What are Valuations?

For the purpose of improving decision-making on stock valuation one needs to understand the absolute and relative valuation methods. Absolute valuation aims at determining the fair value of the company to an investor by considering fundamental information about the firm such as cash flows, dividends, and growth rates. For instance, the Dividend Discount Model (DDM) and the Discounted Cash Flow (DCF) model. DDM stands to be highly effective for firms that frequently distribute dividends, while the DCF model is adequate for firms characterized by unpredictable or unknown dividend distributions.

On the other hand, relative valuation compares a potential investment with the similar companies. This approach determines multiples of other comparable firms and contrasts the findings with the target firm’s current value. The most widespread form of relative valuation is the Comparable Companies Analysis that applies the multiples like the price-to-earnings (P/E) or the enterprise value-to-EBITDA (EV/EBITDA) ratios.

One of the crucial aspects for a stock valuation is to know the nature of growth stocks, which tend to appear overvalued using conventional valuation methods. Growth stocks invest their profits in new growth, which is not paid out to shareholders in the form of dividends, and growth stocks are valued for the degree of growth anticipated in the future. Admittedly, CANSLIM is a good illustration of a model that addresses the most important factors of a growth stock.

These approaches, which include price-to-sales ratio, debt-to-equity ratio, and free cash flow are also important metrics for stock valuation. It is, therefore, vital to consider the general market setting and to avoid typical pitfalls such as value traps and built-in market hazards. Lastly, always keep in mind that stock valuation is an art and a science, and therefore, it needs to be developed and mastered as a result of a detailed analysis of the market trends and consideration of the specific corporate issues.

Absolute or Relative Valuations-Comparative Justifications

Absolute Valuation focuses on determining the intrinsic value of an asset based on its fundamental characteristics like cash flow, earnings, or book value. Common models in this approach include the Discounted Cash Flow (DCF) analysis and the Dividend Discount Model. The primary strength of absolute valuation lies in its focus on the fundamentals of the asset, making it suitable for companies with stable and predictable cash flows. However, it may not fully capture market sentiment and relative pricing dynamics.

Relative Valuation, in contrast, involves comparing the value of an asset to similar assets in the market, using multiples like P/E ratio, P/B ratio, or EV/EBITDA ratio. This method is simpler and offers a straightforward way to compare assets within an industry or sector. Its limitation is the reliance on the accuracy of chosen multiples, which might not always reflect the true value of an asset.

Application in Different Contexts:

- Absolute valuation is often preferred for analyzing companies with unique business models, unstable earnings, or significant growth potential. It is especially useful in industries experiencing rapid technological changes.

- Relative valuation is commonly used for comparing similar companies or assets within a specific industry or market segment, helping to quickly identify overvalued or undervalued opportunities.

Combining Both Methods: Many investors use a combination of both methods to gain a comprehensive understanding of an asset’s value. This blended approach considers both fundamental and market-based perspectives, leading to more informed investment decisions.

Market Conditions and Choice of Valuation:

- In volatile or rapidly changing markets, absolute valuation may offer more clarity on the underlying value of assets.

- In stable or mature markets, relative valuation could be more suitable for identifying relative pricing inefficiencies.

Risks and Limitations:

- Sole reliance on absolute valuation might overlook market dynamics.

- Exclusive dependence on relative valuation might result in overlooking fundamental value drivers and unique asset characteristics.

In conclusion, both absolute and relative valuation methods are essential in the finance and investment field, each with its strengths and limitations. The choice between them should be guided by the specific context, industry, and market conditions

