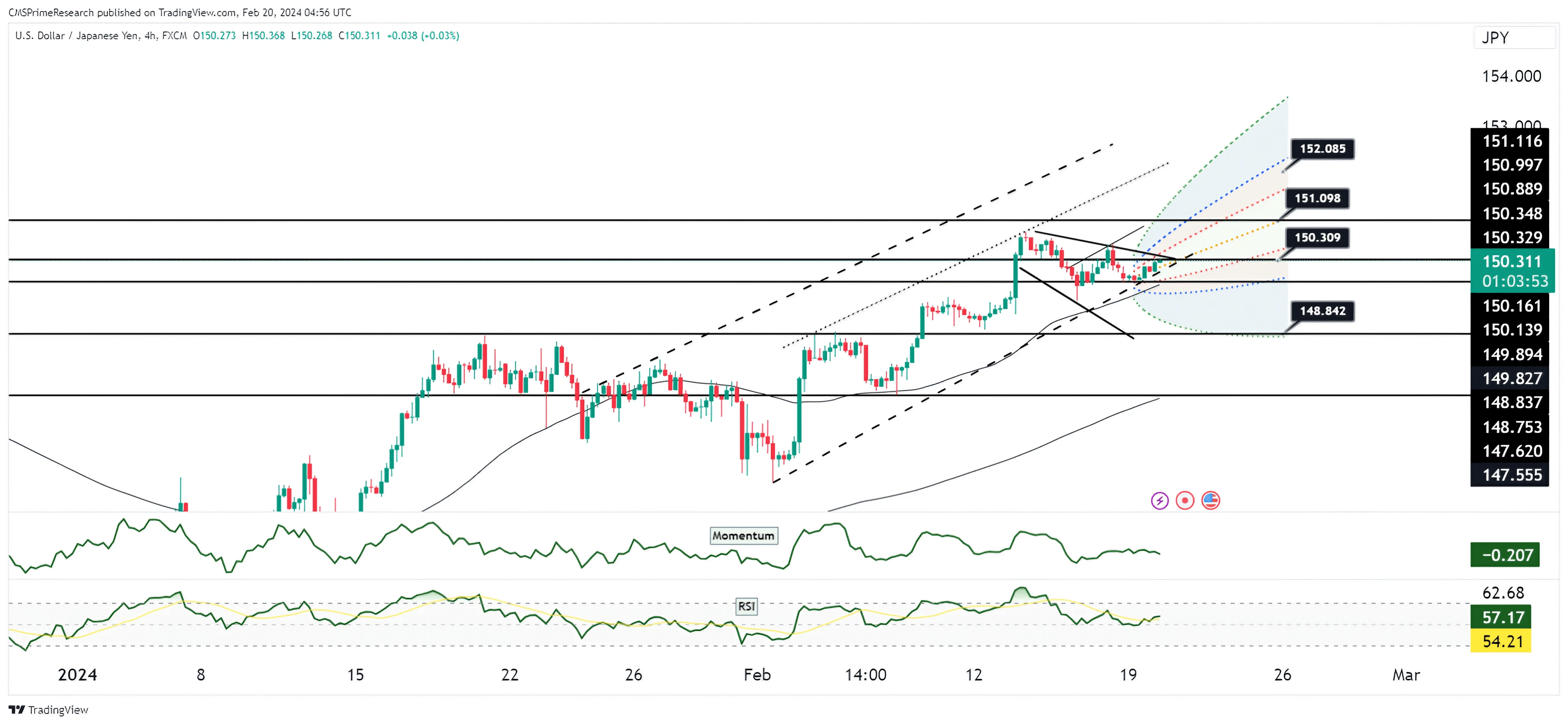

USD/JPY trading in a Strong Bullish Zone, waiting to retest the 151 level

The USD/JPY pair is currently trading within a tight range around the critical 150.00 level. This area is not only psychologically significant but also technically relevant, as the pair is persisting above the 149.20 Fibonacci level, a 61.8% retracement of the November to December decline. The sustained trading above this Fibonacci level suggests a bullish posture in the market. The momentum indicators are mixed, with the RSI hovering around the mid-point, indicating that while there has been some positive momentum, it is not in the overbought territory.

The expectations of a hawkish policy tweak by the Bank of Japan (BOJ) in April are contributing to the sentiment, although such a policy shift may still be considered premature by some market participants. Additionally, the correlations between USD/JPY and EUR/JPY are both robustly positive, highlighting the interconnectedness of these currency pairs and suggesting that movements in one could influence the other.

Overall Market Sentiment: The sentiment in the USD/JPY market can be quantified as follows:

- 60% Positive: Strong technical indicators, such as the break above key Fibonacci levels, and expectations of a hawkish tilt in BOJ policy are fostering a bullish sentiment.

- 30% Neutral: A significant portion of the market remains neutral, recognizing the psychological importance of the 150.00 level and awaiting confirmation of further bullish signals.

- 10% Negative: A small fraction of the market is cautious, acknowledging that the anticipated BOJ policy adjustments could already be priced in and that there may be resistance ahead.

The positive sentiment is underpinned by the technical breakout and the market’s anticipation of potential BOJ policy changes that could favor a stronger yen, hence potentially limiting gains in USD/JPY. The neutral sentiment reflects the market’s watchful approach given the currency pair’s proximity to a key psychological level. The negative sentiment takes into account the possibility that market expectations for the BOJ may not materialize as forecasted, which could result in a reevaluation of the bullish scenario.

Key Levels to Watch: : 149.505,150,151.237,151.739

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 150.256 | 150.868 |

| Level 2 | 149.830 | 151.237 |

| Level 3 | 149.505 | 151.740 |