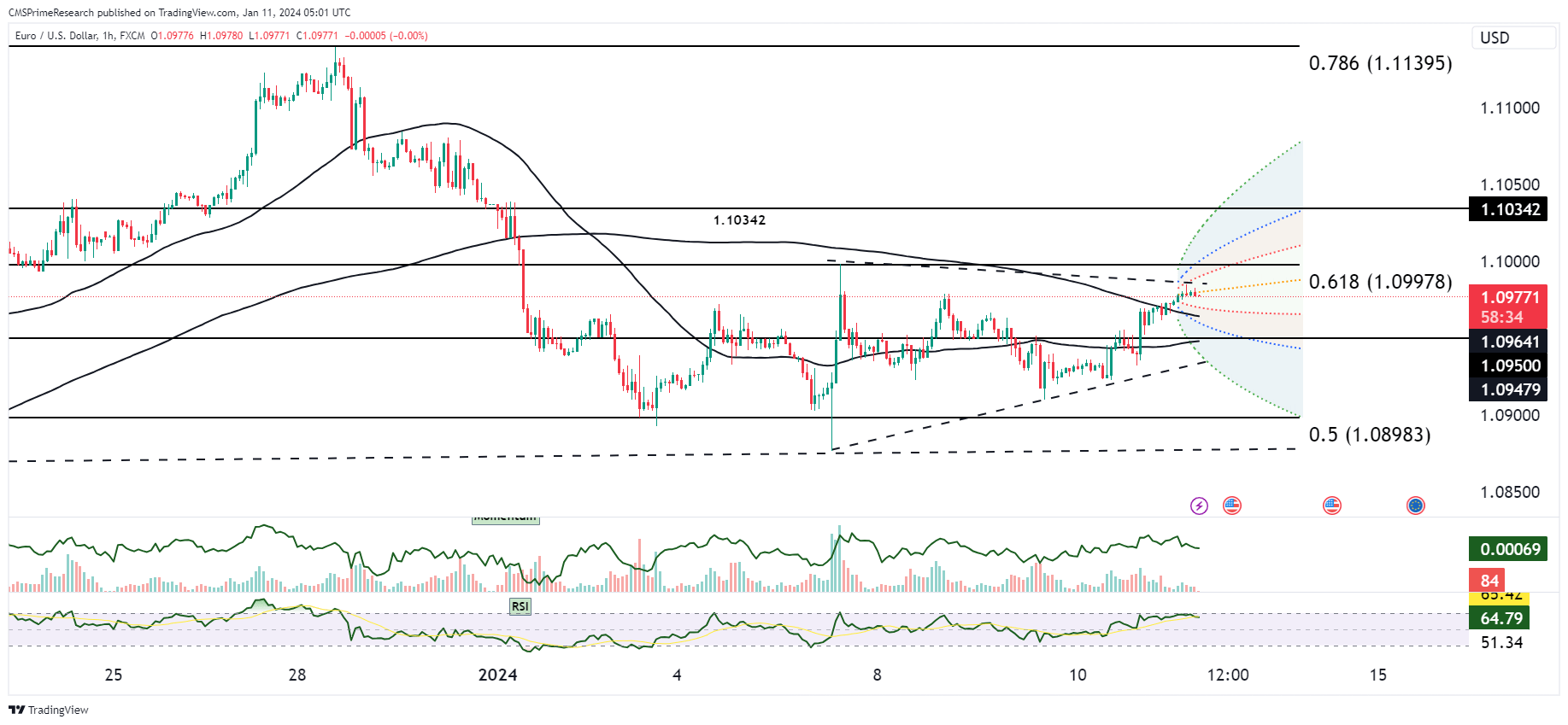

EUR/USD in Bullish Range testing near the 1.10 level ahead of key US CPI news

From a technical standpoint, the moving averages give a resounding endorsement to the bulls, with a “Strong Buy” consensus across the board. The shorter-term Simple and Exponential Moving Averages (MA5 through MA50) are suggesting buying momentum. Even the longer-term MAs (MA100 and MA200) are tilting towards bullish territory, signaling a broad agreement on the positive trend.

In the realm of technical indicators, the RSI at 64.135 is leaning towards the buy side but has not yet entered the overbought territory, suggesting there may still be room for upward price action before a reversal is imminent. The MACD’s position just above the baseline hints at a growing bullish momentum, though the neutrality of the ADX at 47.236 suggests that while the trend is bullish, it may not be exceptionally strong.

The pivot points reinforce the sentiment, with the pair sitting comfortably above the pivot line, potentially targeting further resistance levels. This is indicative of a market that has the conviction to test higher price thresholds.

On the fundamental side, upcoming economic indicators, such as the US CPI and unemployment claims, loom large and carry the potential to significantly impact this technical landscape. A higher than expected CPI could strengthen the USD on the expectation of more aggressive Fed policy, thereby reversing the current bullish trend for EUR/USD. Conversely, a softer CPI may fuel the current bullish run as it could hint at a less hawkish stance from the Fed.

Market sentiment is also waiting with bated breath for these releases. Strong economic figures from the US could bolster USD strength, while any disappointment could lead to a EUR/USD rally, considering the pair’s current technical position.

In summary, the technical analysis suggests that the EUR/USD is in a strong position to extend its gains, supported by the moving averages and technical indicators. However, traders must remain cognizant of the upcoming fundamental events, particularly the US CPI and unemployment claims, which could act as catalysts for significant volatility. As these economic releases draw near, market participants should prepare for possible shifts in market sentiment that could redefine the current technical outlook.

Key Levels to Watch: : 1.09321,1.08850,1.09829,1.10032

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.09655 | 1.10032 |

| Level 2 | 1.09097 | 1.10255 |

| Level 3 | 1.08850 | 1.10460 |