GBPUSD trades lower ahead of BOE Interest Rate Decisions

Technical Analysis:

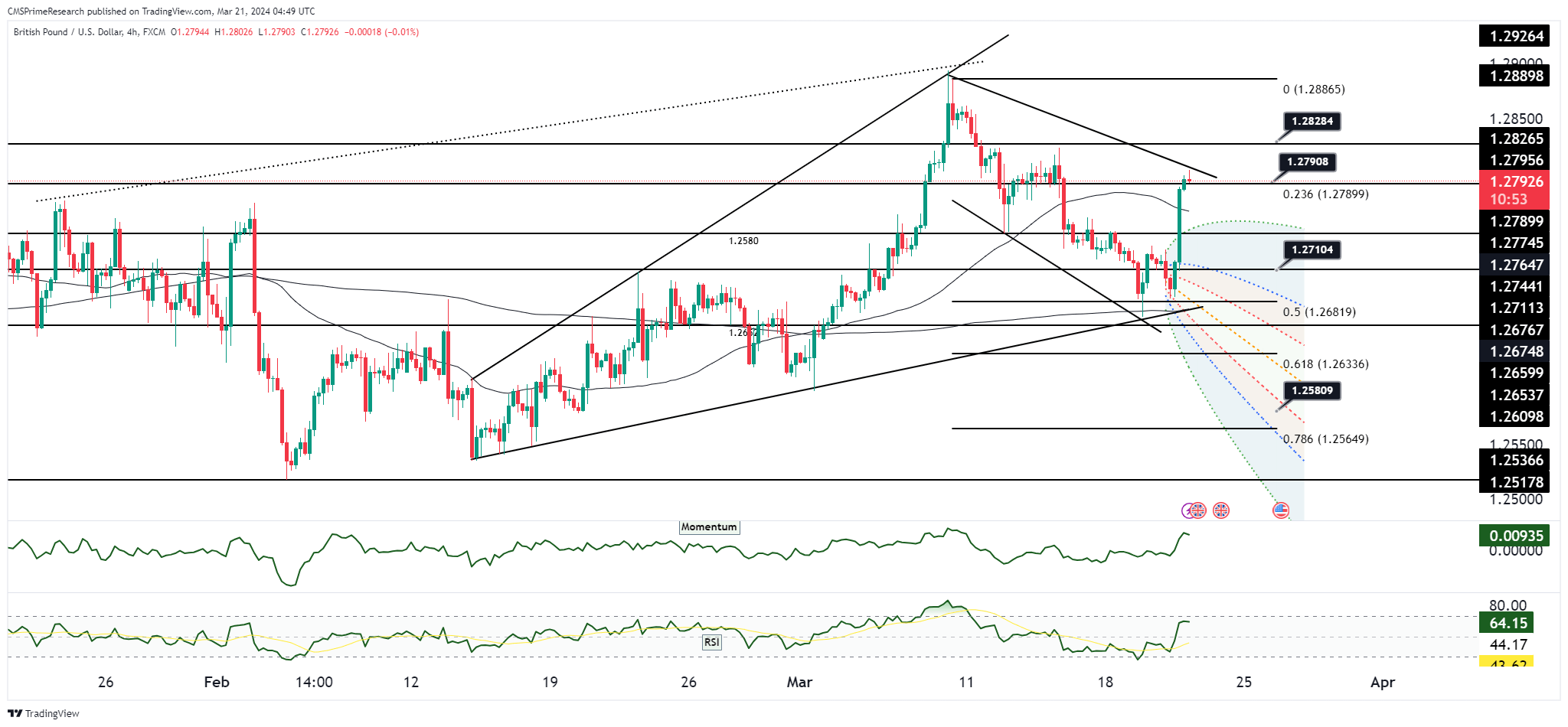

The GBP/USD pair has witnessed a modest uptick, reflected in the 0.08% rise to 1.2774, with trading contained within the 1.2770-1.2685 range. The technical structure reveals resistance at the recent high of 1.2740, followed by the 50-Day Moving Average (DMA) at 1.2775, and a more significant resistance at the 1.2810 level. On the support front, the daily conversion line at 1.2720 provides an immediate floor, with subsequent support seen at the 1.2675 low and the 1.2630 area. The pair’s price action remains above the daily conversion line, suggesting an underlying bullish sentiment.

Fundamental Analysis: The Federal Reserve’s decision to hold rates steady while signaling fewer rate hikes in the forthcoming years initially saw mixed reactions across currency markets. Sterling has maintained stability post-UK CPI release, which came in at a robust 4.5%, notably above the Bank of England’s (BoE) target of 2%. The market now awaits further rate guidance from both the Fed and the BoE. There’s an expectation for the BoE to adopt a less hawkish tone in light of the softer UK CPI figures; the voting pattern in the upcoming meeting will be closely scrutinized for signs of dovish shifts.

Overall Market Sentiment: The market sentiment around GBP/USD is cautiously optimistic, as traders balance the latest Fed rate decision and await the BoE’s response to recent inflation data.

Sentiment Percentage Breakdown:

- 60% Positive: Supported by the GBP’s resilience post-CPI and anticipation of a potentially dovish tilt from the BoE.

- 20% Neutral: There is a sizeable neutral sentiment due to hesitance before the BoE meeting and mixed signals from the Fed.

- 20% Negative: Concerns persist about the BoE’s reaction to inflation remaining significantly above target, which could lead to volatility.

The positive sentiment is bolstered by the GBP holding its ground after the inflation report and the currency’s technical position above immediate support levels. The neutral sentiment reflects the market’s pause for central bank insights, while the negative sentiment accounts for the inflationary pressures that may compel the BoE to maintain a tighter monetary stance despite softer CPI data.

Key Levels to Watch: : 1.2727,1.2736,1.2745

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.2615 | 1.2700 |

| Level 2 | 1.2530 | 1.2720 |

| Level 3 | 1.2470 | 1.2750 |