How has the S&P 500 Fared so far?

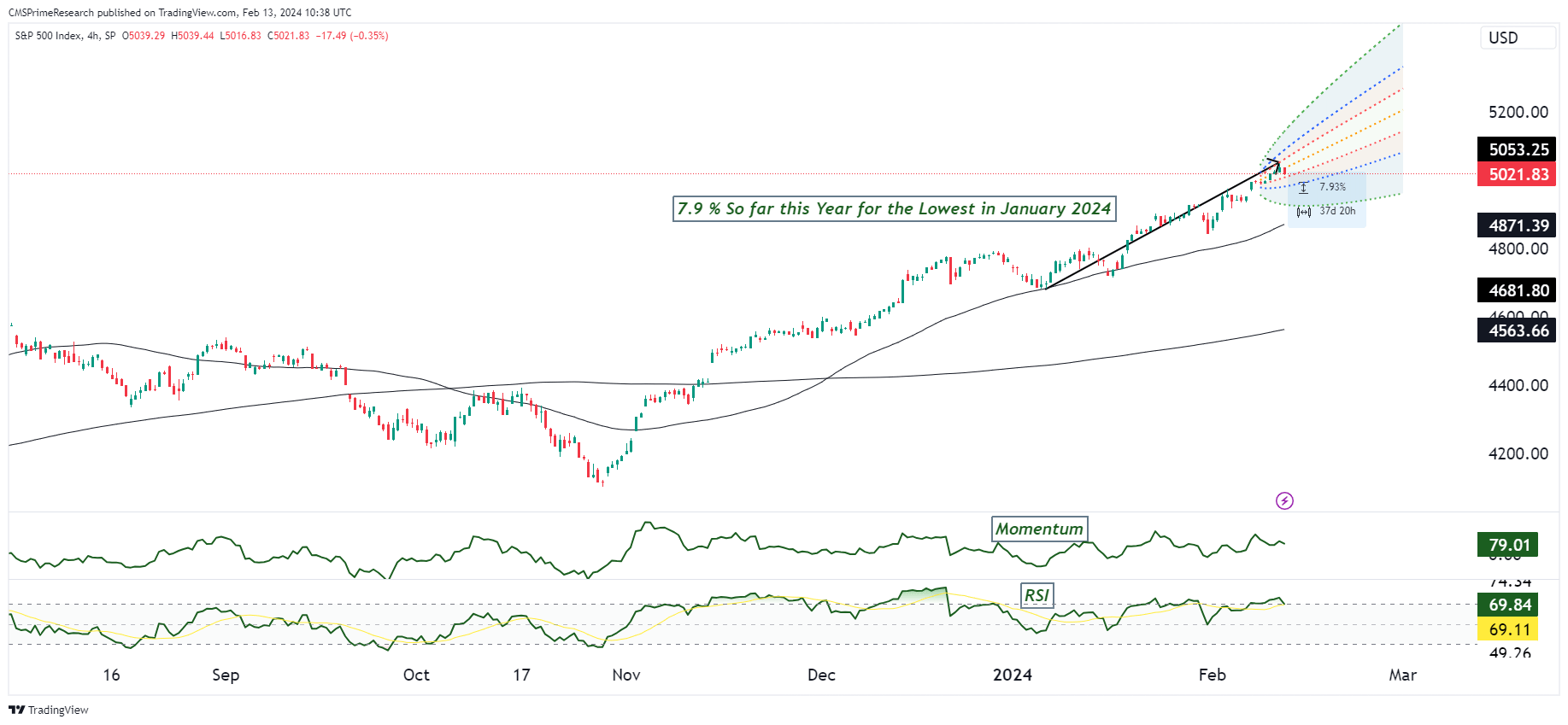

On February 13, 2024, the S&P 500 experienced a small decrease, closing at 5,021.84 points with a decline of 4.77 points or roughly 0.09%. This suggests that the market performance took a modest step back on that particular day. Investors displayed mixed sentiments as reflected in the futures trading before the market opened, with S&P futures showing a slight decline of 0.07%. The market’s key anticipation sourrounding Tuesday’s CPI Data, will be of importance in the coming weeks for S&P 500 Outlooks for February.

The performance of the S&P 500, which serves as a general indicator for the U.S. Stock market, is influenced by various economic factors and market sentiments.

