Introduction:

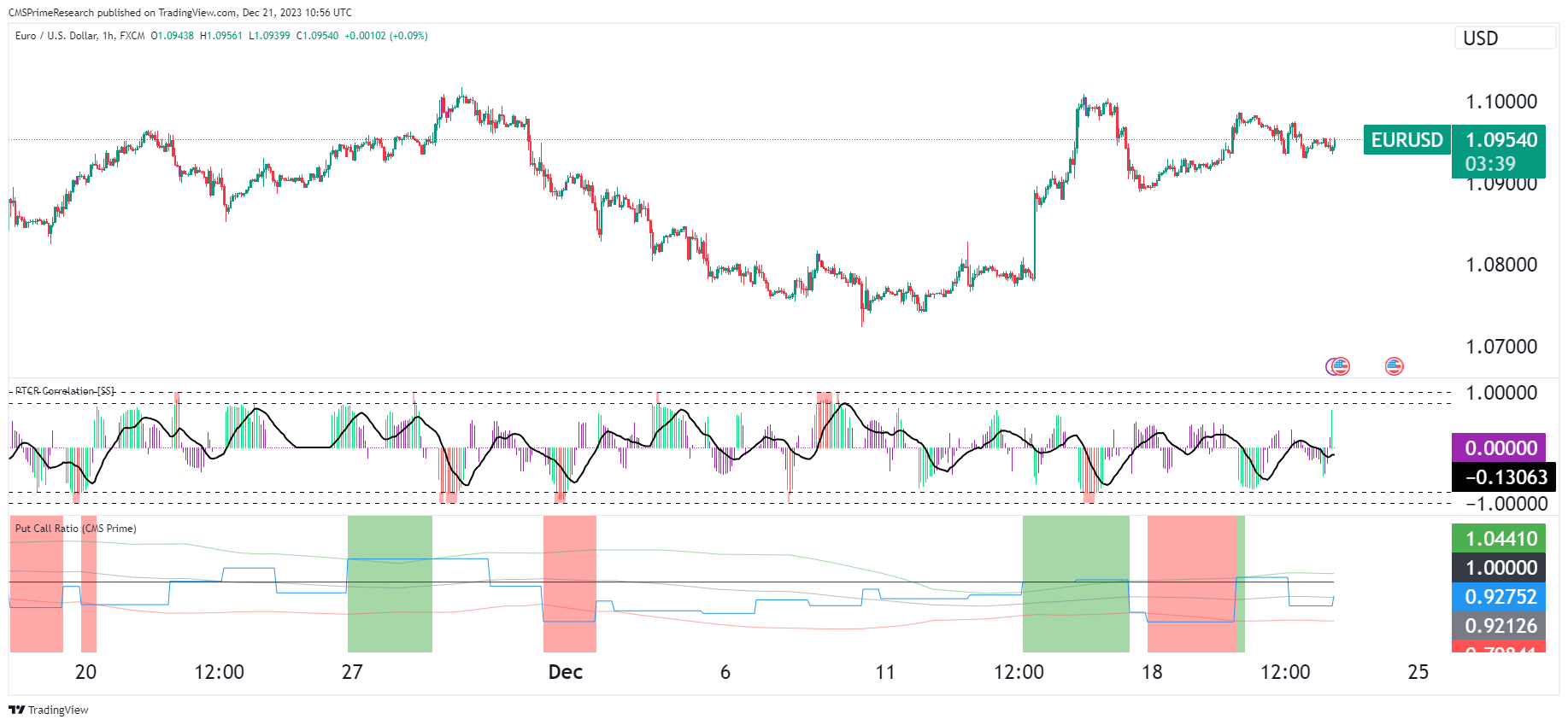

The Put/Call Ratio (PCR) is a significant indicator in currency trading, as well as in other financial markets, offering insights into market sentiment and potential price movements.

Definition and Calculation: The PCR compares the total number of traded put options to the total number of traded call options for a specific underlying security, such as a currency pair. It’s calculated by dividing the open interest or trading volumes of put options by those of call options for a specific period.

Interpretation of PCR Values:

- PCR Below 1 (<1): Indicates more call options than put options are being purchased, suggesting a bullish market sentiment. Traders anticipate an upward trend in the underlying security.

- PCR Above 1 (>1): Reflects a greater number of put options, indicating bearish sentiment. This suggests that investors expect a decline in the market.

