Introduction:

As of December 06, 2023, several factors are influencing and moving gold prices:

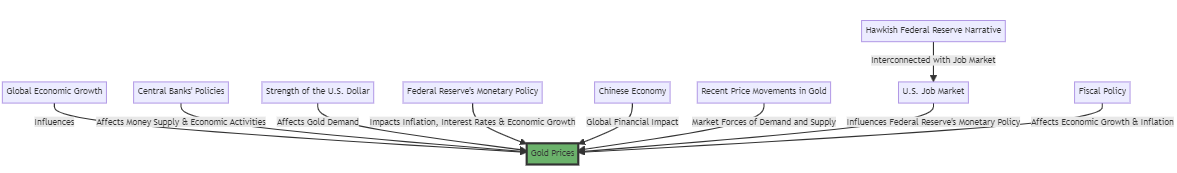

1. Global Economic Growth and Central Banks’ Policies: Signs of weakening economic output are a result of the rate that the central banks are raising interest rates and their aggressiveness. The reduction of global PMI shows that the recession is becoming more widespread and may be the start of recession.

2. Strength of the U.S. Dollar: In the second half of 2022, the US dollar has retreated from its peaks but still appears relatively robust according to recent standards. Generally, the strength of the dollar is in inverse relation to gold prices, a stronger dollar can make gold expensive for buyers using other currencies, which can suppress demand.

3. Federal Reserve’s Monetary Policy and the Chinese Economy: The performance of the Chinese economy and the monetary policy of the Federal Reserve play a significant role in shaping the current gold price in 2023. The U.S. has also seen a softening of consumer and wage inflation that might be important for the Fed. This also includes the state of the Chinese economy, which has implications for the global economic dynamics.

4. Recent Price Movements in Gold: Gold prices touched a six-month high and highest in its history at 2146.79 . The prices of other precious metals like silver have also gone up, implying a larger trend in the precious metals market.

5. Hawkish Federal Reserve Narrative and U.S. Job Market: Strong U.S. jobs market, and the hawkish stance of Fed are capping gold prices to the upside. The actions of the Federal Reserve, especially the statements made by the Chair of the Federal Reserve Jerome Powell, are crucial in moving gold prices, as the market expects.

These factors collectively paint a complex picture of the gold market, with central bank policies, global economic indicators, currency strengths, and market sentiments playing crucial roles in determining the direction of gold prices.

Gold Price Outlook

- Long-term Growth with Short-term Corrections: There is a consensus among experts that the gold price will continue to grow stably in the long term, with the potential to exceed $2,300 in early 2024 and continue rising through 2025 to 2030. However, it is also acknowledged that deep corrections to levels around $1,928 are possible in the Longer Term.

- Near-term Price Fluctuations: In the immediate short term, gold prices are expected to face a correction. Weak inflation pressures have pushed gold prices above $2050 an ounce, but there is a potential for a fall, which could push prices below $2000 an ounce. This decline is attributed to stabilizing geopolitical tensions and fading fear trade.

- Federal Reserve Policies: The Federal Reserve’s policy actions will play a crucial role in gold prices. Markets expect that the Federal Reserve will leave interest rates unchanged in the next month and start cutting rates from May, with a total of three rate cuts expected through the next year. These rate cuts are expected to provide support to gold prices even if there is a near-term correction.

- Inflation and Economic Factors: The gold price forecast is being influenced by inflation, with the US inflation rate dropping from a 40-year high to 3%. However, there are uncertainties surrounding the stabilization of this situation. Tensions in trade and sanctions, potential disruptions in supply chains, and rising prices for energy could lead to increased inflation, which typically boosts gold prices as it is seen as a hedge against inflation.

- RSI Indicators and Technical Analysis: Based on the Relative Strength Index (RSI), gold is currently overbought, and there is a divergence pattern signaling a near-term correction. Long Term Monthly Support levels are identified at around $1997 – $1989 and $1958 – $1946. There is a high likelihood of high volatility in the gold market in the coming months, driven by an unpredictable news background.

In summary, while there is a bullish long-term outlook for gold, the immediate future is expected to see some volatility and potential price corrections. Influencing factors include Federal Reserve policies, inflation rates, geopolitical tensions, and technical market indicators.

An analysis on Market Expectations-WHY?

The factors currently influencing gold prices can be interpreted through various economic and financial factors

- Global Economic Growth and Central Banks’ Policies: The role of central banks in economic stability is pivotal. Central banks influence money supply, which directly impacts economic activities and can affect gold prices, as gold is often seen as a hedge against economic instability.

- Strength of the U.S. Dollar: The value of a currency, like the U.S. dollar, is influenced by monetary policy. A strong dollar can make gold more expensive in other currencies, affecting its demand. Monetary policy decisions can lead to fluctuations in currency strengths, thereby influencing gold prices.