As of February 2024, there are several factors that are currently influencing the S&P 500 in the economic landscape. These include the policy decisions of the Federal Reserve regarding interest rates, inflation pressures and the overall outlook for economic growth. After a period of raising interest rates aggressively, it is anticipated that the Federal Reserve will take a pause and may even consider lowering rates in the latter part of 2024 due to a decrease in inflationary pressures and a slowdown in job market activity. This potential shift has the potential to cause fluctuations in the market and have an impact on how well the S&P 500 performs. Furthermore, if there is slower economic growth, this could introduce some volatility as well. However, it is expected that equities will continue to build upon their gains from previous years, supported by growth in corporate earnings and possible expansion of valuations beyond just large cap technology sectors.

Reflections on the Current Earnings Season

The earnings season for January and February 2024 has been characterized by cautious optimism due to expectations of strong earnings growth throughout the year. Analysts predict a nearly 12% increase in corporate earnings for the S&P 500 in 2024, which is significantly higher than the average of 8.4% over the past decade. This positive outlook is mainly focused on the fourth quarter of 2024, where a substantial jump of 18.2% in earnings is expected. The first three quarters also show promising growth projections; Q1 at 6.8%, Q2 at 10.8% and Q3 at 9%.

However, despite the optimistic outlook for this year, the early stages of the earnings season have started off on a weaker note. The performance of companies in relation to their earnings estimates has been below average, with fewer companies reporting positive surprises compared to historical norms. This trend has been particularly noticeable in the financial sector, contributing to an overall below average performance.

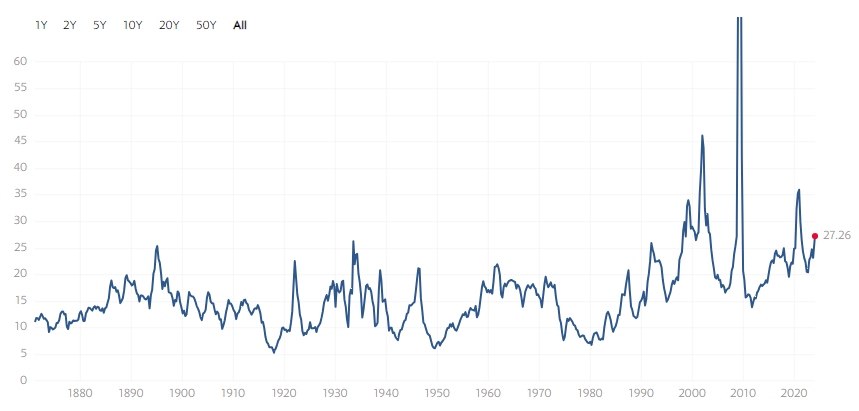

One key area of focus has been corporate profit margins, with expectations that they will rebound towards record highs during the second half of 2024. Although there has been a slight decline from their recent peak, current profit margins remain strong and well above the five year average, which supports market valuations. The current price to earnings (P/E) ratio for the S&P 500 has adjusted to around 27, which is slightly above the average but lower than its recent peak.

S & P 500 PE RATIO Chart

During this earnings season, investor sentiment seems to be influenced by expectations of a recovery in earnings growth. However, there’s a word of caution; if the Q4 2023 earnings season performs worse than expected or if many companies revise their 2024 earnings projections downwards, it could undermine confidence in the optimistic forecasts for the year.

The focus has also been on big tech companies earnings, such as Amazon, Apple and Nvidia. Investors are closely watching how these companies are incorporating AI and other technological innovations into their operations and products. This has implications both for their stock performance and the broader market outlook.

Overall, early 2024’s earnings season sets a tone of cautious optimism. Market participants are carefully observing corporate earnings reports, profit margins and forward looking valuations. There is a mix of hope for sustained earnings growth while being mindful of potential risks ahead.

Valuations, Economic and Market Factors- S&P 500

Economic and Market Factors

Economic Activity and Consumer Strength: J.P. Morgan Research highlights a backdrop of declining consumer strength and increased credit stress, noting that excess savings from the COVID era are largely depleted for the majority of consumers. This financial strain, particularly evident in rising credit card and auto loan delinquencies, suggests that by mid-2024, only the wealthiest tier of consumers might remain financially better off than pre-pandemic levels.

