GBPUSD bearish ahead of Fed Interest Rate Decisions

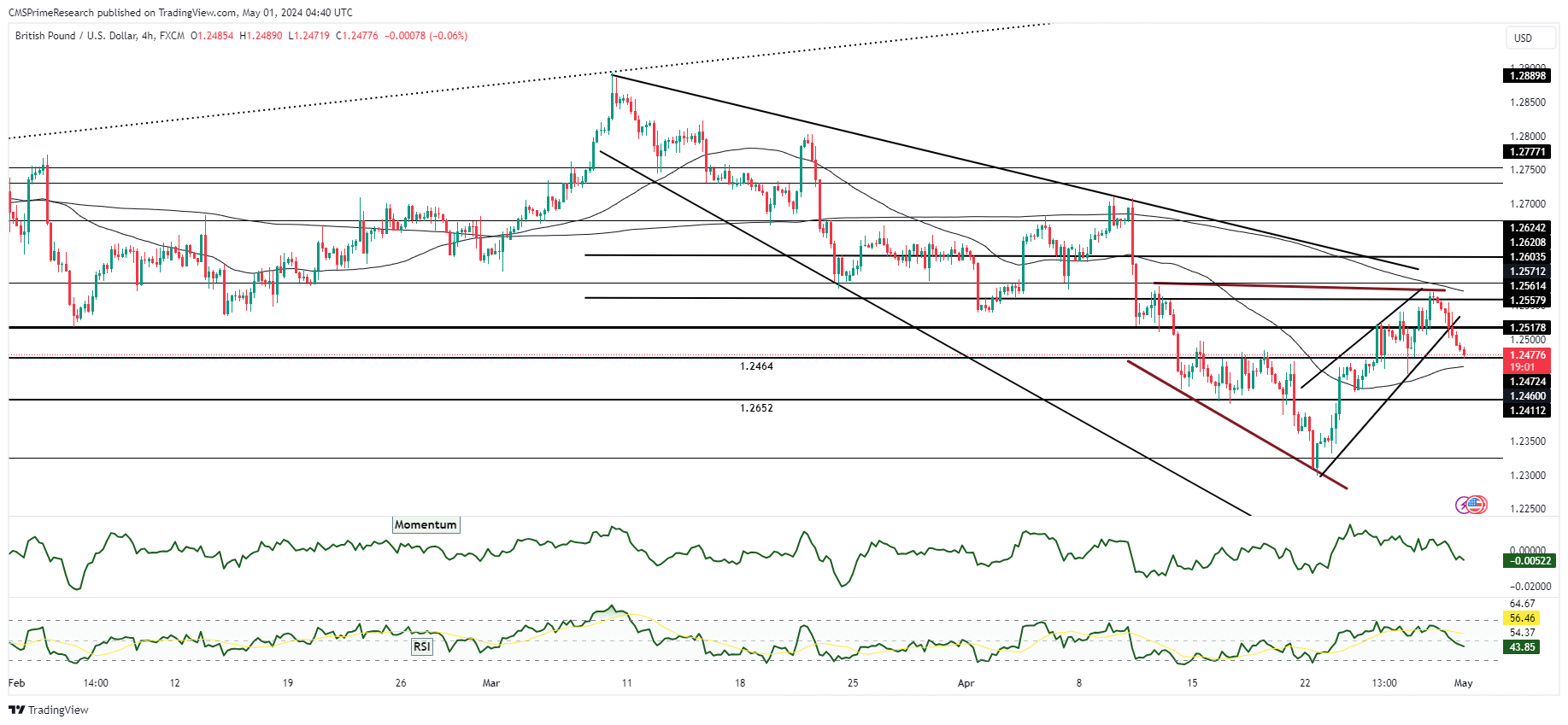

The recent performance of GBP/USD paints a picture of downward pressure, with a notable 0.5% decrease and a consequential test of support at the 1.25 level. This decline is particularly significant as it signifies a breach below its 200-day moving average (DMA), indicating a potential shift in trend dynamics. Concurrently, the stability observed in EUR/GBP hints at a predominantly USD-driven movement in the currency pair, underlining the overarching influence of the greenback in the current market sentiment.

Macro-level concerns loom large, primarily revolving around the increasingly hawkish stance of the Federal Reserve. This shift in tone has propelled the USD higher, in turn elevating yields and intensifying market expectations of impending rate hikes. The amplification of such expectations is further bolstered by the release of U.S. Q1 Employment Cost Index (ECI) data, which has served to reinforce the likelihood of Fed tightening measures. Against this backdrop, the anticipation of month-end flows favoring the dollar adds another layer of support to the prevailing USD-centric narrative. Looking ahead, a break below the critical 1.25 support level for GBP/USD could potentially pave the way for further downside, with subsequent support expected around the 1.2451-60 range. Moreover, the looming shadow of the upcoming Fed meeting suggests that any upside potential for the Sterling may remain limited in the near term, as market participants brace for potential policy adjustments that could further bolster the greenback’s position on the global stage.

Key Levels to Watch: : 1.2565,1.2508,1.2454

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.2430 | 1.2465 |

| Level 2 | 1.2408 | 1.2500 |

| Level 3 | 1.2390 | 1.2527 |