- Federal Reserve’s Monetary Policy and the Chinese Economy: Monetary policy, especially in major economies like the U.S. and China, significantly impacts global financial markets, including gold. The policy decisions by the Federal Reserve can affect inflation rates, interest rates, and economic growth, all of which can influence gold prices.

- Recent Price Movements in Gold: Gold prices are subject to market forces of demand and supply. The market’s perception of gold as a security or investment can drive its price movements. As investors seek to diversify their portfolios, especially in times of economic uncertainty, gold’s price can be affected.

- Hawkish Federal Reserve Narrative and U.S. Job Market: The job market and the Federal Reserve’s stance are interconnected. A robust job market can influence the Federal Reserve’s monetary policy, which in turn can impact gold prices. For instance, a strong job market might lead to higher interest rates, which can affect the attractiveness of gold as an investment.

Regarding fiscal policy, government spending and taxation decisions also play a role. Changes in fiscal policy can affect economic growth and inflation, indirectly influencing gold prices. For instance, expansive fiscal policy can lead to higher inflation, potentially increasing the demand for gold as an inflation hedge.

A deeper Methodology for Market Biases-How to Approach the Current Market

Understanding the Gold Market Dynamics

- Rational Expectations and Market Efficiency: The theory that expectations in financial markets are rational, reflecting optimal forecasts using all available information, is relevant here. This implies that the current gold prices are a reflection of the market’s collective rational expectations considering all known factors, such as central bank policies, economic indicators, and geopolitical tensions.

- Behavioral Finance Perspectives: Behavioral finance offers insights into how psychological factors and social dynamics can drive market movements, potentially explaining the recent surge in gold prices and their potential for speculative bubbles. This aspect considers how overconfidence, social contagion, and media influence might impact investor behavior towards gold.

- Efficient Market Hypothesis (EMH) Considerations: The efficient market hypothesis suggests that current security prices fully reflect all available information. This would imply that gold prices already incorporate expectations regarding central bank policies, inflation rates, and economic outlooks.

- Empirical Evidence and Market Analysis: While theories like EMH provide a starting point, the actual behavior of the gold market also needs to be compared with empirical data and real-world developments, such as interest rate trends, inflation expectations, and geopolitical events.

Theoretical Framework for Market Bias and Future Outlooks

- Integration of Rational Expectations and Behavioral Factors: A comprehensive framework should consider both rational expectations (based on economic fundamentals and data) and behavioral aspects (like investor sentiment and psychological biases).

- Dynamic Analysis of Economic Indicators: Continuous monitoring of key economic indicators, such as inflation rates, GDP growth, and employment data, is crucial. These indicators influence central bank policies, which in turn affect gold prices.

- Assessing the Impact of Global Events: Geopolitical tensions, trade agreements, and global economic trends play a significant role in shaping market bias. Understanding their potential impact on investor sentiment and economic conditions is essential

- Technical Analysis for Short-Term Trends: While long-term trends might be driven by fundamentals and rational expectations, short-term movements in gold prices can be analyzed using technical indicators like Relative Strength Index (RSI) and support-resistance levels.

- Diversification of Analysis Sources: Relying on a variety of sources, including economic data, market reports, and investor sentiment analysis, can provide a more balanced view and help mitigate the risk of bias in any single analytical approach.

In summary, understanding the current dynamics of the gold market and estimating future outlooks requires a blend of rational economic analysis, an understanding of behavioral finance, and continuous monitoring of both macroeconomic indicators and global events. This approach acknowledges the complexity and interconnectivity of financial markets, allowing for a more nuanced interpretation of market trends and biases.

Conclusion

Analyzing different economic and financial aspects affecting gold prices shows that gold market is a highly internationalized one. This is due to the fact that central banks can have a very strong effect on the economies and money supply by policies. In addition, gold has traditionally been considered as safe haven asset during the economic times. However, a stronger dollar makes gold more expensive in other currencies, which may dampen the demand for gold. Major economies, such as the U.S. and China, play a crucial role in determining the global financial markets through their monetary policies. Changes in gold prices are related directly with decisions made by the Federal Reserve with respect to the inflation rates, interest rates, and overall economic growth.

Gold’s price is influenced by market perceptions, including its status as an investment of choice, particularly when the economy is facing uncertainty. Moreover, the story concerning the Federal Reserve, especially on the United States job market, reveals a significant link. Strong job market can result in the change of the policies, as interest rate hikes, for example, can reduce the attractiveness of gold as investment.

Another consequential factor is a fiscal policy, which involves government spending and taxation. Gold prices are also influenced by economic growth and inflation, which may affect economic performance. It is such as an expansionary fiscal policy that would cause inflation thus increasing the demand for gold which is an inflation hedge. Finally, gold prices are not determined by one factor but are the outcome of a complex interplay of world economic growth, monetary & fiscal policies, strong currencies, and market forces. It is important for investors and policymakers to understand the complex relationships so as to navigate the gold market correctly.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.