EUR/USD consolidates ahead of Key ECB Decisions on March 7

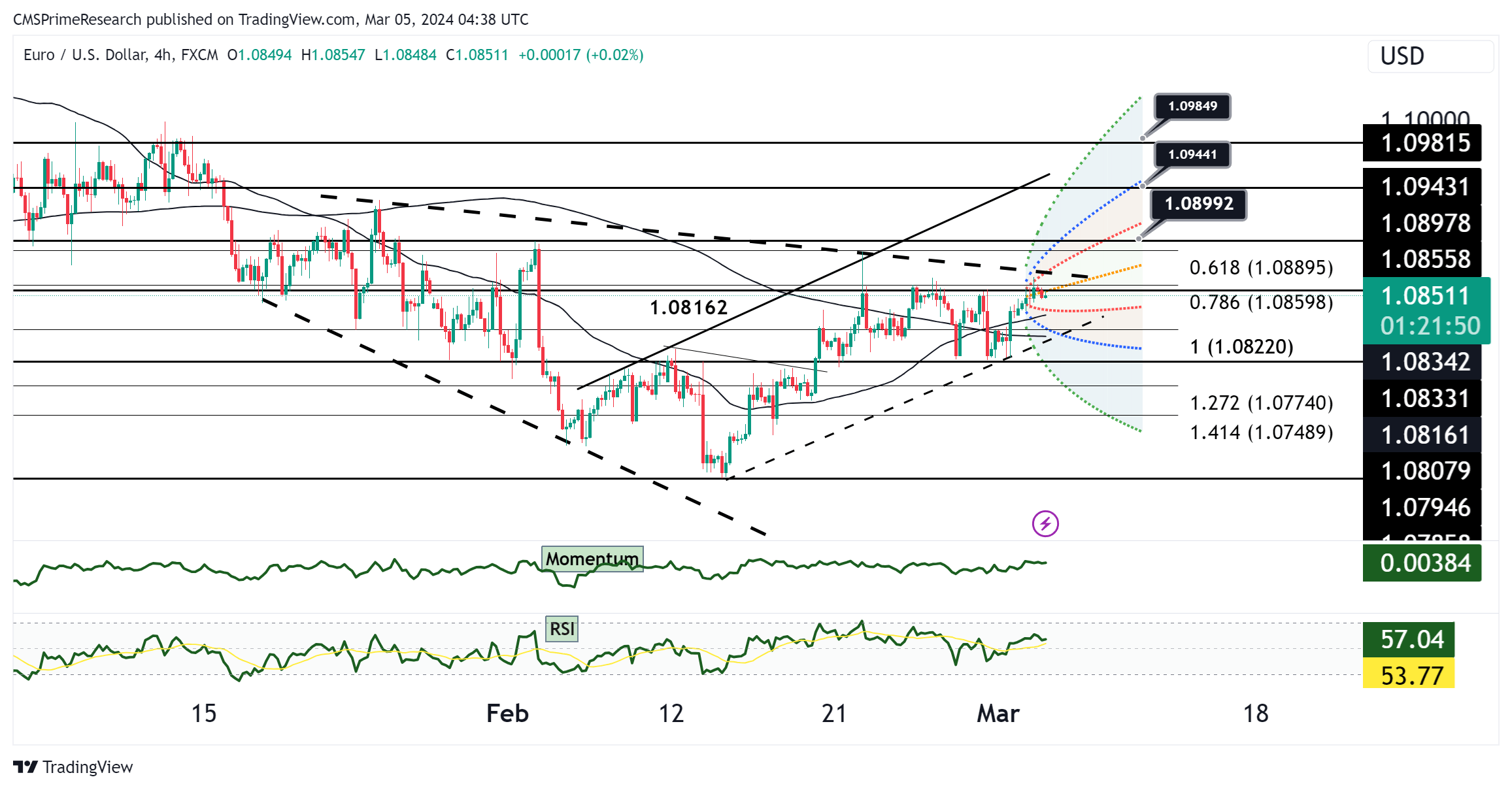

EUR/USD has shown resilience, opening positively but retreating slightly as the sentiment soured. The pair’s early advance to 1.0858 before stabilizing just below 1.0850 suggests a tentative approach among traders. Technically, support is found at the 21-day moving average (MA) at 1.0799. A breach below this level could intensify bearish pressure, shifting the focus to the downside. Resistance is identified at the 55-day MA at 1.0878 and further at last week’s high of 1.0889. These levels will serve as benchmarks for the pair’s short-term trajectory.

The chart shows the pair trading within an ascending channel, with a recent attempt to push higher. The Momentum indicator is positive, but the RSI has retreated slightly, indicating a possible slowdown in the bullish momentum.

Fundamental Analysis: Fundamentally, the mood was affected by slightly disappointing economic projections from China’s NPC, causing a turn towards risk aversion that has impacted the Euro. The key event for today will be the testimony of Federal Reserve Chairman Jerome Powell, which is expected to have a significant influence on Fed rate expectations. The market consensus is that Powell will likely push back against the notion of early interest rate cuts, which could bolster the U.S. dollar and create headwinds for EUR/USD.

Overall Market Sentiment: The market sentiment for EUR/USD can be quantified as follows:

- 45% Positive: Despite the softer tone, there is a positive sentiment underpinned by the pair’s position above the 21-day MA and the initial rise in Asian trading, suggesting underlying support.

- 40% Neutral: A neutral sentiment prevails due to the uncertainty surrounding Powell’s upcoming testimony and its potential to affect market expectations regarding the Fed’s policy path.

- 15% Negative: There’s a cautious negative sentiment reflecting the impact of risk aversion and potential for a stronger dollar if Powell’s testimony is interpreted as hawkish.

The positive sentiment is supported by the pair’s technical posture and initial gains, while the neutral sentiment dominates amid the wait for clarity from Powell’s testimony. The negative sentiment acknowledges the risk-averse mood and the possibility that Powell may reinforce a less dovish Fed outlook, which could pressure the pair downwards.

Key Levels to Watch: : 1.07600,1.08256,1.07306

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.07510 | 1.07792 |

| Level 2 | 1.07306 | 1.07897 |

| Level 3 | 1.07137 | 1.08032 |