USD/JPY Key Support Levels at 146.80 Amid Fed and BOJ Policy Divergence

The currency pair USD/JPY experienced significant fluctuations, initially dropping from 147.48 to 146.68 in Asian markets, before reclaiming the 147 level. This initial decline was influenced by lower U.S. rates, a reaction to Federal Reserve member Waller’s dovish remarks.

The turnaround in USD/JPY coincided with comments from BOJ’s Adachi, who clarified that the Bank of Japan is not considering an exit from its negative rate policy, countering the dovish stance of BOJ Governor Ueda. This statement suggested a split in views within the BOJ Policy Board, indicating that a consensus on policy direction is lacking. Consequently, maintaining the status quo in monetary policy appears more likely.

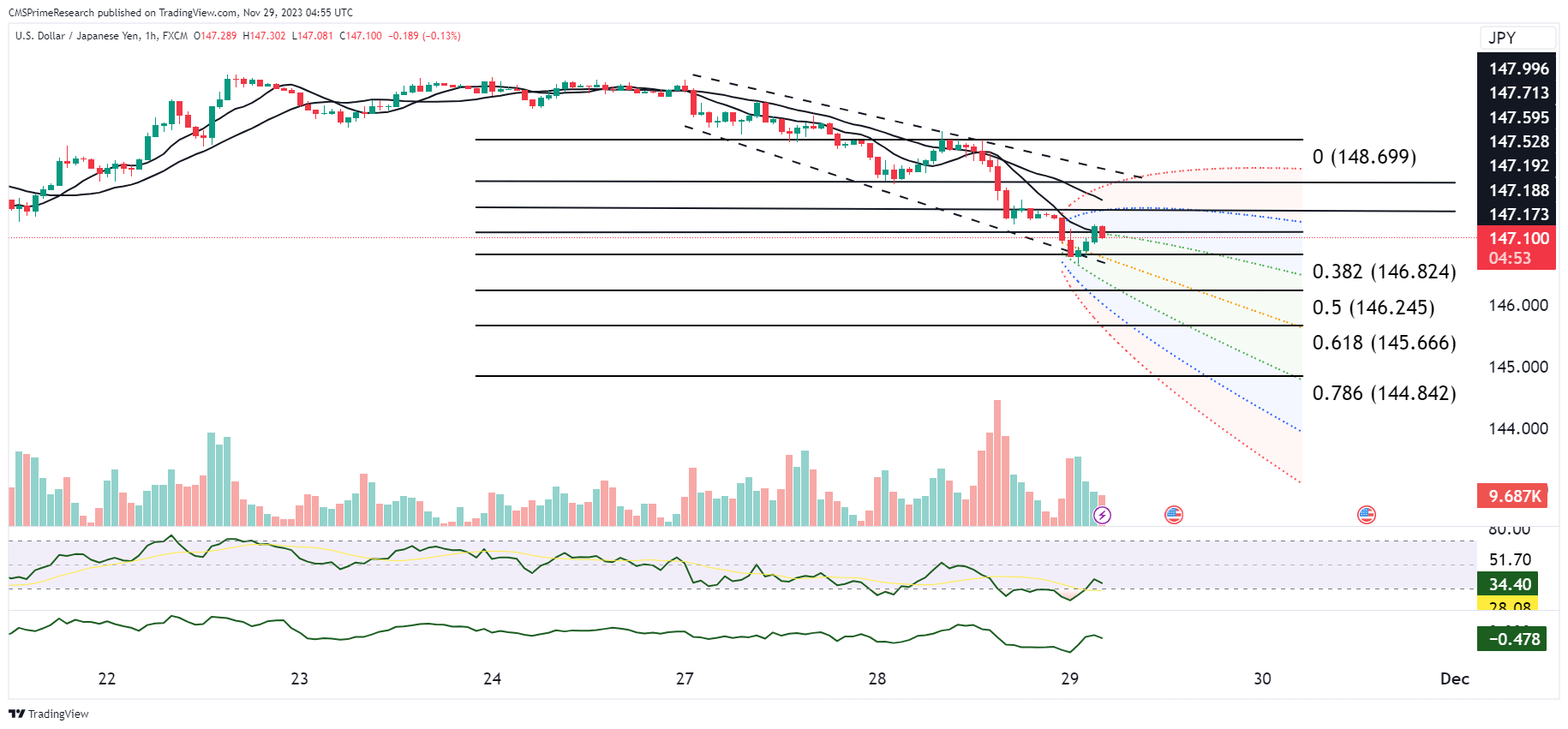

For USD/JPY, the key support level is identified at 146.25. Further support levels are seen at 145.65 and the September 11 spike low of 145.91.

The USD/JPY’s bearish reversal is testing key supports as the likelihood of Fed rate cuts increases. The pair is probing below the 50 and 200 Day MA and October lows at 147.30, following comments by Fed officials Goolsbee and Waller suggesting possible rate cuts in the first half of 2024. A close below 146.824 would signal a sell, reinforcing the double-top reversal pattern from the 2023-22 multi-decade highs. Upcoming U.S. data will be crucial for speculators. The reversal of the Fed-BoJ policy divergence is undermining the significant rise in USD/JPY from 127 level to nearly the 152 level seen in 2023. Key Fibonacci and technical levels to watch include the 50% Fibonacci retracement at the 146.245.

Key Levels to Watch: : 147.000,146.500,148.327,145.792

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 146.615 | 147.260 |

| Level 2 | 146.435 | 147.350 |

| Level 3 | 145.792 | 147.950 |