Optimizing the Ichimoku:

Optimizing the use of different timeframes within the Ichimoku Cloud strategy to cater to various trading styles involves understanding the unique components and signals of the Ichimoku system and how they interact across timeframes. Here are some insights and guidelines:

1. Timeframe Considerations

- Higher Timeframes: These may provide more reliable signals as they filter out much of the ‘noise’ found in lower timeframes. This is particularly relevant for swing traders or long-term position traders who focus on more substantial price moves over weeks or months.

- Lower Timeframes: Suitable for day traders seeking shorter-term opportunities. However, these timeframes might be more prone to false signals and market ‘noise’.

2. Combining Timeframes

- Multiple Time-Frame Analysis: A technique where day traders, short-term, and long-term traders can come together. This approach allows traders to get a more comprehensive view of the market by analyzing it from different time perspectives simultaneously.

- Strategy Adaptation: Adapting the Ichimoku strategy based on the chosen timeframe and combining it with other technical analysis methods, like Fibonacci retracements or Elliott Wave, can enhance the effectiveness of trade setups.

3. Signal Interpretation Across Timeframes

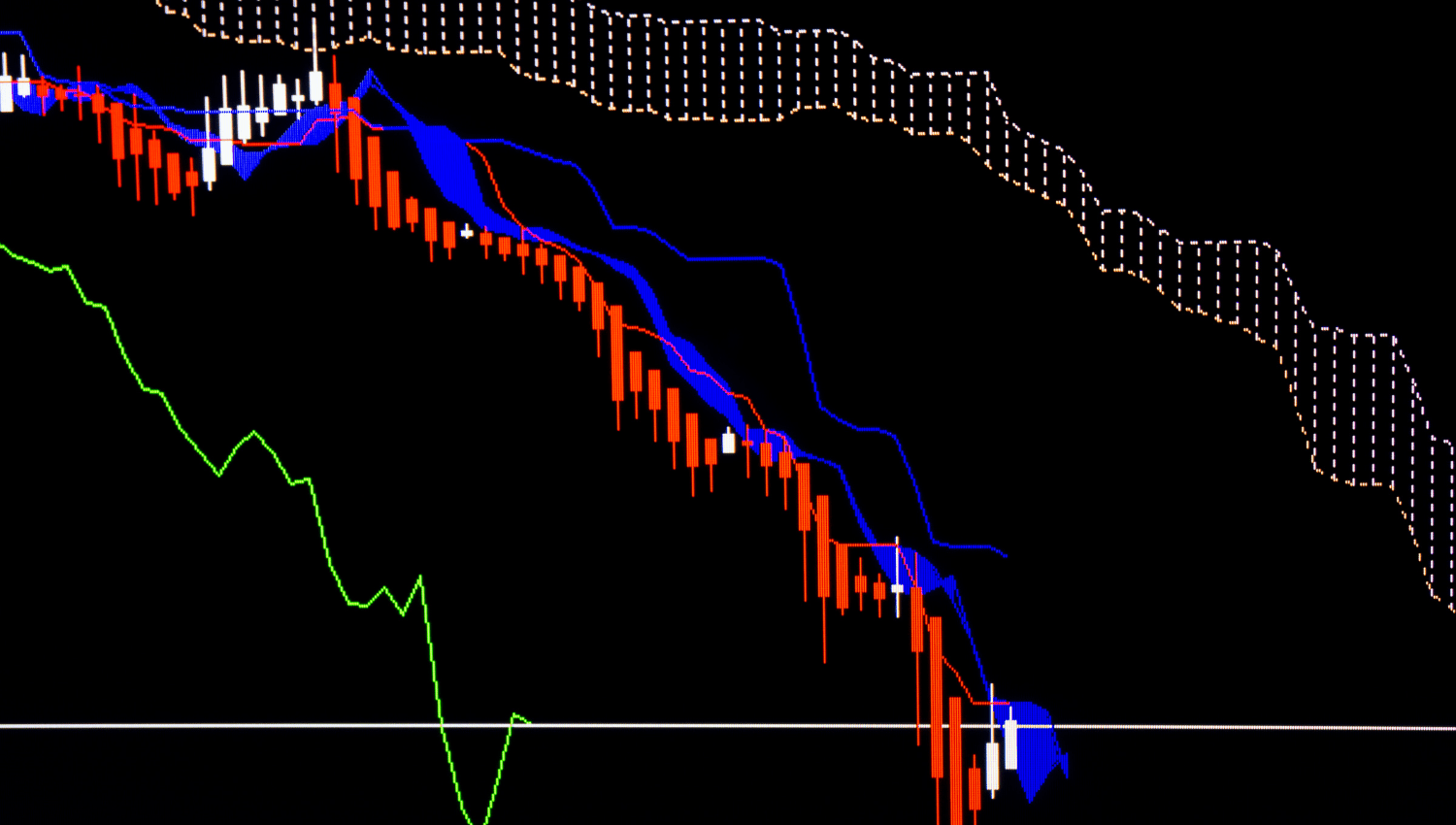

- Trend Identification: Use the Ichimoku Cloud to identify market trends, where a bullish trend is indicated when the price is above the cloud and a bearish trend when below it. This is crucial for all trading styles but interpreted differently depending on the timeframe.

- Crossovers and Cloud Signals: Pay attention to crossovers between the Tenkan-sen and Kijun-sen lines and the positioning of price in relation to the Senkou Span lines. These can signal entry points for trades but should be contextualized within the timeframe being used.

In conclusion, the key to effectively using the Ichimoku Cloud across different trading styles lies in adapting the strategy to the specific timeframe, combining it with multiple time-frame analysis and other technical tools, and consistently testing and refining the approach based on market conditions and personal trading style.

Advanced strategies for setting stop-loss and Take Profit

Optimizing stop-loss and take-profit orders when trading with the Ichimoku Cloud, especially in volatile market conditions, involves a nuanced approach that accounts for the complex dynamics of the market. Here are some advanced strategies gathered from various sources:

1. Utilizing Ichimoku Components for Stop-Loss and Take-Profit

- Kijun-Sen as Stop-Loss: One effective technique is to use the Kijun-sen line as a trailing stop-loss. As it reflects the overall trend, trailing the stop-loss below the Kijun-sen can protect profits when the trend reverses.

