USD/JPY in a short term bullish range testing near the 145.200 level.

The USD/JPY pair exhibits a “Buy” stance, with technical indicators aligning towards bullish momentum. This positive outlook is echoed in the Moving Averages, where the shorter-term MAs signal a buying opportunity. This buying pressure, however, is tempered by the longer-term MAs which suggest a neutral to sell perspective, indicating a potential divergence in the short-term and long-term market views.

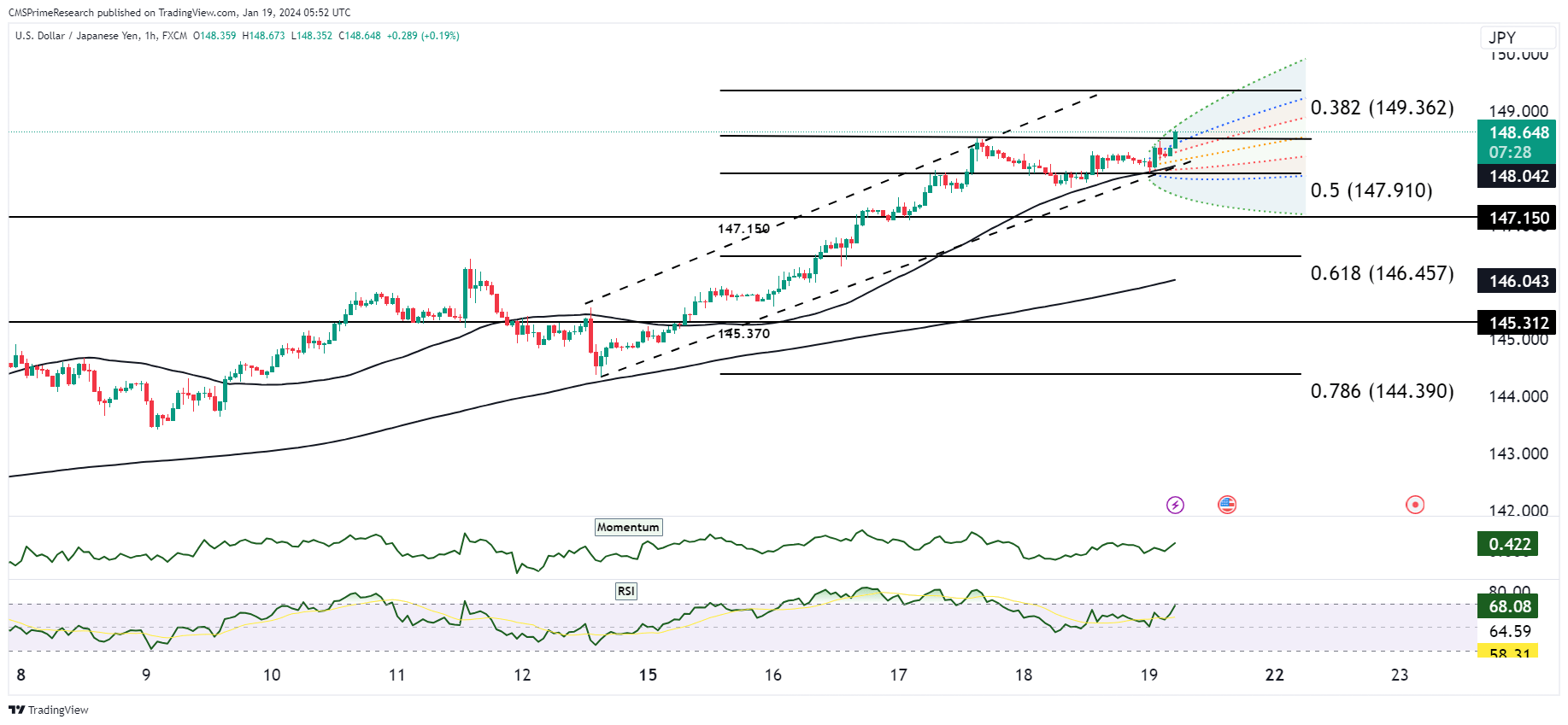

From the chart, USD/JPY is experiencing resistance around the 148.50 area, with the currency pair showing signs of consolidation. The RSI is in neutral territory, which doesn’t provide a clear direction. The Stochastics are in overbought territory, suggesting that there might be a potential for a pullback or at least a pause in the upward trend. The MACD is flat, indicating that the momentum could be waning, and a change in direction could be imminent.

The pair has seen some upward movement in tandem with a stronger Nikkei, hinting at a positive correlation with the equity market. Commentary from Japan’s Finance Minister Suzuki about a weak JPY has likely played a role in capping gains, as market participants consider the implications of potential government intervention.

US yields have remained relatively firm, providing underlying support to the USD. The Treasury yields, sitting at 4.363% for 2-year notes and 4.161% for 10-year notes, are indicative of a strong dollar backdrop.

Market Sentiment Ratings:

- Bullish Sentiment: Approximately 60% – This is driven by the recent bid in USD/JPY, firm US yields, and the correlation with a rising Nikkei, suggesting that there is a solid base for the bullish case.

- Neutral Sentiment: Approximately 30% – Given the large option expiries and the mixed signals from technical indicators, there’s a notable portion of the market that may be sitting on the sidelines, waiting for clearer signals.

- Bearish Sentiment: Approximately 10% – With stochastics indicating an overbought condition and the resistance encountered near the 148.50 level, there’s a smaller, yet significant, anticipation of a potential retracement.

In conclusion, the USD/JPY pair is currently riding a bullish wave, buttressed by strong technical indicators and underlying fundamentals, including firm US yields and a positive correlation with the equity market. However, the mixed signals from the moving averages and the overbought stochastic readings suggest that traders should remain cautious. Looking ahead, the Bank of Japan’s upcoming policy decision could introduce volatility, especially if the BOJ’s stance deviates from market expectations regarding core inflation and monetary policy.

Key Levels to Watch: : 147.732,146.909,146.436,149.380

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 148.437 | 149.007 |

| Level 2 | 147.732 | 149.074 |

| Level 3 | 146.909 | 149.380 |