The 3 Indicators-What are they?

Leverage in equity markets: Leverage in equity markets refers to the use of borrowed capital to increase the potential return of an investment.In more detail, when an investor uses leverage in the equity markets, they are essentially borrowing money to invest in more stocks than they could with their own capital alone. This approach can magnify returns if the market moves in their favor. For instance, if an investor uses leverage to buy more shares of a company and the stock price increases, their return on investment is amplified. However, leverage also increases risk. If the stock price falls, the losses are magnified, and the investor still owes the borrowed funds. In financial markets, leverage acts as a rule that intensifies the impact of price movements,the interconnected nature of financial markets means that the use of leverage can have systemic implications. Thus, leverage in equity markets is a double-edged sword, offering the potential for increased returns but also carrying the risk of magnified losses.

Asset Price Movements:Asset price movements refer to the fluctuations in the prices of financial assets such as stocks, bonds, commodities, or real estate. These movements are the result of a myriad of factors interacting within the financial markets. The price of each asset is influenced by both local factors (such as a company’s financial performance in the case of stocks) and global factors (like economic policy changes or global market trends). These factors interact in a networked environment, leading to the overall emergent behavior of the market – reflected in the asset price movements. The dynamics of asset prices are complex and multifaceted. They can be driven by fundamental factors, such as earnings, economic indicators, and interest rates. Additionally, psychological factors, market sentiment, and investor behavior play a critical role. Asset prices are continuously adjusting based on the interplay of local and global factors. These movements are not random but are influenced by underlying patterns and rules, which can sometimes be predicted or analyzed through various financial theories and models. In summary, asset price movements in financial markets are the result of complex interactions among various factors.

Lets analyze these in the current Context:

PE Ratio

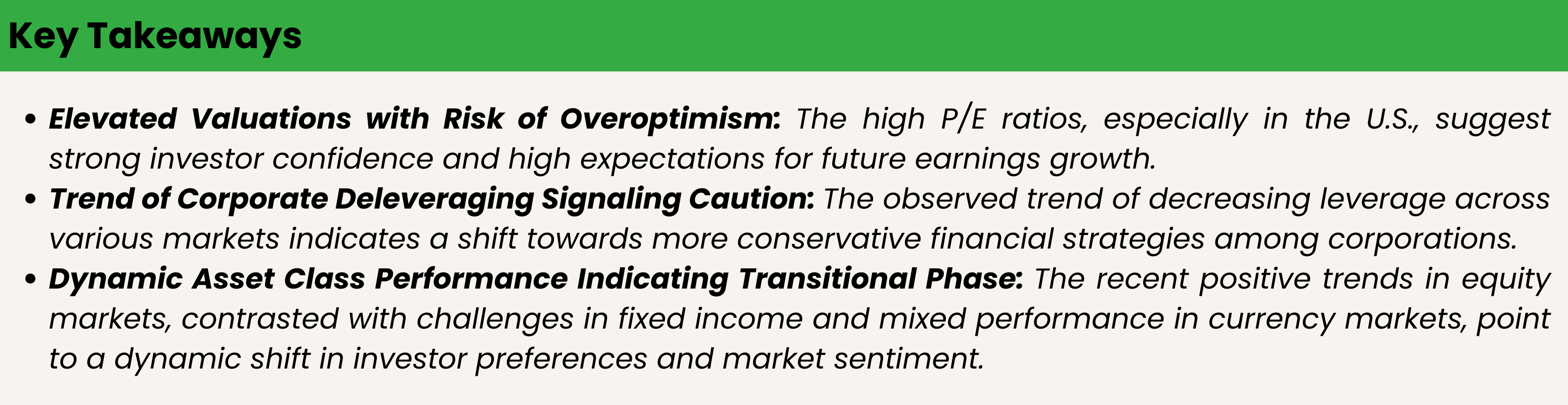

Noticeable peak is observable in the U.S. market, suggesting a higher valuation or potential overvaluation compared to the world and developed markets excluding the U.S. This could be indicative of investor optimism or speculation within the U.S. equities market. The cyclic patterns reflect investor sentiment shifts, often corresponding with economic cycles. The convergence of these lines at certain points suggests moments when market valuation differences narrow, possibly due to global events affecting markets similarly.

