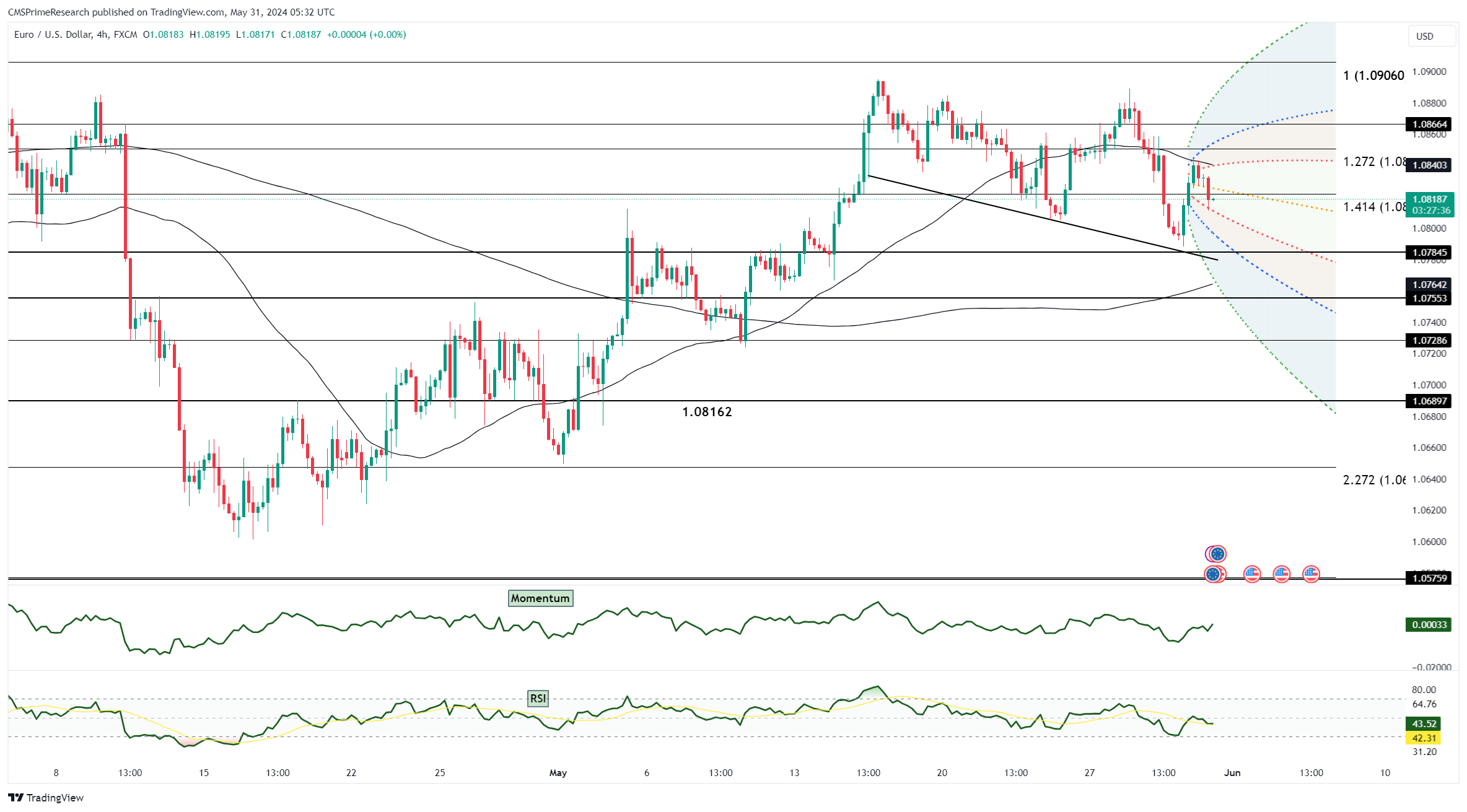

EUR/USD Turns Positive Amid Bullish Technical Signals and Economic Data

EUR/USD rebounded after hitting a 12-session low on Thursday, bolstered by bullish technical indicators and favorable economic data. The recovery was driven by lower-than-expected euro zone April unemployment figures, hinting at potential economic improvement. Meanwhile, the U.S. Q1 GDP was revised down to 1.3%, in line with expectations, and core PCE was adjusted to 3.6% from 3.7%. Weekly and continuing jobless claims also saw an increase, leading to softened U.S. yields and a narrowing of the German-U.S. spreads, to which EUR/USD is closely correlated.

Key technical indicators such as a daily RSI divergence on the low and a daily bull hammer formation, which appeared after EUR/USD tested and held the daily cloud top and the 200-DMA, added validity to the currency pair’s reversal. Investors are now eyeing the U.S. April PCE report, anticipated to match March’s results at +0.3% month-on-month and 2.8% year-on-year. A downside surprise in the report could further depress yields and the dollar, potentially pushing EUR/USD above 1.0900 and towards the 1.1050/1.1100 range.

Overnight, EUR/USD fell towards the daily cloud top and the 200-DMA before bouncing back, hitting a low of 1.07885. The pair opened near 1.0815 in New York and extended its rally, supported by the Q1 GDP’s PCE revision to 3.6% and increased weekly claims. This data helped lower U.S. yields and the dollar while tightening the DE-US spreads. Additionally, USD/CNH neared 7.2525, gold turned positive, and stocks bounced, contributing to EUR/USD’s rise above the 21-DMA, piercing the 10-DMA, and reaching 1.0845 late in the session. The pair traded up by +0.37%, with bullish technical signals emerging. Focus now shifts to the U.S. April PCE report, which could significantly impact Fed policy. An above-estimate PCE might rally yields and the dollar, potentially driving EUR/USD downward.