Current Factors Influencing Current Crude Oil Prices:

Oil prices experienced a slight decline on Wednesday due to concerns about demand growth in China, the largest importer of crude oil globally, despite signs of supply tightness resulting from output cuts by major producers.

Brent crude futures dropped 13 cents to $81.85 a barrel, while U.S. West Texas Intermediate crude futures fell to $78.00 a barrel.

China’s announcement of an economic growth target of around 5% for 2024 lacked substantial stimulus plans, raising concerns about potential lagging demand growth in the country this year.

The recent “risk-off” sentiment in trading was evident in the decline in Treasury yields, which also exerted downward pressure on oil prices. Gold prices reached a record high on Tuesday amid increasing expectations of a U.S. interest rate cut in June.

However, oil prices found support from a weaker U.S. dollar and the extension of output cuts by the Organization of the Petroleum Exporting Countries and its allies (OPEC+) until the end of the second quarter, totaling 2.2 million barrels per day.

The extension of output cuts, combined with disruptions in oil tanker movements due to attacks in the Red Sea by the Houthi militia in Yemen, contributed to supply tightness, especially in Asian markets.

Saudi Arabia, the largest oil exporter globally, announced slightly higher prices for April crude sales to Asia, indicating signs of physical tightness in the market.

The American Petroleum Institute reported a smaller-than-expected increase in U.S. crude stocks, with gasoline inventories dropping by 2.8 million barrels and distillate fuel stocks falling by 1.8 million barrels, according to industry sources.

Official data from the U.S. Energy Information Administration, scheduled for release later on Wednesday, will provide further insights into U.S. crude storage levels. If the EIA reports a build in crude storage, it will mark the sixth consecutive week of rising oil stocks in the country.

Technical and Fundamental Analysis

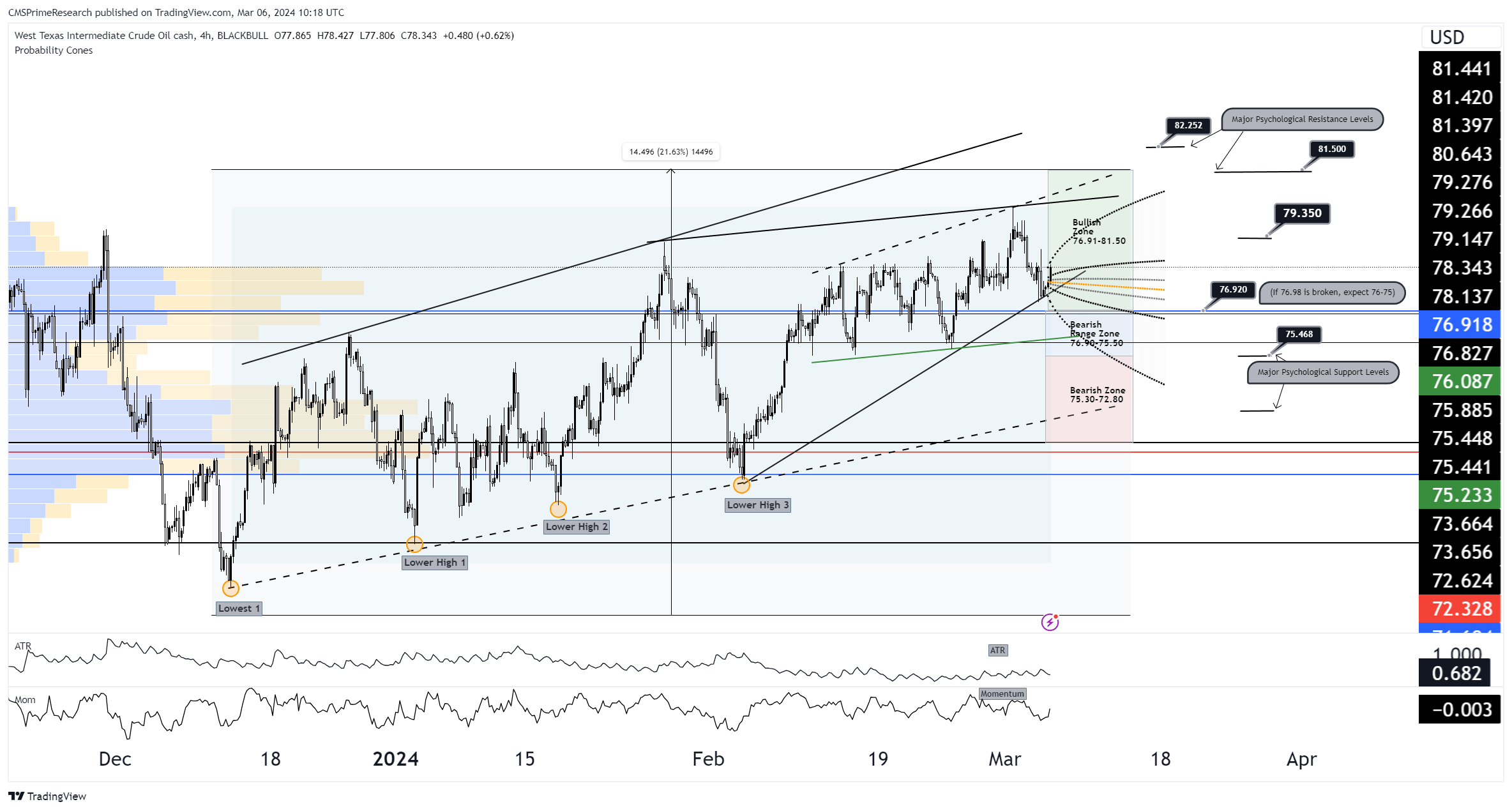

Chart Overview and Price Action

Technical Analysis:

Trend: WTI prices are currently experiencing consolidation with a slight bearish tilt due to lower highs since the peak around $82.252. The market is hesitating below this level, signaling a lack of bullish conviction to push higher.