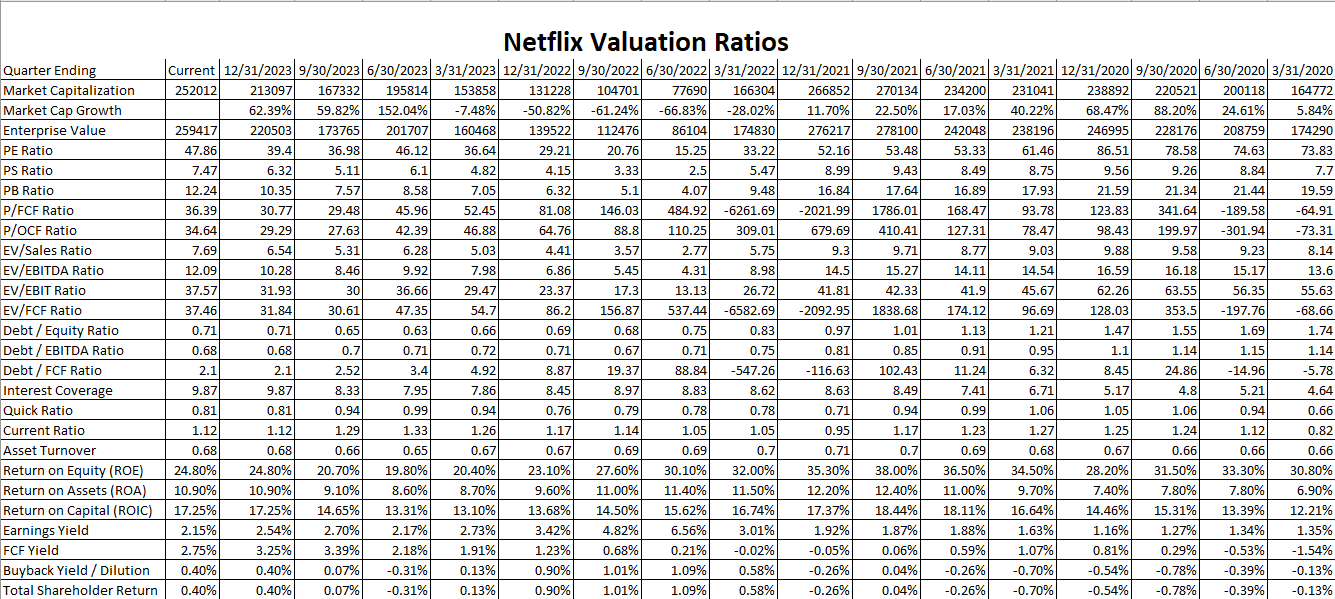

Lets Analyze Netflix's Valuation Metrics

Market Capitalization Growth: There is a significant fluctuation in market cap growth rates, indicating periods of expansion and contraction. This is expected as market capitalization is directly influenced by the company’s stock price, which is subject to market sentiment, earnings reports, and broader economic trends.

Price-Earnings (PE) Ratio: The PE ratio seems to exhibit a general downward trend, indicating either a decrease in the company’s share price or an increase in its earnings, or both. A declining PE ratio can suggest that the company’s valuation is becoming more reasonable relative to its earnings.

Price-Sales (PS) Ratio: This ratio also shows a decreasing trend, which might imply that the company’s revenue growth is outpacing the share price growth. This could be viewed as the market pricing the company more conservatively relative to its sales.

Price-Book (PB) Ratio: The PB ratio has seen some decline as well, suggesting an improving relationship between the company’s market valuation and its book value. This can be interpreted as the company’s assets and shareholders’ equity gaining ground in terms of market valuation.

Price to Free Cash Flow (P/FCF) and Price to Operating Cash Flow (P/OCF) Ratios: These ratios have seen some extreme values, particularly in the P/FCF ratio with negative spikes, which could be due to extraordinary items affecting free cash flow within those periods. Generally, these ratios would be analyzed for consistency over time to assess the company’s valuation in terms of its cash-generating ability.

Debt Ratios (Debt/Equity, Debt/EBITDA, Debt/FCF): These ratios indicate the company’s financial leverage. While there are some fluctuations, a generally stable or declining debt ratio could suggest that the company is either reducing debt, increasing equity, or improving earnings, which generally is a positive sign for financial health.

Return Ratios (ROE, ROA, ROIC): The return on equity, assets, and invested capital provide insights into the company’s profitability and efficiency. While there are variances, the return ratios seem to be on a downward trend more recently, which could warrant further analysis into the operational efficiencies and profit margins.

Yields (Earnings Yield, FCF Yield): The yields have seen some volatility. The FCF yield, especially with negative values, may point to periods where the company had negative free cash flow. Earnings yield fluctuations are directly related to the company’s profitability in relation to its share price.

To summarize, the valuation ratios suggest a mixed picture with evidence of some volatility in the company’s valuation, profitability, and financial health. Each ratio provides a different perspective, and when combined, they offer a comprehensive view of the company’s financial status and market valuation over the observed periods.