- Chikou Span for Confirmation: The Chikou Span, when crossing below the price, suggests a potential reversal, indicating a trigger for stop-loss. Conversely, a cross above the price signals potential upward momentum, allowing for take-profit adjustments.

- Cloud Support and Resistance: The Ichimoku Cloud can act as support and resistance levels. Stop-loss orders below cloud support and take-profit orders near cloud resistance optimize risk-reward ratios.

2. Advanced Forex Trading Strategies with Ichimoku

- Ichimoku Cloud + RSI Divergence: Pairing Ichimoku with RSI can help identify market reversals. A stop-loss can be placed at the last swing high, and take-profit at significant support levels in higher timeframes.

- Ichimoku Cloud + Moving Average: Useful for long-term traders. Stop-loss can be placed just above the entry price, and take-profit when the market starts losing momentum.

3. Multi-Timeframe Analysis

- Stronger Signals: Analyzing Ichimoku Cloud across different timeframes aligns trades with higher timeframe trends, enhancing accuracy.

- Trend Identification and Confirmation: Use Ichimoku Cloud and crossovers for trend confirmation across different timeframes.

4. Combining Ichimoku with Other Technical Indicators

- Integration with Indicators: Like RSI and MACD enhances trading signals, providing higher confidence.

- Short-term vs. Long-term Strategies: Modify parameters and timeframes for short-term trading, while for long-term trading, adapt Ichimoku for identifying major trends

Can Ichimoku Clouds gauge Market Psychology?

Understanding the Ichimoku Cloud Components

- Senkou Span A (Leading Span A): Acts as one border of the Ichimoku Cloud. It’s viewed as a support level when the price is above it and a resistance level when below it.

- Senkou Span B (Leading Span B): Forms the other border of the cloud. This line represents a longer-term view and is also considered a support level when the price is above it and a resistance level when below.

- The Cloud (Kumo): The area between Senkou Span A and B. The cloud’s thickness indicates the strength of the support or resistance. A thicker cloud suggests stronger levels and greater volatility, while a thinner cloud indicates weaker levels and less volatility.

- Chikou Span (Lagging Span): This component, plotted 26 periods behind the current price, helps confirm trends and identify potential reversals.

Gauging Market Psychology

- Trend Perceptions and Color Changes: The color of the cloud indicates the market bias – green for bullish and red for bearish. When the cloud changes color, it may indicate a shift in market sentiment and a potential trend reversal.