Leverage for Equity Markets

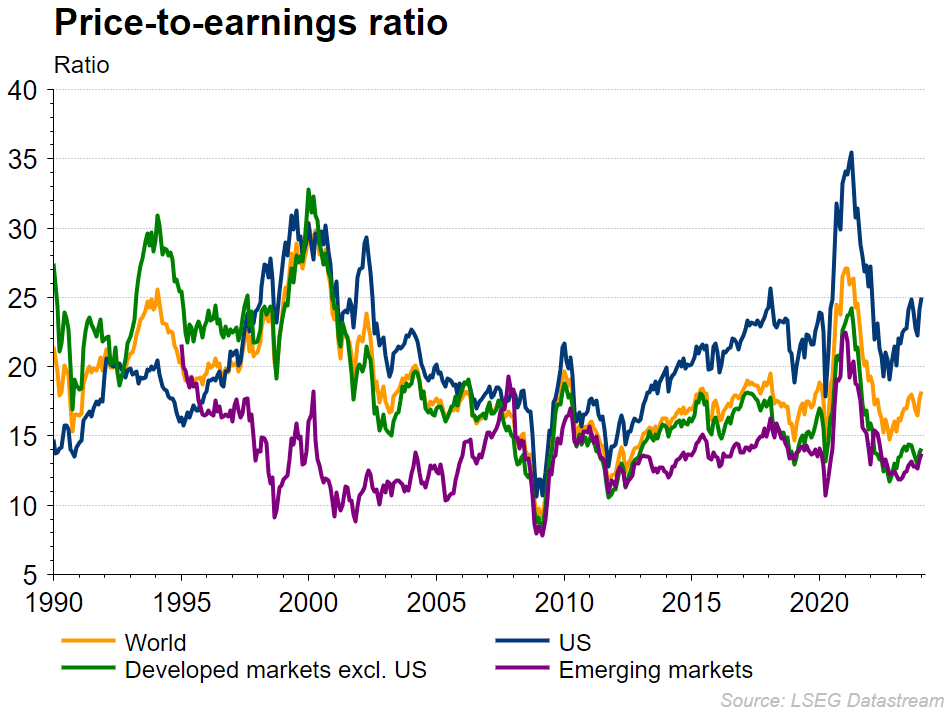

Leverage, measured by net debt to shareholder equity, has declined across all observed markets since the early 2000s. This trend could imply a decrease in risk appetite, improved corporate balance sheets, or a shift in corporate financing strategies. Notably, the leverage in emerging markets remains lower than in developed markets, potentially reflecting less access to debt financing or a more conservative corporate culture in these markets. The sharp decrease in leverage during recessionary periods highlights the deleveraging that typically occurs as firms reduce debt levels in response to economic uncertainty.

Asset Price Movements

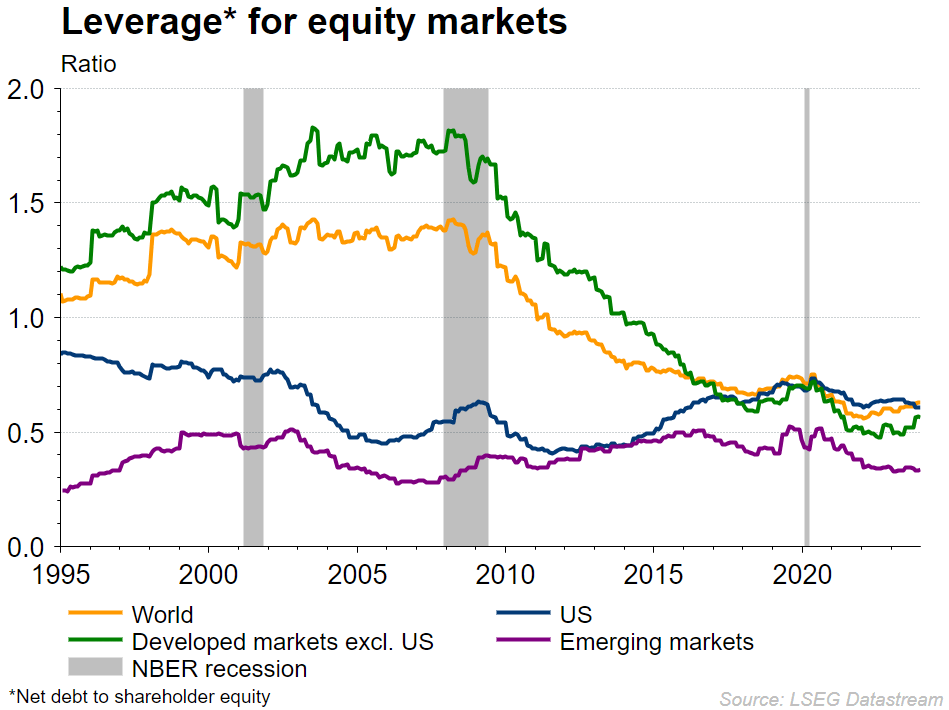

The table of asset price movements provides a snapshot of recent performance across various asset classes. We observe a broad recovery in equities after a period of decline, suggested by the positive weekly changes compared to the negative three-month changes. The negative performance of Gilts and the mixed performance in foreign exchange markets could be reflecting adjustments to monetary policy expectations and currency strength. Such a pattern could imply shifting investor confidence and a reassessment of risk, possibly due to changing economic forecasts or geopolitical tensions.