Valuation Perspective (Value vs. Growth) for Netflix

Growth Perspective:

- Market Cap Growth: A noticeable fluctuation in Market Cap Growth, especially the significant increases in some quarters, may indicate investor optimism about future earnings, a hallmark of growth investing.

- PE Ratio: Higher PE ratios, like the ones observed here, can be indicative of growth stocks. Investors might be willing to pay more for earnings today in anticipation of future growth.

- PS Ratio: This ratio is also relatively high, suggesting that the market values the company’s sales highly, often a characteristic of growth stocks.

Value Perspective:

- Market Capitalization and Enterprise Value: These metrics provide a basis for valuing the company in absolute terms. A value investor would look at these in the context of the company’s fundamentals like earnings, assets, and debt.

- Quarterly Variability: The variability in these ratios could be a point of analysis for value investors, who often seek undervalued companies that may be temporarily out of favor.

The differing perspectives of value and growth investing bring complexity to the narrative around a company like Netflix. Growth investors focus on the potential for future earnings and revenue growth, often accepting higher valuations. In contrast, value investors seek stocks trading for less than their intrinsic values, focusing on more traditional valuation metrics.

Given the nature of Netflix’s business and its position in the streaming market, along with its fluctuating but generally high valuation ratios, the company is often viewed through a growth lens. However, any shifts in market dynamics, competitive landscape, or company fundamentals could alter this perception, making it crucial to continuously re-evaluate the investment thesis from both perspectives.

Outlooks: Scenario-Based Fundamental Analysis

Market Position and Competition:

- Growth Perspective: Netflix is a dominant player in the streaming industry, with a substantial subscriber base and brand recognition. This could lead to sustained growth in revenues and market share.

- Counterpoint: Intense competition from other streaming services (like Disney+, Amazon Prime, HBO Max) could limit growth potential, as the market is becoming increasingly saturated.

Content Creation and Acquisition:

- Growth Perspective: Netflix’s investment in original content has been a key growth driver. Exclusive, high-quality content can attract new subscribers and retain existing ones.

- Counterpoint: High costs of content creation and acquisition could pressure profit margins. The necessity to continuously produce hit shows/movies to keep subscribers engaged is a challenging and costly endeavor.

International Expansion:

- Growth Perspective: Expansion into international markets presents a significant growth opportunity, especially in regions where streaming is still gaining popularity.

- Counterpoint: Different regions have diverse content preferences, regulatory challenges, and varying levels of competition, which could complicate expansion efforts and impact profitability.

Technological Advancements:

- Growth Perspective: Netflix’s investment in technology for content recommendation and user experience positions it well to capitalize on the growing trend of personalized entertainment.

- Counterpoint: Technological advancements are rapidly evolving, and failure to keep pace can result in losing market share to more innovative competitors.

Financial Health:

- Growth Perspective: Strong market capitalization and valuation ratios indicate investor confidence in future growth.

- Counterpoint: Fluctuating financial ratios and high PE and PS ratios may suggest overvaluation and potential future correction.

Macroeconomic Factors:

- Growth Perspective: The increasing trend towards digital streaming as a primary form of entertainment can be a long-term growth driver.

- Counterpoint: Economic downturns can lead to reduced consumer spending on entertainment, affecting subscription revenues.

Validation through Comparative Analysis:

- Comparison with Competitors: Netflix’s performance, in terms of subscriber growth and revenue, can be compared with major competitors to gauge its market position and growth potential.

- Historical Performance: Analyzing Netflix’s past financial performance, especially during different economic cycles, can provide insights into its resilience and growth potential.

- Industry Benchmarks: Comparing Netflix’s financial ratios with industry averages helps to understand whether its growth prospects are already priced in.

The analysis reveals a complex picture. On one hand, Netflix shows strong growth potential due to its market position, content strategy, and technological focus. On the other, challenges such as stiff competition, high content costs, and macroeconomic factors present significant risks.

Investment in Netflix can be seen as an opportunity if one believes in the company’s ability to navigate these challenges and continue its growth trajectory. However, this investment also carries risks, particularly relating to market saturation, cost management, and potential overvaluation.

This compare and contrast narrative underscores the multifaceted nature of investment decisions, where different factors and perspectives must be weighed to form a comprehensive view.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.