- Price Relation to the Cloud: If the price is above the cloud, it suggests a bullish trend, whereas a price below the cloud suggests a bearish trend. When the price is within the cloud, it often indicates a consolidation phase or a potential for trend change.

- Dynamic Support and Resistance: The cloud acts as a dynamic support and resistance level. The price relationship with the cloud can indicate market strength or weakness. For instance, a price consistently above a green cloud might indicate a strong bullish sentiment, while a price below a red cloud could reflect strong bearish sentiment.

- Cloud Twists and Market Turns: A twist in the cloud (where Senkou Span A crosses over Senkou Span B) can signal a potential trend change. This is particularly significant if the market has been following a strong trend and the cloud twists, suggesting a shift in market psychology and future price movements

Thinking Diffirently-What does the Ichimoku Capture

Trend Analysis and Market Sentiment

- Kumo (Cloud): The cloud is a key feature, providing insights into market trends and volatility. A thicker cloud indicates stronger support or resistance and a more robust trend, while a thinner cloud suggests weaker levels and a weaker trend.

- Senkou Span A and B: These spans form the cloud and are projected 26 periods into the future, offering a unique forecasting ability. They provide dynamic support and resistance levels, influencing trader expectations and market sentiment.

Momentum and Relative Strength

- Tenkan-Sen (Conversion Line) and Kijun-Sen (Base Line): The crossover of these lines signals changes in momentum and is akin to moving average crossovers. A bullish signal is generated when the Tenkan-Sen crosses above the Kijun-Sen and vice versa.

- Chikou Span (Lagging Span): This span represents the closing price projected 26 periods into the past and is used to confirm trends and identify potential reversals.

Market Psychology and Trading Behavior

- Price Position Relative to the Cloud: The position of the price in relation to the cloud indicates market psychology. Price above the cloud suggests bullish sentiment, while below the cloud indicates bearish sentiment.

- Cloud Color and Shape: The color change in the cloud (from green to red or vice versa) can signal a shift in market psychology, indicating potential trend reversals.

Non-Linearity and Market Complexity

- The Ichimoku Cloud accounts for non-linear market behaviors by integrating multiple time periods and forecasting future support/resistance levels. This complex approach helps in understanding the intricate movements of the market that are not linear or straightforward.

Market Confluence and Correlation

- The indicator’s multiple components work together to provide a confluence of signals, enhancing the reliability of the analysis. This multifaceted approach accounts for various market factors, reducing reliance on single indicators and increasing the robustness of the analysis.

Why Should the Ichimoku Cloud Work?

The effectiveness of the Ichimoku Cloud lies in its comprehensive nature. It captures a wide range of market information, from trend direction and momentum to support and resistance levels. This holistic view enables traders to make more informed decisions by considering multiple aspects of market behavior simultaneously. The Ichimoku Cloud’s ability to forecast and provide dynamic support and resistance levels adds a forward-looking dimension that many other indicators lack.

Additionally, the Ichimoku Cloud’s components are interrelated, providing a system of checks and balances. For instance, while the Tenkan-Sen and Kijun-Sen provide immediate trade signals, the Chikou Span offers confirmation, and the Kumo (cloud) gives context to the current trend. This integrated approach reduces the likelihood of false signals and enhances the indicator’s reliability.

In summary, the Ichimoku Cloud works because it encapsulates various dimensions of market analysis, offering a richer, more nuanced view than many traditional indicators. Its multi-component structure captures the complexities and non-linearities of market behavior, providing traders with a versatile tool for navigating various market conditions.

Conclusion

The Ichimoku Cloud’s ability to gauge market psychology and adapt to non-linear market behaviors is a distinct advantage. The color changes in the cloud, the position of price relative to the cloud, and cloud twists offer valuable insights into market sentiment and potential trend reversals. The Ichimoku Cloud’s multi-component structure acts as a system of checks and balances, reducing the likelihood of false signals and enhancing overall reliability. In conclusion, the Ichimoku Cloud’s effectiveness stems from its holistic approach to market analysis, adaptability across various timeframes, and its capacity to capture the intricacies of market behavior. Traders who embrace this versatile tool gain a deeper and more nuanced understanding of the markets, ultimately leading to more informed and profitable trading decisions.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.