Introduction:

In November 2023, the stock market witnessed noteworthy performances across various sectors, with Information Technology and Communication Services leading the way. Additionally, specific industries, such as Broadline Retail and Medical Devices, displayed remarkable growth. These developments not only impact the financial markets but also have ripple effects on currency pairs and commodity-linked currencies. In this overview, we delve into the top-performing sectors, their implications on currency markets, and the factors driving the surge in the Consumer Discretionary sector, shedding light on the intricate interplay between finance and economic dynamics.

Top Performing Sectors and Industry growth in November

As of November 22, 2023, the sectors that are performing well in the stock market are:

- Information Technology: This sector has seen a significant performance increase of 40.4% in 2023. Notably, stocks like Apple, Microsoft, and Alphabet have performed well, with gains of 31.8%, 31.7%, and 48.3% respectively. Nvidia, a prominent tech company, has also been highlighted for its strong performance.

- Communication Services: This sector has seen the highest performance increase of 42.4% in 2023. Within this sector, Interactive Media Services has shown a significant increase of 70.3%.

- Consumer Discretionary: This sector has seen a performance increase of 26.2% in 2023. Within this sector, the Broadline Retail industry has shown a significant increase of 61.0%.

- Insurance: The SPDR S&P Insurance ETF (KIE) hit its highest intraday level on record on November 21, 2023, extending its November gains to more than 4%.

Industries are experiencing growth:

- Medical Devices: Medtronic, a medical device maker, reported better-than-expected quarterly earnings and raised its full-year revenue and earnings guidance, indicating growth in the medical device industry.

- Solar Energy: The solar energy sector is positioned for resilient and balanced growth, with companies like NextEra Energy Partners leading the way.

- Healthcare Interoperability Solutions: The global healthcare interoperability solutions market is set for remarkable growth, expected to grow from $3.4 billion in 2023 to an impressive $6.1 billion by the end of 2028, exhibiting a Compound Annual Growth Rate (CAGR) of 12.7% during the period.

- Oil: The oil market is also experiencing growth, with Chinese oil demand rising to a record high and contributing significantly to global growth. World oil output also increased, with growth in the United States and Brazil outperforming forecasts.

Sector Growth and Currency Pairs

Major currency pairs and commodity-linked currency pairs can greatly be impacted by sector growth. This is so because a health of a nation’s economy, which is typically demonstrated by the sector performance, is the main driver of the rate of exchange of a country’s currency. Macroeconomics indicators like inflation, international trade figures and political news play a critical role in major currency pairs in the Forex markets. As an example, a currency appreciates in a country that has products or services in high demand globally. Instead, countries with high trade deficits are net buyers of foreign goods, which might depreciate their respective currencies.

For instance, the Canadian dollar, Australian dollar, and New Zealand dollar are commodity-linked currency pairs that are closely tied to the prices of commodities. Take for instance, the Canadian economy depends upon commodities such as crude oil and metal. As a result, an oil price rally would probably cause the Canadian dollar to strengthen in comparison to other currencies. Just like in the case of Germany, as the major producer of gold, the Australian dollar enjoys a high positive correlation with the price of gold.

In addition, balance of trade between other countries is also very significant. The currency in a country that has products and services that are highly demanded internationally will normally appreciate. However, countries with large trade deficits buy goods from other countries, which lowers the value of their currency.

It is also vital to point out that the strength and the direction of the correlation can change when using various time frames. GDP, interest rates, and unemployment are main economic indicators that influence these correlations.In conclusion, sector growth can affect major currency pairs and commodity-linked currency pairs through its impact on macroeconomic indicators, commodity prices, and the balance of trade. However, these relationships can be complex and are influenced by a range of other factors, including geopolitical events and market sentiment.

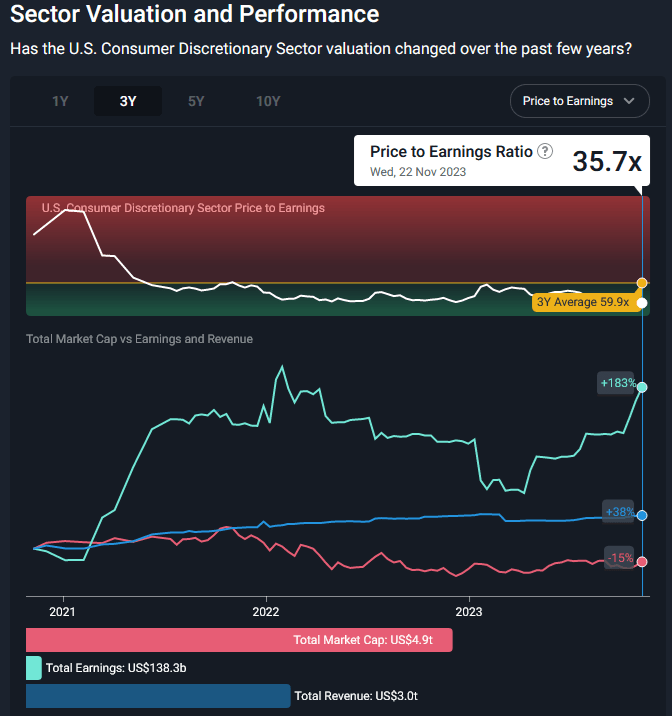

The Consumer Discretionary Sector

Consumer discretionary sector, which comprises companies selling non-indispensable goods and services, has recorded a 26.2% growth in 2023. During a slow economy and recession risk, this sector usually lags behind. In contrast, in 2023, the sector sprinted ahead, gaining more than twice as much as the S&P 500 year-to-date through the end of September. This has been fuelled by the same macro themes that have kept the stock market higher this year e.g., the economy continues to grow, low inflation, the Federal Reserve near the end of raising interest rates, and better chances for a soft landing.