- PCR at 1 (=1): Implies an equal number of put and call options, indicating a neutral market trend.

- Specific PCR Thresholds:

- Strong Resistance: PCR less than 0.60 at a strike price indicates significant resistance at that level.

- Strong Support: PCR more than 1.80 at a strike suggests strong support.

- Oversold Market: PCR of 0.80-1.0 for all strikes suggests an oversold market condition.

- Overbought Market: PCR of 1.80-2.0 for all strikes indicates an overbought market.

In summary, the Put/Call Ratio is a crucial tool for currency traders to understand market sentiment and to anticipate potential price movements. By analyzing the PCR, traders can gain insights into the prevailing mood in the market and adjust their strategies accordingly. This helps in making more informed trading decisions, considering the balance between bullish and bearish sentiments among market participants.

Using Real-Time PCR Data for Currency Algorithmic Trading

Integrating PCR in Algorithmic Trading

- Market Sentiment Indicator: PCR serves as a robust indicator of market sentiment, providing insights into investor attitudes towards specific securities or indices.

- Risk Management: It aids in assessing systemic risk exposure, as extreme PCR values can indicate potential market tops or bottoms, thereby signaling contrarian trading opportunities.

How: Integration in Algorithmic Trading Strategies

- Data Collection: Real-time PCR data can be sourced from financial data providers or calculated using market data on Put and Call options.

- Algorithm Incorporation: Integrate PCR calculations into the trading algorithm. This involves coding the algorithm to recognize and react to specific PCR values or trends.

- Risk Assessment: Use PCR values to gauge systemic risk exposure. High PCR values might indicate a bearish market, which can affect currency pair movements.

- Trade Execution: Program the algorithm to execute trades based on PCR values. For example, a high PCR might trigger a short position in a currency pair, anticipating a market downturn.

- Back-testing and Optimization: Rigorously test the algorithm with historical data to ensure its efficacy and adjust parameters for optimal performances

Can we use it make Predictions?

The Put/Call Ratio (PCR) is a widely recognized contrarian sentiment measure in financial markets, particularly useful for gauging investor sentiment and market expectations. However, its effectiveness as a predictive tool for future market movements comes with notable limitations.

Effectiveness of PCR as a Predictive Tool:

- Contrarian Indicator: PCR is a reliable contrarian sentiment indicator. A high PCR, indicating a preponderance of put buying, usually signals bearish sentiment and that a market bottom may be near. Conversely, a surge in call buying, reflected in a low PCR, often suggests bullish sentiment and a potential market top.

- Use in Market Timing: PCR can be used for market timing, especially when it reaches extreme levels. An unusually high PCR might indicate excessive fear, suggesting a buying opportunity, while a very low ratio could imply excessive optimism, signaling a potential selling point.

- Interpretation in Context: PCR’s utility increases when viewed in conjunction with other indicators and broader market analyses. It is particularly useful in identifying overbought or oversold market conditions, offering additional insight into the broader market dynamics.

Limitations of PCR:

- Inconsistency in Predictive Power: There is a lack of consistency in the predictive power of PCR. While it has been successful at times, it has also given false signals, making it unreliable as a sole predictive tool for market movements.

- Volume as a Sole Factor: PCR focuses only on volume, which is just one aspect of market liquidity and activity. This singular focus limits its ability to offer a complete picture of market dynamics. Changes in open interest, for instance, can provide additional context and are not captured by the PCR.

- Case-by-Case Utility: The effectiveness of PCR in predicting market movements varies on a case-by-case basis. Historical instances have shown that while it sometimes aligns with market tops or bottoms, this is not always consistent.

Assessment and Divergent Thought Processes:

- PCR should be used as part of a diversified set of tools for analyzing market trends and biases, rather than as a standalone indicator.

- Given its limitations, employing divergent analytical approaches, including fundamental analysis, technical indicators, and macroeconomic considerations, can provide a more comprehensive view of market trends.

- The PCR is valuable in certain contexts and can provide insights into phase transitions in market sentiment, but it should be interpreted with caution and in combination with other metrics.

In conclusion, while the Put/Call Ratio offers valuable insights as a contrarian indicator and can assist in market timing, its predictive power for future market movements is limited and inconsistent. It should be integrated into a broader analytical framework, rather than relied upon exclusively for investment decisions.

