USD/JPY sentiment largely remains Neutral

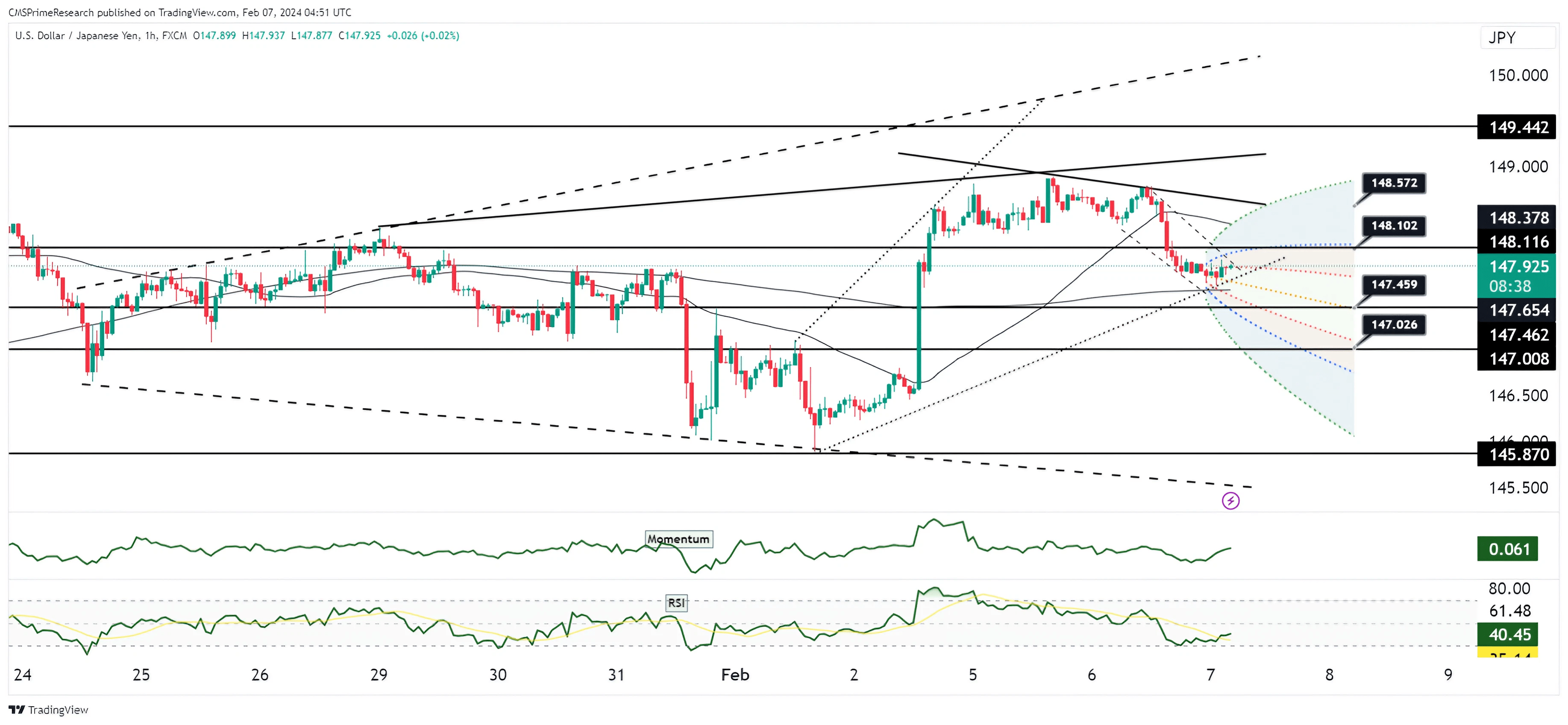

The USD/JPY pair has been exhibiting signs of a pullback, as discernible from the charts. After hitting a high of 148.90, the pair saw a retracement to the 147.87 region. Currently, the pair is trading within an ascending hourly Ichimoku cloud, which offers a mixed technical perspective. The support levels are distinctly marked by the 100-hour moving average (HMA) at 147.75, the 200-HMA at 147.64, and notably the 100-day moving average (DMA) at 147.49.

Resistance is now forming around the 148.00 mark, which could be reinforced by Japanese exporter interests. Additional resistance is found at the descending 55-HMA at 148.40. The currency pair’s ability to hold above these key moving averages may determine the short-term directional bias.

From a fundamental perspective, the correction in the yen is attributed to the easing of U.S. Treasury yields, which typically move inversely with the yen. The yields on Treasury 2s and 10s are notably dampening, which might help cap any significant upside in the USD/JPY pair. Moreover, the market is observing the large option expiries at the 147.00 level, which could act as a magnet for price action. Crosses with the yen are also displaying varying degrees of pressure, with EUR/JPY and GBP/JPY indicating some steadiness while AUD/JPY shows resilience.

Overall Market Sentiment:

The market sentiment for USD/JPY is currently mixed, with technical indicators signaling caution while fundamentals point to a limited downside due to softer U.S. yields.

- 50% Neutral: The indicators and price action between key support and resistance levels imply a wait-and-see approach among market participants.

- 30% Negative: There’s a cautious undertone due to the yen’s correction and the influence of easing U.S. yields, suggesting potential downside risks.

- 20% Positive: Some optimism remains due to the pair’s position above key moving averages, indicating the potential for a bounce-back if yields firm up or on bullish catalysts.

This sentiment is driven by the juxtaposition of technical support holding firm and fundamental factors such as U.S. Treasury yields, which are currently acting as a headwind against the USD.

Key Levels to Watch: : 148.327,147.436,149.20

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 147.436 | 148.327 |

| Level 2 | 147.280 | 148.694 |

| Level 3 | 147.090 | 149.020 |