The Broadline Retail industry under the Consumer Discretionary sector has increased by 61.0% in 2023. This might be because of the stock valuations, great firm fundamentals, or strong long-term drivers.

Currency markets can be affected in several ways due to the performance of the Consumer Discretionary sector and the Broadline Retail industry. This is through the affect on investor sentiment. Good results in these industries can help to attract investors and strengthen the country’s currency. On the other hand, low performance may discourage investors and lead to reduced investment as well as a weak currency.

The other way is through the effect on interest rates. However, if these sectors continue to display strong performance that results into higher inflation, there is a possibility of the central banks hiking interest rates to cool down the economy. Such a trend attracts foreign investors, increasing demand for the currency and makes the currency stronger.

However, if the government lowers the interest rate in response to poor performance, this is likely to result in reduced foreign investment and a weaker currency. Nevertheless, it is important to note that the relationship between sector performance and the currency markets is complex and dependent on many other factors such as the overall economic status, monetary policy and geopolitical events. Hence, the above-mentioned growth in the Consumer Discretionary sector and the Broadline Retail industry could have an effect on the exchange rate in 2023, but to what degree or what exactly is yet to be determined.

Factors contributing to the growth of Retail Sector

The significant increase in the broadline retail industry in 2023 can be attributed to several factors:

1. E-commerce growth: It was forecasted that e-commerce sales would increase by 10.4% in 2023 while 20.8% of retail transactions would be made online. By this year (2023), the global e-commerce market was predicted to have reached $6.3 trillion, indicating the growing shift towards internet shopping. This growth was mainly due to the convenience of online shopping, ability to reach a large customer base, and the growing trend of mobile commerce.

2. Consumer behavior changes: Hybrid shopping increased in the retail industry, with 59% of customers preferring online shopping and 41% store purchases. There were also increased incidents of impulse buying, especially among the younger generation. Also, consumers spent more on experiences and big ticket items such as tickets for travelling and vacations. While prices went up, sustainability became more of a luxury than a necessity, with consumers making the eco-friendly choice only if they could afford it.

3. Market trends: In 2023, the retail industry experienced frictionless delivery, AI and personalization, augmented reality, social commerce, in-store efficiency, and luxury. Consumer needs for simplicity, convenience and flexibility in shopping created these trends.

4. Government policies: These factors affected economic outlook for retail industry including slowing economy, inflation, and services spending. Slowing down of economy was projected to contain the growth of retail sales and consumers buying power reduced by inflation. On the other hand, there was a healthy labor market that supported sales. Consumer spending on services bounced up as consumers went back to normal activities. This could have also weighed on retail sales in stores selling consumer goods.

These factors combined to create a complex and rapidly evolving retail landscape in 2023, with retailers needing to adapt to changing consumer behaviors and market trends to succeed.

What may be Driving Demand in these Sectors

1. Technology Sector:

– Digital Transformation Acceleration: The pandemic acted as a catalyst for digital transformation in a number of sectors, thus driving demand for technology solutions.

– Economic and Global Uncertainties: In the wake of macroeconomic uncertainties, tech companies are looking forward to margin management and revenue growth through business process efficiency and potential mergers and acquisitions.

– Innovation and Diversification**: Digital progress in other sectors such as real estate, retail and manufacturing, is supported by technology expansion to non-tech companies.

2. Communication Services Sector:

– Economic Sensitivity and Diversity: The market is made of different companies with varying economical sensitivities, including more defensive ones and is a broad investment opportunity.

– Consumer Spending: Consumer spending has been strong in the face of rising interest rates and inflation, and many companies in this sector have thrived as a result.

– Strategic Cost Management: The companies can reduce costs and sustain a solid balance sheet to have a strong position during the economic downturns.

3. Consumer Discretionary Sector:

– Economic Growth and Market Dynamics: Despite such macro factors as strong economic growth, low inflation, and possibly the final interest rate hike cycle, the sector has been abnormal in its growth.

– Performance of Major Companies: The sector has performed strongly, as evidenced by meaningful gains made by major companies like Amazon and Tesla, which are perceived as investing plays on artificial intelligence.

– Defensive Business Models: TJX Companies is one of the retailers whose economic resilient in downturns include providing the lowest-priced products.

Such factors imply a strong relationship between macroeconomic conditions, sector-specific trends and corporate strategies. Organisations are seeking to meet the need for digital solutions and the need to adapt their strategic business models.

The communication services sector’s performance hinges on broader consumer spending patterns and the ability of companies to navigate economic challenges. The consumer discretionary sector is benefiting from broader economic trends and the

Conclusion

In conclusion, as of November 2023, the financial landscape reflects the impressive performance of key sectors such as Information Technology, Communication Services, and Consumer Discretionary. These sectors have not only outpaced expectations but have also offered insights into the broader economic trends. Their influence extends beyond stock markets, affecting currency pairs and commodity-linked currencies, where factors like inflation, trade balances, and interest rates come into play.

The robust growth within the Consumer Discretionary sector, particularly in the Broadline Retail industry, is a testament to evolving consumer behaviors, e-commerce expansion, and changing market dynamics. This sector’s success has the potential to bolster investor sentiment and currency values, depending on how central banks respond to economic conditions.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.