The interconnectivity between these indicators can also be observed. For instance, a high P/E ratio in the U.S. might align with significant asset price movements in the S&P 500. Meanwhile, the reduction in leverage may correlate with conservative corporate behavior, which can influence P/E ratios due to changes in earnings dynamics.

Lets analyze these in Detail-Compare and Contrast--HISTORICALLY

Price-to-Earnings Ratio:

- Pattern: The P/E ratio chart shows cyclical patterns that correspond to market cycles such as booms, busts, and recoveries. Peaks in the P/E ratio typically represent market optimism and high investor confidence, while troughs often align with economic downturns or bear markets.

- Comparison: The U.S. market consistently exhibits a higher P/E ratio than the world average and developed markets excluding the U.S. This suggests that the U.S. equities are often priced at a premium, possibly due to stronger economic fundamentals, a higher concentration of high-growth sectors like technology, or market perceptions of the U.S. as a safe haven. The emerging markets show more volatility in their P/E ratios, indicating a higher level of risk and uncertainty.

- Contrast: During periods of market correction, such as the dot-com bubble burst around the year 2000 and the financial crisis of 2008, all regions experience a sharp decline in P/E ratios, though the U.S. market’s P/E ratio tends to spike more dramatically during recoveries, indicating a faster return of investor confidence.

Leverage for Equity Markets:

- Pattern: There has been a general downtrend in leverage since the late 1990s across all markets. Economic recessions, as marked by the grey vertical bars, often accelerate the decline in leverage, as firms work to strengthen their balance sheets by reducing debt.

- Comparison: The developed markets, including the U.S., started with higher leverage ratios in the mid-1990s but have seen a significant deleveraging over the past two decades. In contrast, emerging markets began with lower leverage and have maintained a relatively stable but declining leverage ratio.

- Contrast: The U.S. has shown a consistent deleveraging trend, especially post the 2008 financial crisis, suggesting a shift toward more conservative financial management within firms. However, the leverage ratio in emerging markets, while lower, is more erratic, which may reflect differing market dynamics, such as variations in access to capital and differing stages of economic development.

Asset Price Movements:

- Pattern: The table shows the performance of various asset classes over different time periods. The green shading indicates periods of positive performance, while red indicates negative performance.

- Comparison: Over the most recent week, all listed equities have seen positive changes, with oil and European stocks (EURO STOXX) leading the way. This suggests a short-term bullish sentiment in the market. However, when looking at the three-month performance, a more nuanced picture emerges, with significant red in oil and EURO STOXX, indicating volatility and perhaps negative sentiment in the medium term.

- Contrast: Comparing equities and fixed income, we see that Gilts have experienced significant negative changes over the one-month and year-to-date (YTD) time frames, which could reflect investor sentiment shifting away from fixed income due to expectations of rising interest rates. In contrast, equities, despite some volatility, show a trend towards recovery or positive sentiment in the same periods.

By integrating these insights, we can surmise that the U.S. market is often viewed as more robust but also comes with higher valuations, which could suggest a higher risk of correction. The developed markets, while having undergone significant deleveraging, might still be seen as more stable compared to emerging markets, which, despite their lower leverage, exhibit more volatility in their P/E ratios, reflecting inherent risks and growth potential. Recent asset price movements indicate a return of investor confidence in the short term, especially in the equity space, yet fixed income securities like Gilts are underperforming, possibly due to changing interest rate environments.

Lets analyze these in Detail-Compare and Contrast--In the Past 5 years Only

Price-to-Earnings Ratio (Last 5 Years):

- Trend: The chart indicates a rise in P/E ratios across all markets until reaching a peak, followed by a sharp decline. The timing of the peak varies slightly between regions, but the decline seems to be quite synchronous, possibly due to a global event or sentiment shift.

- Comparison: The U.S. maintains the highest P/E ratio among the groups, signaling that investors may expect higher future earnings growth from U.S. companies or are willing to pay a premium for perceived quality and stability.

- Contrast: Emerging markets have experienced the most significant volatility in P/E ratios, reflecting the increased uncertainty and risk associated with these markets. The developed markets excluding the U.S. show less extreme fluctuations, suggesting a more tempered investor outlook.

Leverage for Equity Markets (Last 5 Years):

- Trend: Leverage ratios have generally continued their long-term decline over the last five years, though there appears to be a period of stability or slight increase just before the most recent downturn.

- Comparison: All regions show this trend of reducing leverage, which could be indicative of companies taking a cautious approach to debt amidst global economic uncertainties, perhaps influenced by factors such as trade tensions, geopolitical events, or changes in monetary policy.

- Contrast: The U.S. and developed markets excluding the U.S. have lower leverage ratios compared to emerging markets, which could indicate a more conservative corporate financing approach or a mature credit environment.