Support and Resistance Levels:

- Immediate Support: The immediate support is found at the $75.468 level, which aligns with the previous swing low and a psychological level.

- Key Resistance: The key resistance is near the $79.350 level, which represents recent highs and a potential pivot point for bullish momentum.

Moving Averages: The absence of moving averages on the chart limits the analysis; however, the price being below recent highs suggests it could be under a key moving average, providing dynamic resistance.

Volume Profile: The highest volume node in the recent price range is near the $76.920 area, suggesting a strong area of interest which could act as a pivot.

Momentum Indicators: The Momentum indicator is showing weakness with a downward trend, and the ATR suggests decreasing volatility which is typical of a consolidating market.

Fundamental Analysis:

Demand Concerns in China: The modest growth target without robust stimulus is bearish, indicating potential for demand weakness from the world’s largest importer.

Supply Tightness: The OPEC+ output cuts and Red Sea disruptions are bullish factors that could limit downside risk and potentially drive prices higher if they persist.

Saudi Pricing: Saudi Arabia raising its prices to Asia is a bullish signal of physical market tightness which could support crude prices.

U.S. Inventories: A smaller-than-expected increase in U.S. crude stocks is supportive, with a draw in gasoline and distillate stocks indicating higher demand.

Scenario Forecasts:

Bullish Scenario (40% Probability): If the EIA data confirms a draw or smaller build in stocks, combined with OPEC+ discipline and Asian market tightness, WTI could break above the $79.350 resistance.

- Price Targets:

- First Target: $79.350 (break of consolidation)

- Second Target: $81.500 (approaching previous high)

- Stretch Target: $82.252 (retest of recent peak)

- Price Targets:

Bearish Scenario (30% Probability): Should the EIA data show a significant build, coupled with persistent demand concerns from China, WTI could breach below $75.468 support.

- Price Targets:

- First Target: $75.468 (loss of immediate support)

- Second Target: $73.000 (next psychological level)

- Stretch Target: $72.328 (extended downside target)

- Price Targets:

Neutral Scenario (30% Probability): Mixed signals from fundamentals and a wait-and-see approach from traders could keep WTI ranging between $75.468 and $79.350.

- Price Targets: Trading within this range with no clear breakout.

Overall Market Sentiment:

- Positive: 40% based on OPEC+ cuts, physical market tightness, and potential supportive EIA data.

- Negative: 30% due to China’s growth concerns and the risk of increased U.S. inventories.

- Neutral: 30% reflecting the current consolidation and mixed market signals.

This analysis represents a snapshot based on current information. Any new economic data, geopolitical developments, or changes in market sentiment can quickly alter the landscape, requiring a re-evaluation of these scenarios and targets. It’s crucial to stay updated with real-time information and adjust positions accordingly.

Price analysis and Targets:($75.50-$81.50)

Strategy Overview

The intricate dynamics of the crude oil market, as outlined, with a focus on the interplay between demand concerns in China, OPEC+ output cuts, and geopolitical tensions, present a fertile ground for crafting a trading strategy targeting the specified price points of $75.50 and $81.50. Here’s how such a strategy could be structured, taking into account the technical and fundamental analysis:

Strategy Framework

Market Condition Overview:

- The market is currently experiencing consolidation with a bearish tilt, amidst mixed signals from fundamental factors such as China’s demand outlook and OPEC+ output cuts.

Strategic Approach:

- For the $75.50 Target (Bearish Outlook): This approach leverages the potential for further demand concerns from China and the possibility of a significant build in U.S. inventories, pushing prices below immediate support levels.

- For the $81.50 Target (Bullish Outlook): Capitalizes on the tight supply scenario reinforced by OPEC+ discipline and geopolitical factors that might squeeze supply, aiming for a breakout above key resistance.

Entry Points, Stop-Loss, and Profit Targets

Bearish Target ($75.50):

- Entry Point: Initiate a short position if the price fails to breach the $79.350 resistance or if bearish EIA data triggers a move towards immediate support.

- Stop-Loss: Place stop-loss orders slightly above the $79.350 resistance to minimize losses if the market unexpectedly turns bullish.

- Profit Target: Set the profit target at $75.50, being prepared to adjust based on market response and potential further targets if bearish momentum intensifies.

Bullish Target ($81.50):

- Entry Point: Enter long positions upon a confirmed breakout above the $79.350 resistance, particularly if driven by supportive EIA data or further signs of market tightness.

- Stop-Loss: Implement stop-loss orders just below the breakout level to protect against false breakouts or a quick reversal in sentiment.

- Profit Target: Aim for the $81.50 price point, while being open to extending gains towards the stretch target if bullish factors dominate market sentiment.

Risk Management and Market Monitoring

- Position Sizing: Adjust the size of trades based on the current market sentiment and individual risk tolerance, with a cautious approach given the prevailing uncertainty.

- Continuous Analysis: Keep a close watch on upcoming EIA data releases, OPEC+ actions, and geopolitical developments, ready to swiftly adjust or exit positions based on new information.

- Sentiment Adjustment: Regularly reassess market sentiment, staying alert to shifts in fundamentals that could influence oil prices, such as changes in China’s economic outlook or unexpected moves by major producers.

This strategy is designed to navigate the complexities of the crude oil market, leveraging identified bearish and bullish scenarios to target specified price points. By employing disciplined entry, stop-loss, and profit target mechanisms, and staying adaptable to evolving market conditions, traders can aim to capitalize on the opportunities presented within the current market landscape. Continuous engagement with market developments and sentiment analysis will be key to refining the approach as conditions evolve.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.