PCR during High Volatile and Black Swan Events

The extreme market circumstances and unforeseeable world events in isolation are not the important things. The PCR exists to help us analyze market movements, timing risk, sentiment, and systemic risk.

Market Structure and Volatility During COVID-19: These unprecedented levels of market volatility were caused by the advent of the COVID-19 pandemic. For example, the S & P 500 Index fell 35 percent in March 2020 from its high in February 2020, illustrating the seriousness of the market response to the epidemic. Because the PCR responds to changes in credit and market sentiment, it must have been heavily affected by such high volatility levels.

PCR as a Sentiment Indicator: PCR is an indicator of investor sentiment. High numbers are generally bearish, and low numbers are bullish. Under normal circumstances the PCR will continue to reflect the twists and turns in investor sentiment which tend to occur during high volatility periods or in response to some crisis, such as the recent corona virus outbreak.

Contrarian Indicator: For example, if the PCR is very high, it may represent panic, and stock prices are due for a bounce-back, while if it is very low, it may reflect complacency and a speculative bubble.

Historical Context of PCR: It’s important to note that PCR has historically provided warning signals ahead of major market downturns, such as the 1987 Black Monday crash and the 2008 financial crisis. However, it has also given false alarms, as seen in 2010 and 2020.

PCR during Market Stress: During market stress conditions like those experienced in the COVID-19 pandemic, PCR can provide insights into the prevailing market sentiment, whether it is overly fearful or overly optimistic. This information is crucial for risk management and decision-making during such turbulent times.

In summary, while the PCR is a valuable tool for gauging market sentiment and can offer insights during periods of extreme volatility, its predictive power and behavior can vary and should be interpreted with caution, especially during unprecedented events like the COVID-19 pandemic. It is most effective when used in conjunction with other indicators and within a broader market analysis framework.

Correlations and PCR

Correlation between Commodity Prices and PCR in Equity Markets

- Direct Impact on Specific Sectors: Changes in commodity prices can directly affect sectors such as energy and materials. For instance, rising oil prices might lead to a bullish sentiment in energy stocks, potentially lowering the PCR as more calls are bought in anticipation of price increases.

- Indirect Impact on Broader Market: Commodity price fluctuations can also have broader economic implications, impacting general market sentiment. A surge in commodity prices might lead to inflationary concerns, potentially increasing the PCR in broader equity markets as investors hedge against market downturns.

Currency Market Movements and PCR in Equities

- Commodity-Sensitive Currencies: Strength or weakness in currencies tied to commodities (like the AUD) can signal broader economic trends. For example, a strong AUD due to rising commodity prices might indicate global economic growth, potentially leading to a lower PCR in global equity markets.

- Safe-Haven Currencies: Movements in safe-haven currencies like the USD or JPY, often in response to global uncertainties, can influence investor sentiment in equity markets, thereby affecting the PCR.

Economic Policies and PCR

- Central Bank Decisions: Monetary policies can impact currency values and economic outlooks, which in turn can influence equity markets. For instance, a hawkish stance by central banks might lead to a higher PCR, reflecting increased uncertainty and bearish sentiment.

Global Economic Trends and PCR

- Economic Growth or Recession: Signs of global economic growth can lead to a risk-on sentiment, potentially lowering the PCR in equity markets as investors opt for more call options. Conversely, recessionary trends can increase the PCR due to higher put buying for protection against declines.

Inter-market Volatility and PCR

- Spillover Effects: High volatility in one market (like commodities or currencies) can spill over into equity markets, potentially leading to a higher PCR as investors seek to hedge their equity positions.

Conclusion

In conclusion, analyzing the Put/Call Ratio (PCR) across currency, equity, and commodity markets reveals intricate dynamics, characterized by self-organization and coevolution, where changes in one market may reflect or influence another. The robustness of PCR as an indicator varies, being a well-established contrarian measure in equity markets, while its implications in currency and commodity markets are less definitive, necessitating market-specific analyses. This underscores the importance of considering potential data biases and the distinct theoretical frameworks governing each market. Understanding PCR trend behavior requires a holistic approach, integrating various economic, geopolitical, and sector-specific factors. While correlations between these markets through PCR trends may exist, they should be interpreted within the broader context of each market’s unique characteristics and driving forces, highlighting the necessity of a nuanced and comprehensive approach for effective financial analysis across diverse markets.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.