Inflation and Economic Demand: The anticipation is for both inflation data and economic demand to soften in 2024. While a decline in inflation could initially be welcomed by investors, leading to a boost in bonds and stocks, there’s a risk that it might also signal an economic slide towards recession. The market’s response to inflation trends and economic activity will be critical, with potential shifts in investor sentiment from optimism to concern, depending on the trajectory of these economic indicators.

Interest Rates and Geopolitical Developments: The impact of past interest rate shocks and geopolitical developments presents a primary challenge for risky asset performance and the broader macro outlook. J.P. Morgan’s analysis suggests that without significant interest rate reductions and a reversal of quantitative tightening, a sustainable rally in risk assets appears unlikely, pointing to potential market declines and volatility in 2024.

Market Valuations and Performance Indicators

S&P 500 Valuations: Despite a challenging economic backdrop, historical indicators offer some optimism for the S&P 500’s trajectory. Analyzing past patterns, there seems to be a strong likelihood of continued market gains, supported by factors such as performance following a double-digit return year, Federal Reserve easing cycles, and presidential election years. These indicators collectively suggest a favorable environment for the S&P 500, with a higher probability of positive returns in 2024.

Investor Sentiment and Strategy: The blend of macroeconomic challenges and historical market performance trends underscores the importance of a nuanced investment strategy. Investors might consider balancing caution with opportunity, factoring in economic indicators, market valuations, and historical performance patterns when making investment decisions.

The market is pricing in a mix of caution and optimism for the S&P 500’s performance in 2024, influenced by a variety of economic and market factors. While the broader macroeconomic challenges pose risks to risky asset performance, historical market indicators and valuation analyses suggest potential for continued gains. Investors navigating this landscape will need to weigh the interplay of economic trends, market dynamics, and historical performance patterns, remaining adaptable to shifts in economic indicators and investor sentiment.

A sample Strategy and Risk Management

For a detailed strategy combining fundamental and technical analysis, consider the following approach:

Risk Analysis of the Combined Fundamental and Technical Analysis Strategy

The proposed investment strategy integrates both fundamental and technical analysis to make informed decisions on buying and selling stocks within the S&P 500. While this approach is comprehensive, it is essential to understand the inherent risks associated with it. The following analysis highlights the potential risks involved in implementing this strategy.

Market Volatility Risk

- Sensitivity to Market Conditions: This strategy heavily relies on market trends and indicators, making it sensitive to sudden market volatility and economic shifts. Events such as geopolitical tensions, economic policy changes, or unexpected financial market movements can rapidly alter the effectiveness of the strategy.

Technical Analysis Limitations

- Lagging Indicators: Technical analysis tools like moving averages and RSI are based on past price movements and may not accurately predict future trends. The reliance on these lagging indicators can lead to delayed entry or exit signals, potentially resulting in missed opportunities or increased losses.

- False Signals: Technical analysis can sometimes generate false signals due to market noise or atypical price movements. Acting on these signals could lead to entering or exiting trades based on misleading information.

Fundamental Analysis Challenges

- P/E Ratio Misinterpretations: The use of the P/E ratio as a valuation metric does not account for the growth prospects or the industry context of the stocks. Some sectors naturally trade at higher P/E ratios due to growth expectations. Relying solely on this metric may result in overlooking potentially valuable investments or misidentifying overvalued stocks.

- Market Overreaction: Stocks may become undervalued or overvalued due to market overreactions to news or events, leading to potential misalignments with their fundamental values. This discrepancy can affect the strategy’s effectiveness in identifying true buying or selling opportunities.

Risk Management Concerns

- Stop-Loss Limitations: While stop-loss orders are designed to limit losses, they can also result in premature exits from positions during temporary market dips, potentially missing out on subsequent recoveries.

- Position Sizing Complexity: Properly allocating portfolio percentages to different trades requires constant adjustment and rebalancing, especially in a volatile market. Incorrect sizing could lead to overexposure to risk or underutilization of capital.

Entry and Exit Strategy Risks

- Timing Challenges: The requirement for both fundamental and technical criteria to be met before entering or exiting a trade can lead to timing issues. The market conditions may change between the identification of a potential trade and the fulfillment of all criteria, affecting the trade’s outcome.

- Overreliance on Indicators: An overemphasis on technical indicators for exit strategies might ignore fundamental changes in the company’s outlook, potentially leading to exits from positions that may still have long-term value.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies, CFD’s involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.