EUR/USD strength Regains agian USD with positive news flow

The technical indicators reinforce the bullish outlook, with key oscillators such as the RSI (Relative Strength Index), STOCH (Stochastic Oscillator), MACD (Moving Average Convergence Divergence), and CCI (Commodity Channel Index) all signaling buy. Notably, the RSI is not in the overbought territory, which suggests that there might still be room for upward movement.

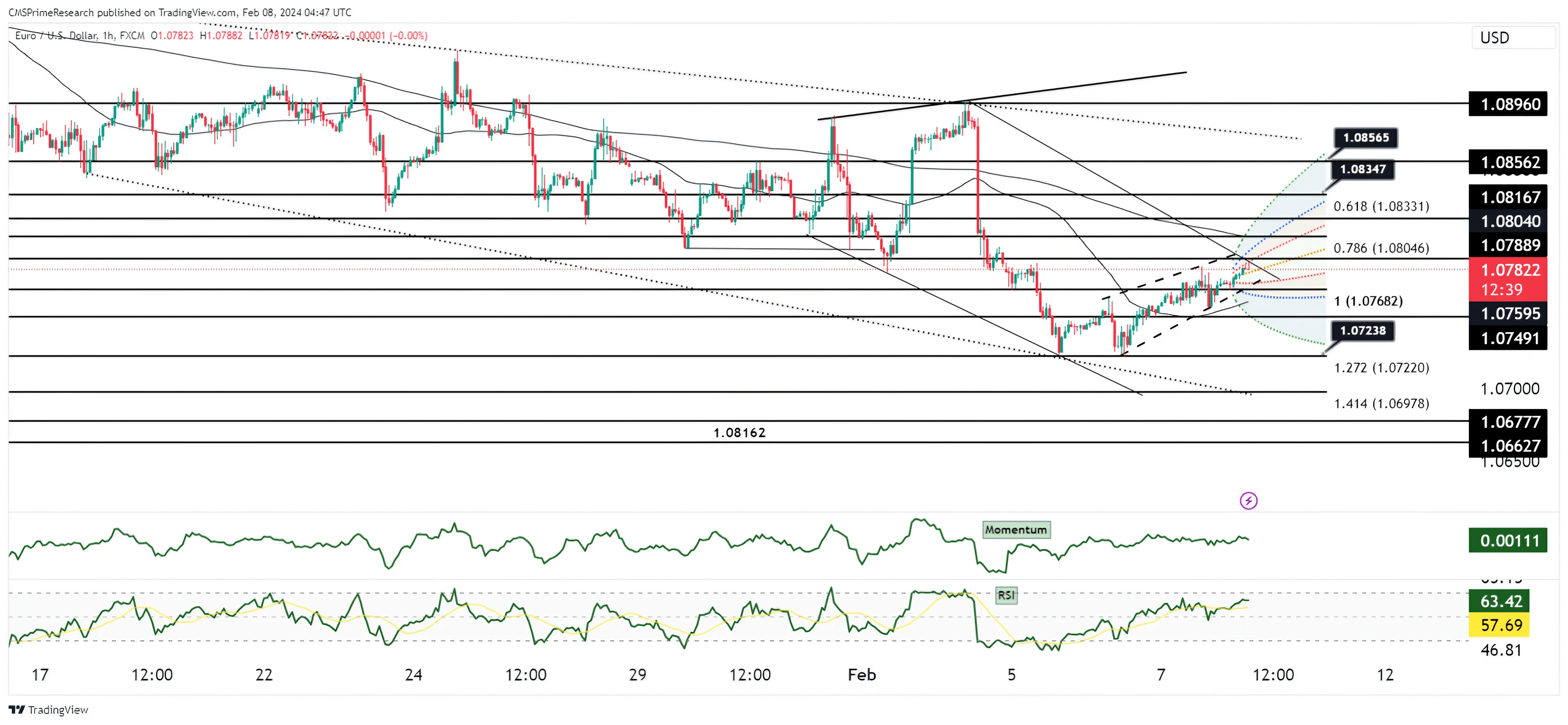

The Chart also highlights the momentum indicator trending upwards, and the RSI is moderately above the 50 level, indicating decent buying momentum but not yet overbought.

The current news indicate hawkish comments from the European Central Bank (ECB) and a dovish stance from the Bank of Japan (BOJ), which has strengthened the Euro against the USD

The GBP/USD pair would be influenced by the relative monetary policies of the Bank of England (BOE) and the Federal Reserve. While the report speaks to the ECB and BOJ, we can extrapolate that a hawkish ECB implies a strengthening Euro, which could potentially weigh on the USD if the market perceives the Federal Reserve to be less aggressive in its tightening cycle. However, the fundamental picture for the GBP will also hinge on the BOE’s policy direction, UK economic data, and Brexit-related developments.

Overall Market Sentiment: Considering the strong buy signals from technical indicators and the hawkish sentiment from the ECB, the overall market sentiment is skewed positively. The hawkish ECB comments and the dovish BOJ stance suggest a risk-on environment which typically benefits the GBP due to its higher yield relative to the JPY.

- 70% Positive: Indicated by strong technical buy signals and positive news flow from the ECB, suggesting that traders are leaning towards a bullish outlook.

- 20% Neutral: Despite the positive indicators, there’s always a portion of the market that remains on the sidelines, awaiting clearer signals or further data.

- 10% Negative: There’s a minor sentiment of caution due to potential overextensions in price movements and uncertainty surrounding global monetary policy tightening impacts.

The predominant positive sentiment is driven by the technical alignment of buy signals and the fundamental backdrop of a hawkish ECB, which implies confidence in the Euro and, by extension, could influence the GBP/USD pair through USD weakness.

Key Levels to Watch: : 1.07600,1.08256,1.07306

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.07600 | 1.07897 |

| Level 2 | 1.07500 | 1.08032 |

| Level 3 | 1.07306 | 1.08256 |