USD/JPY bullish after Suprise CPI outcome, cautious optimism exists.

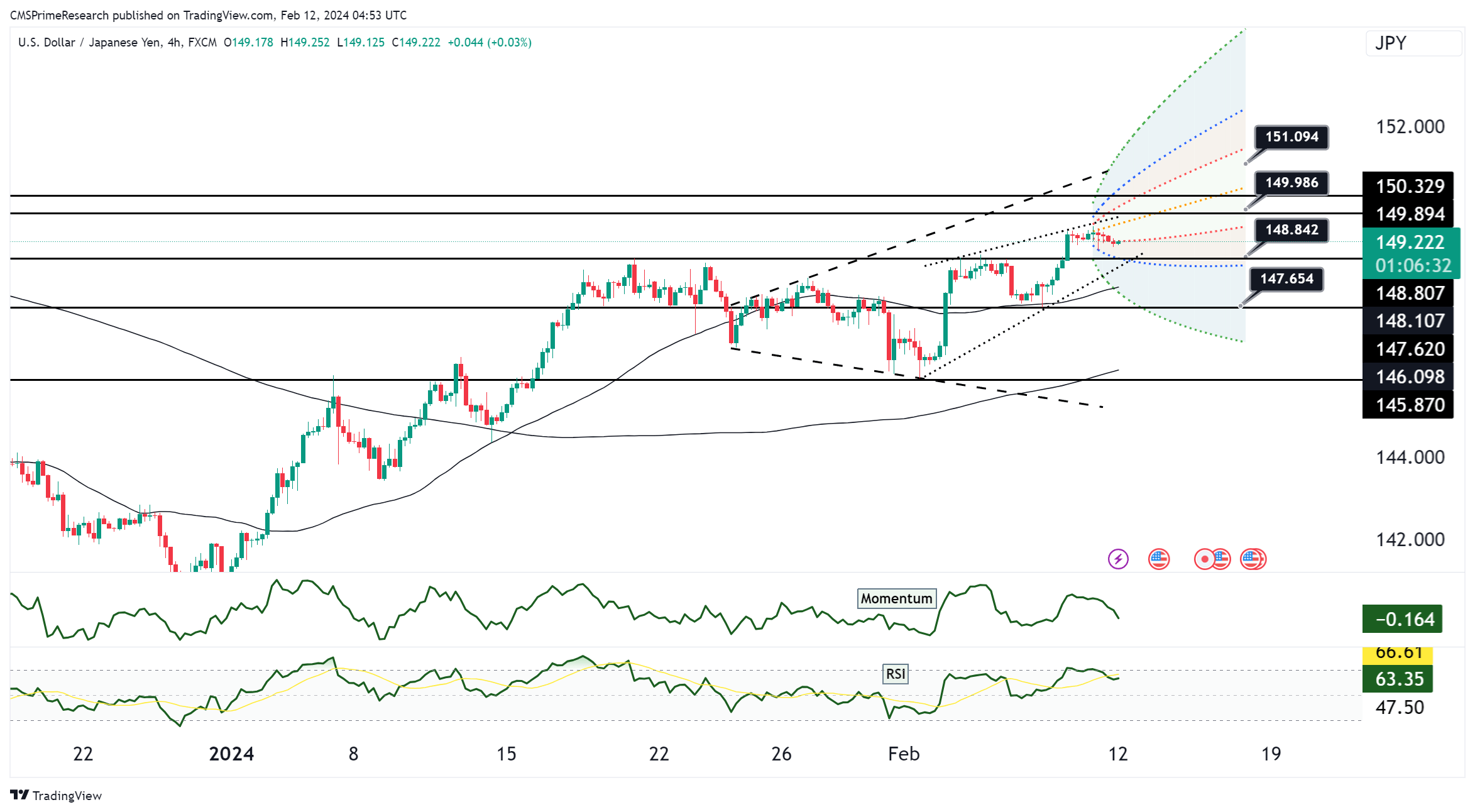

The technical structure for USD/JPY shows the pair retreating from an overnight high, as evidenced by the pullback on the candlestick chart. The chart exhibits a short-term consolidation pattern, with price oscillating within a defined range, suggesting a pause in the previous uptrend. The momentum indicator, while still on the upper side, has begun to recede, which correlates with the price action taking a step back from the recent peaks. The RSI, settled near the overbought threshold, supports the idea that the pair might be due for a period of consolidation or a slight correction.

Fundamentally, the pair’s dynamics are being shaped by the interplay between U.S. Treasury yields and Japanese fiscal activity. The U.S. yields remain firm following hotter-than-expected CPI data, which diminishes the likelihood of aggressive rate cuts by the Federal Reserve and supports the strength of the dollar. Meanwhile, the massive option expiries at the 151.00 level are creating a gravitational pull that could be capping the upside potential of the pair. Japanese exporter and importer activities are adding to the currency dynamics, creating resistance and support levels, respectively. Additionally, the early remarks from Japanese officials, potentially hinting at discomfort with a weaker yen, may have contributed to the pair’s pullback from its highs.

Overall Market Sentiment: The sentiment within the USD/JPY market can be encapsulated as follows:

- 55% Positive: Despite the retreat from overnight highs, the firm U.S. yields bolster the dollar’s position, reflecting a largely positive outlook.

- 30% Neutral: The market is acknowledging the substantial option barriers and the involvement of Japanese fiscal parties, which may lead to a temporary stasis in the pair’s direction.

- 15% Negative: The possibility of further jawboning by Japanese officials and technical indicators hinting at overbought conditions contribute to a slightly bearish sentiment.

The positive sentiment underscores the strength of the dollar backed by U.S. yields and inflation data, which suggest a less dovish Federal Reserve. The neutral sentiment recognizes the impact of significant option expiries and the ebb and flow of exporter and importer interests. Lastly, the negative sentiment takes into account the potential interventionist rhetoric from Japanese officials and the technical indicators that suggest the pair may be due for a correction after recent gains.

Key Levels to Watch: : 149.505,150,151.237,151.739

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 150.256 | 150.868 |

| Level 2 | 149.830 | 151.237 |

| Level 3 | 149.505 | 151.740 |