Asset Price Movements (Last 5 Years):

- Trend: The table reflects a mixed performance across assets, with recent positive weekly changes suggesting a rebound or corrective rally in the markets after what appears to be a challenging period, as indicated by the predominantly red three-month columns.

- Comparison: Equities have shown resilience with a rebound across most indices, whereas fixed income (Gilts) and some currencies (GBP, EUR) have been under pressure, possibly due to interest rate expectations and Brexit-related uncertainties.

- Contrast: The recovery in equity prices is not uniform; the S&P 500 and NIKKEI have had a stronger rebound compared to others like the MSCI Emerging Markets, which could reflect regional economic strengths and investor confidence levels.

When synthesizing the last five years of data for these indicators, it’s apparent that the U.S. market’s high valuation (as seen in the P/E ratio) may indicate both confidence in U.S. corporate earnings growth and a higher risk of price corrections. Leverage ratios across all markets are converging, reflecting a global trend towards deleveraging and possibly a more prudent financial management approach. The asset price movements show a recovery in the short term, with equities leading the way, suggesting a shift in investor sentiment toward risk assets, though this is not uniform across all regions and asset classes.

What trends do we Interpret from a Current Perspective?

When synthesizing the current trends from the three indicators – Price-to-Earnings (P/E) ratio, leverage for equity markets, and asset price movements – we can infer several things about the latest state of the financial markets:

Valuation and Market Sentiment: The P/E ratios, despite the recent decline, are still relatively high, particularly in the U.S. market. This suggests that despite any recent corrections or volatility, there remains an underlying confidence in the earnings potential of companies, especially in the U.S. However, the elevated P/E ratios also imply that markets might be somewhat optimistic about future growth prospects, and there is a risk of overvaluation which could lead to increased volatility if earnings do not meet expectations.

Corporate Financial Health: The leverage ratios indicate a continued trend of deleveraging, or at least stable leverage, which could mean that corporations have healthier balance sheets and are possibly in a better position to withstand economic stress. Lower leverage ratios can also imply that companies are more risk-averse and are managing their capital structures conservatively, which can be a stabilizing factor for the markets.

Asset Class Performance: Recent asset price movements show a positive trend in equity markets, indicating a recovery or at least a short-term bullish sentiment. However, the negative performance of fixed income securities like Gilts, and mixed performance in currencies, suggest a shifting landscape. This could be due to a variety of factors, including anticipations of changes in monetary policy, inflation expectations, and macroeconomic adjustments.

Combined Interpretation: The combination of high P/E ratios, reduced leverage, and the recent positive performance in equity markets suggests a complex environment for financial markets. On one hand, there is optimism, as evidenced by the willingness to sustain higher equity valuations and the recent uptick in asset prices. On the other hand, the cautious approach to leverage indicates a degree of risk aversion and a focus on financial robustness.

The contrast between the performance of equities and fixed income could also point to a transition phase in the markets, where investors may be moving away from the safety of bonds and into equities in search of higher returns, driven by a low interest rate environment that has persisted for some time. This shift, however, brings its own risks, as it can lead to heightened valuations and potential mispricing of assets.

This period might be seen as a tipping point where the financial markets are balanced between continued growth expectations and the reality of economic and geopolitical uncertainties. Should the corporate earnings fail to justify the current high P/E ratios, or should the interest rates rise more quickly than expected, it could lead to a reevaluation of asset prices. Conversely, if the earnings growth materializes and interest rates remain moderate, the current positive momentum in equity markets may persist. In summary, the indicators reflect an environment of cautious optimism in the financial markets, with an undercurrent of awareness about potential risks on the horizon. It’s a market that rewards discernment, where understanding the interplay between valuation, corporate behavior, and asset class performance is key to navigating the current financial landscape.

Conclusion

In conclusion, the current financial landscape, as depicted through the analysis of key indicators like the Price-to-Earnings (P/E) ratio, leverage in equity markets, and asset price movements, reveals a nuanced picture of cautious optimism tempered with an awareness of potential risks. The high P/E ratios, particularly in the U.S. market, reflect a robust confidence in future earnings growth but also hint at the possibility of overvaluation and subsequent market adjustments. The trend of reduced corporate leverage points to a general shift towards financial prudence and risk aversion, likely contributing to the stability of the markets. Meanwhile, the recent positive trends in equity markets contrasted with the challenges in fixed income and currency sectors, indicating a dynamic and transitional phase in asset class preferences. This complex interplay between optimism and caution, growth expectations, and economic realities underscores a financial environment that is poised at a critical juncture. Investors and market participants must navigate this terrain with careful analysis and a balanced approach, remaining vigilant to the potential shifts in market sentiment, corporate health, and macroeconomic factors that could influence future market directions.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.