USD/JPY Rebound in Sight Despite Intervention Risks, Await U.S. Data for Clarity

The USD/JPY pair saw a notable uptick of 0.6% on Monday, marking a rebound from recent lows. However, there are indications that further upward movement may be limited until the release of key U.S. economic data on May 15th, particularly the Consumer Price Index (CPI) and retail sales report. Last week’s sharp decline, attributed in part to suspected Japanese interventions and lackluster U.S. economic reports, prompted concerns and subsequently, this rebound. Carry traders and Japanese importers are cautiously eyeing the opportunity to re-engage in breakout trades initiated in April, despite intervention risks and a narrowing of Treasury-JGB yield spreads.

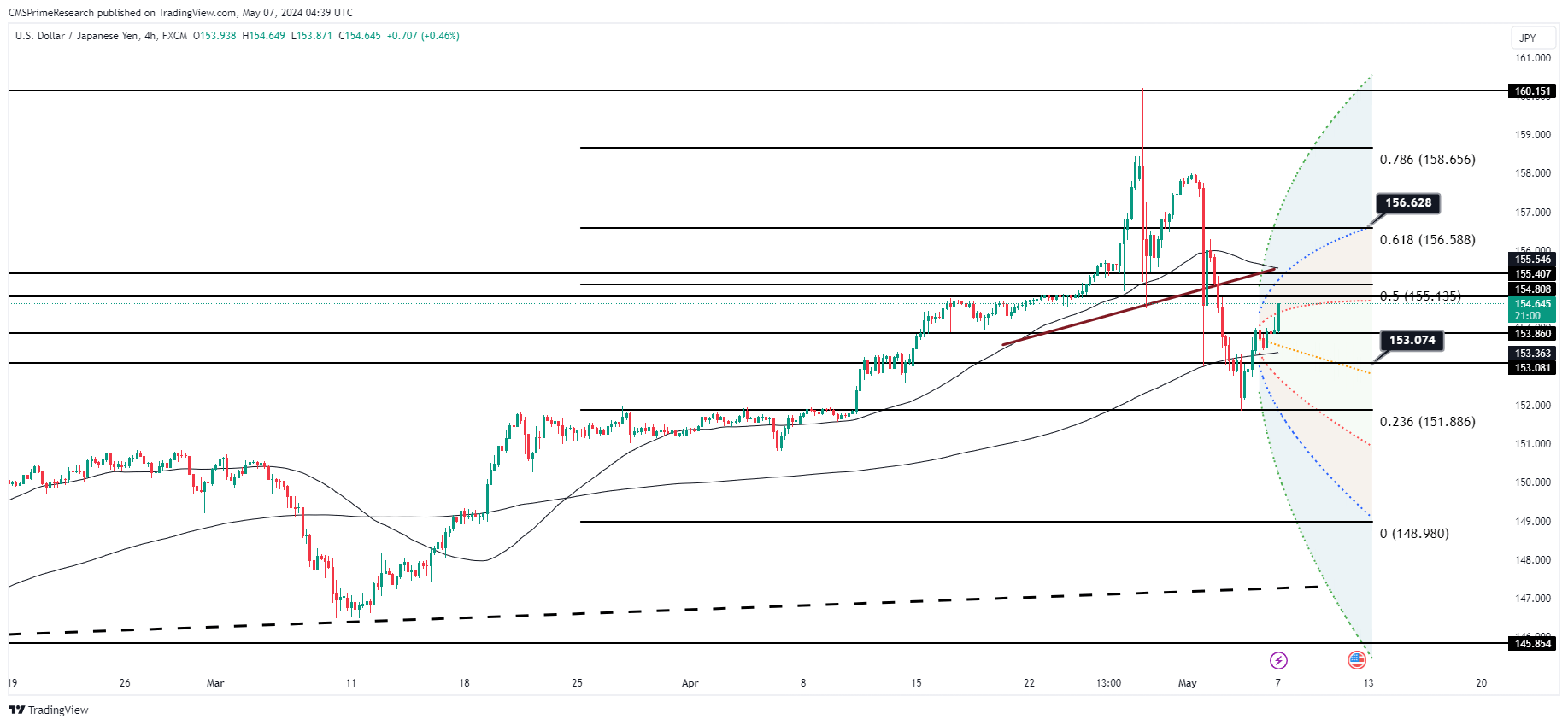

Looking forward, there’s anticipation of a potential correction towards daily kijun and tenkan levels, as well as Fibos, at 155.53/6.05 and 155.06/6.05 respectively. However, the extent of any pullback may be contingent upon the upcoming economic data, especially if it indicates a cooling from the hot March readings, potentially shaping the Federal Reserve’s stance on rate adjustments.

The recent fluctuations in USD/JPY underscore its sensitivity to a myriad of domestic and global factors. With the imminent release of crucial U.S. economic indicators, market participants are on edge, closely evaluating the data’s implications for future monetary policy decisions by the Fed.

The trajectory of the currency pair hangs in the balance, subject to the sustainability of U.S. yield levels and any signs of inflationary pressures. While a mean reversion towards certain technical levels suggests a possible correction in the short term, intervention risks and the Fed’s response to economic data may temper this movement.

Moreover, amidst ongoing concerns about the global economic recovery, geopolitical tensions, and market volatility, the outlook for USD/JPY remains uncertain. Traders are maintaining a cautious stance, adjusting their positions based on incoming data and evolving market conditions.

In summary, while recent movements in USD/JPY offer trading opportunities, the landscape is complex, with various risks and uncertainties at play. Market participants will continue to closely monitor developments in the U.S. and Japanese economies, as well as broader geopolitical events, to gauge the future trajectory of the currency pair.

Key Levels to Watch: : 155,156,160,158