EUR/USD Bearish bias near the 1.07890 waiting on FED's Key Decision

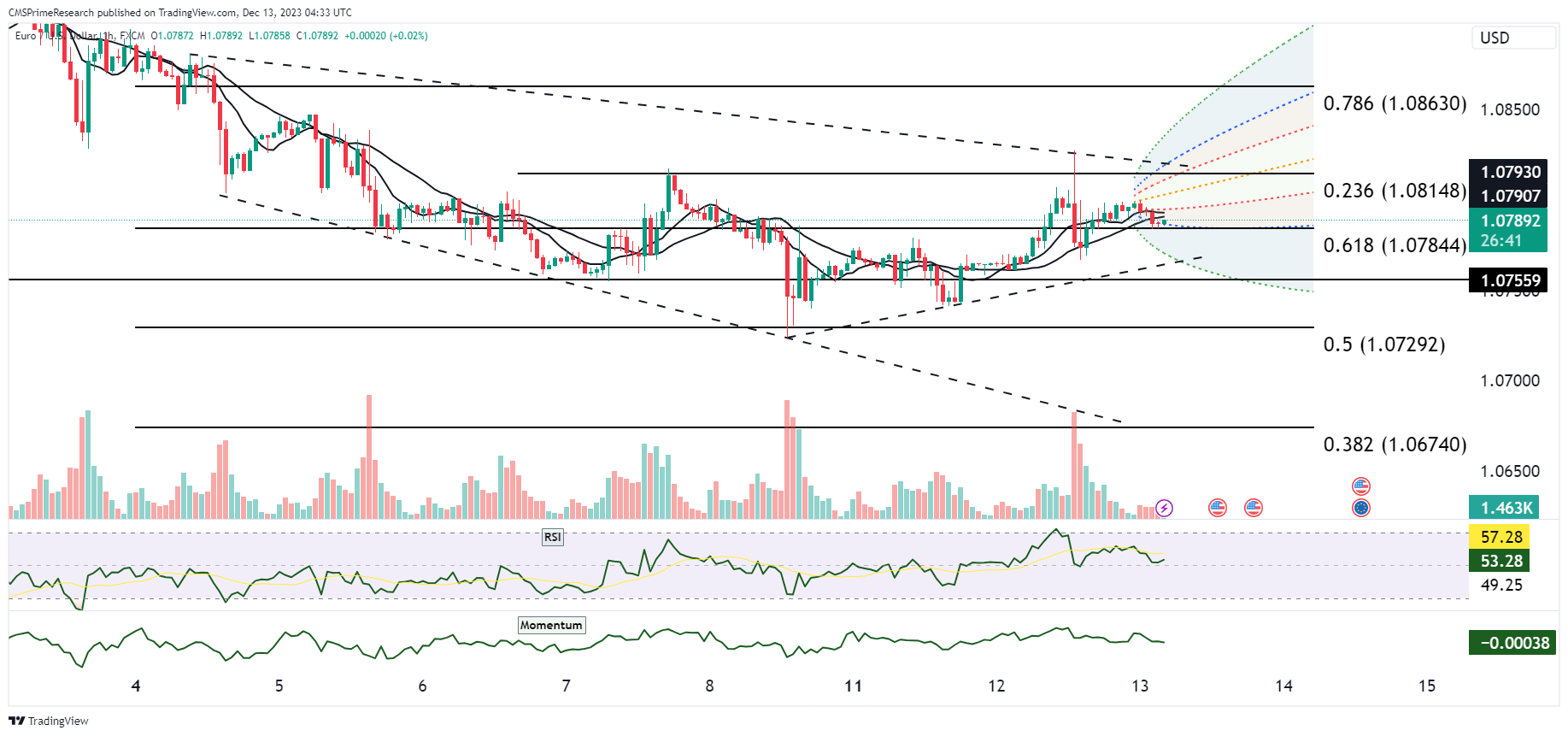

In the EUR/USD currency pair analysis, the charts highlight critical Fibonacci retracement levels with the 23.6% level at 1.08148, followed by the 38.2% at 1.06740, the 50% mark at 1.07292, and the 61.8% level at 1.07844. These serve as potential barriers to price movements, with the 23.6% level currently acting as resistance. The moving averages have converged just below the 23.6% retracement, signaling a possible shift in momentum, and the Relative Strength Index (RSI) is neutral, suggesting there’s room for movement in either direction without immediate overbought or oversold constraints.

In the EUR/USD currency pair analysis, the charts highlight critical Fibonacci retracement levels with the 23.6% level at 1.08148, followed by the 38.2% at 1.06740, the 50% mark at 1.07292, and the 61.8% level at 1.07844. These serve as potential barriers to price movements, with the 23.6% level currently acting as resistance. The moving averages have converged just below the 23.6% retracement, signaling a possible shift in momentum, and the Relative Strength Index (RSI) is neutral, suggesting there’s room for movement in either direction without immediate overbought or oversold constraints.

The pair briefly touched near 1.0800 before retracing to 1.07892 and currently trading near session lows. Expectations of range trading prevail ahead of the upcoming Fed decision, with EUR/USD vulnerable if the Fed resists market expectations for aggressive rate cuts in 2024. Key levels to watch include support at last week’s 1.0723 low and the resistance at 1.08148, Fed dot plots and Chair Powell’s press conference are expected to provide clarity on Fed expectations.

The Fibonacci extension levels further indicate where the price may encounter resistance in the event of an upward trajectory, with significant attention to the 0.618 level at 1.07844 and the 0.786 level potentially around 1.08630. The momentum indicator’s flat profile indicates a lack of clear directional momentum, corroborated by uniform volume bars that do not suggest any significant immediate buying or selling pressure. The current price hovers around 1.07892, with the recent high near 1.07930 providing immediate resistance, while the lower bounds of the descending channel, now breached, may offer future support.

Key Levels to Watch: : 1.07600,1.08032,1.08340

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.07792 | 1.08032 |

| Level 2 | 1.07600 | 1.08160 |

| Level 3 | 1.07386 | 1.08339 |