market sentiment. The ECB’s rate cut, amidst other European rate cuts, might be contributing to the rise in bund yields due to potential stimulatory and inflationary effects. However, persistent inflation could pose challenges for the ECB and the euro. Extending EUR/USD’s rally towards March’s high of 1.0980 and above the key 1.1000 level seems plausible only if Friday’s U.S. employment report is weaker than expected. Recent U.S. economic data, excluding Wednesday’s ISM services report, has been slightly softer, including a below-forecast May ADP report and the second-highest jobless claims of the year, indicating a potential slight miss in payrolls and a more dovish Fed meeting next week.

The ECB’s rate cut had been thoroughly priced in, along with high data dependence for further cuts. Despite this, bund yields and the euro were bolstered as the ECB raised its 2024-2025 inflation projections. ECB President Christine Lagarde highlighted that real rates have increased since September and the last rate hike. Rising initial jobless claims, now the second highest of the year, have kept Treasury yields under pressure. The 2- and 10-year Treasury yields are probing crucial support levels near May’s lows. With Friday’s payrolls report taking on increased importance, the CPI report on June 12 will also be pivotal ahead of the Federal Reserve’s meeting conclusion. Mid-week support for EUR/USD was provided by the rising 10-DMA, currently at 1.0858. Additionally, the widening bund-Treasury yield spreads and a rebound in risk sentiment since Tuesday have offered further support. The March swing high at 1.0980 and the psychological 1.1000 level remain major upside objectives. It’s noteworthy that speculative positions are not as net long as they were around the price peaks in March and January, suggesting potential room for further bullish momentum if upcoming U.S. data disappoints.