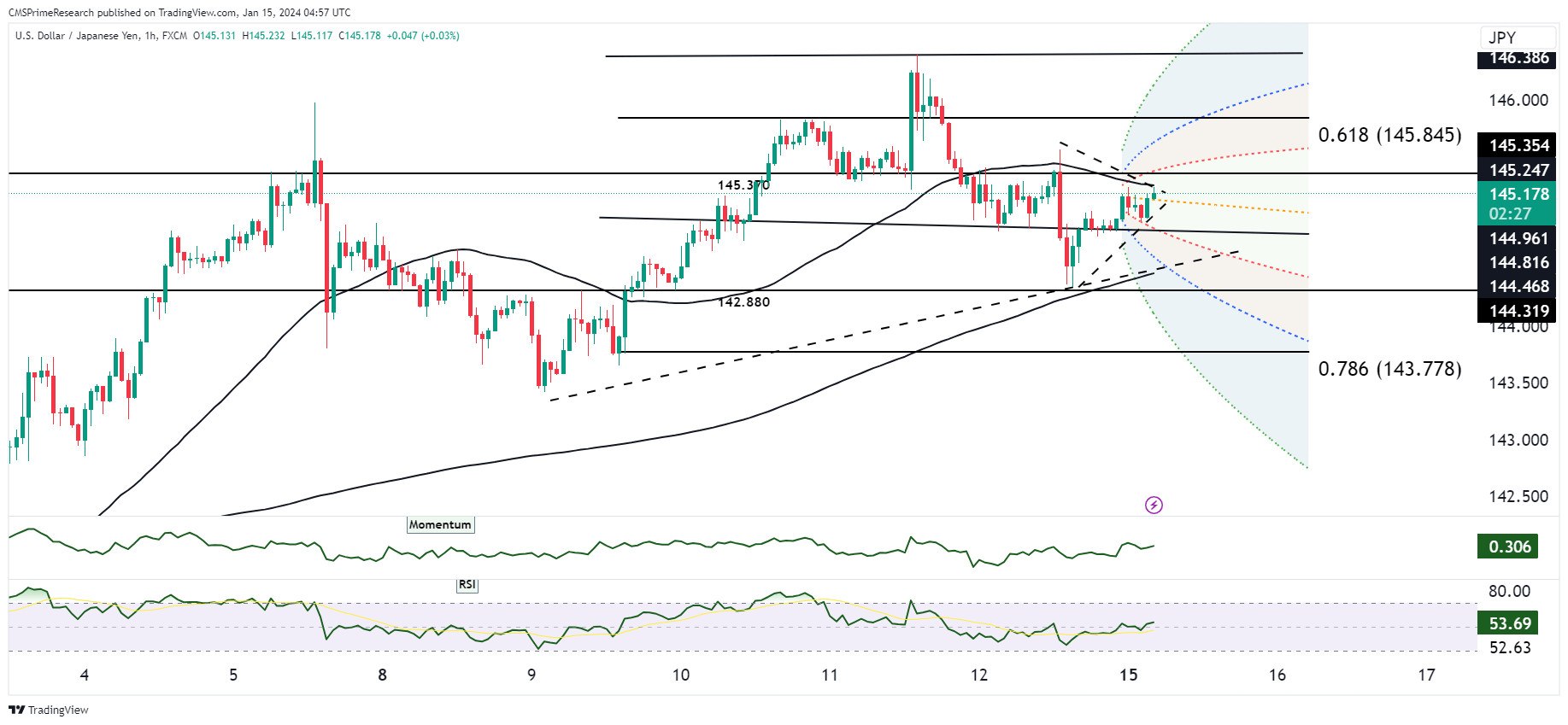

USD/JPY in a short term bullish range testing near the 145.200 level.

The pair, steeped in the aftermath of recent CPI and PPI data, awaits further direction from upcoming US economic releases. The USD/JPY charts are marked by a “Strong Buy” sentiment from both moving averages and technical indicators, painting a bullish picture. The moving averages, particularly the MA50 and MA200, reinforce a long-term bullish trend, with the price trading above these indicators. However, the price hovers between the MA10 and MA20, indicating short-term uncertainty.

The RSI and Stochastic indicators resonate with buying momentum, yet the STOCHRSI flags an overbought condition, suggesting the pair may be due for a short-term pullback or consolidation. The MACD’s negligible value suggests a market in balance, seeking a catalyst for directional momentum. The ADX reflects a moderate trend strength, and the Williams %R, deep into overbought territory, hints at the potential for price correction.

Fundamentally, the narrative is driven by anticipation of Federal Reserve rate adjustments. The PPI’s downside miss may temper inflation expectations, potentially leading to a dovish shift in Fed policy. This environment has caused USD/JPY to resume its downtrend, finding support just above recent lows, indicating a market sensitive to monetary policy cues.

The market sentiment hinges on the upcoming US retail sales, industrial production, and NAHB housing market index. These releases will likely shape expectations for future Fed rate hikes and could provide the impetus for the next significant move in USD/JPY. Until then, the pair may well consolidate below the 146 level as the market digests these developments.

Market Sentiment Ratings:

Currently, the USD/JPY sentiment could be quantified as follows:

- Positive Sentiment: The robust positioning of price action above the 50 and 200 Day Moving Averages suggests a bullish undertone that could be approximately quantified as 60% positive.

- Negative Sentiment: The overbought conditions indicated by the STOCHRSI, alongside the potential dovish shift in the Fed’s stance inferred from the PPI data, introduce caution into the market sentiment, which could be quantified as 20% negative.

- Neutral Sentiment: The price consolidation below the 146 level and the anticipation of upcoming economic data releases suggest a holding pattern in market sentiment, quantifiable as 20% neutral.

The market awaits the January 17 data with bated breath, as it could recalibrate the prevailing sentiment. Retail sales and industrial production will offer insights into the US economy’s health, while the NAHB housing market index will shed light on the real estate sector, an integral component of economic wellbeing. Any deviations from expectations could sway the Fed’s hand on rate changes, which in turn would impact the USD/JPY pair significantly.

Key Levels to Watch: : 144.722,145.538,145.792

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 144.722 | 145.538 |

| Level 2 | 144.362 | 145.792 |

| Level 3 | 143.951 | 146.137 |