Introduction:

The article discusses the importance of risk management in trading, focusing on techniques that active traders use to manage risk and avoid potential losses. It emphasizes the significance of planning trades, setting stop-loss and take-profit points, diversifying investments, and adhering to the one-percent rule, which suggests that traders should never risk more than 1% of their total account value on a single trade. We also highlight the need for setting trading limits to control the size and amounts that authorized traders can trade. It underscores common risk management mistakes, such as improper governance, ignoring opportunities, using past events to predict future risks, and lacking transparency.

Moreover, we encourage traders to conduct a self-assessment, asking questions about their enjoyment of trading, their profit and loss statements, their long-term commitment, their trading rules, and their readiness for more. It also discusses common risk management strategies, including minimizing losses, keeping emotions out of trading decisions, and diversifying investments. Lastly, we introduce the concept of a daily trading limit, which is the maximum price range limit that an exchange-traded security is allowed to fluctuate in one trading session.

In summary, the article provides a comprehensive overview of risk management in trading, offering valuable insights and strategies to help traders minimize losses and maximize profits.

Maximum Loss Per Trade

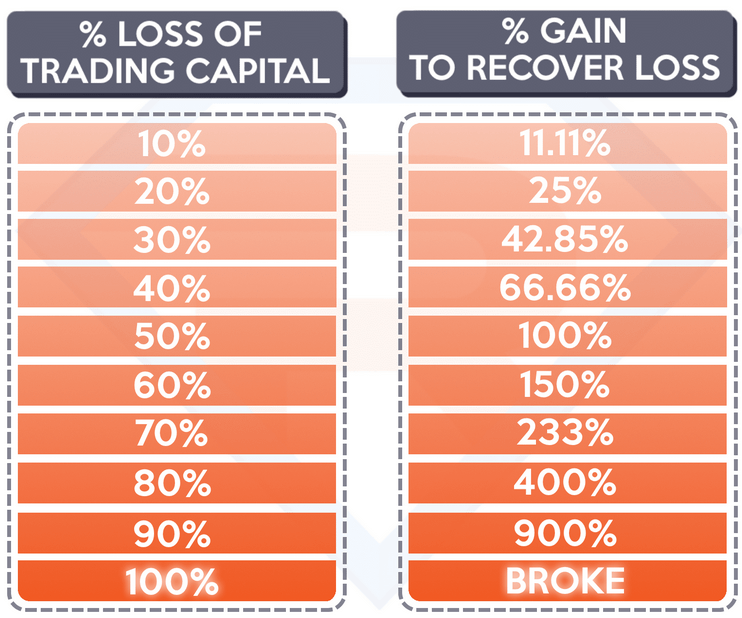

Setting threshold levels for risk tolerance is undoubtedly a vital part of developing a comprehensive trading strategy. These thresholds include the loss per trade, the total exposure, and the maximum drawdown that depends on the risk appetite and the experience on the trader’s side.

The maximum loss per trade can be categorized into three levels: conservative, moderate, and aggressive. Traders who are conservative about safeguarding their capital will take a chance of no more than 1% on their total trading capital per trade. This strategy reduces the possibility of losses and is appropriate for people who do not want much volatility in the market.

More knowledgeable traders and traders who are able to balance risk and reward may be willing to risk between 1% and 2% of their whole trading capital per trade. The method enables a balance between the opportunities of profit and the risk of loss, and thus provides opportunities for growth while caution.

Some aggressive traders, with a high risk appetite, could risk between 2% and 5% of their total trading capital per trade. This approach may result in high returns but with the attendant risk of incurring huge, unexpected losses. They are well-informed and knowledgeable about the volatility of the market.

Please note that these are general guidelines and the specific percentages can be adjusted to fit the trader’s financial goals and situation. However, the most important thing is to determine a risk tolerance level, which is acceptable for the trader’s comfort, financial, and trading objectives in the end.

Total Capital at Risk

Total Capital at Risk is the percentage of an investor’s total capital that may be affected by market losses. This proportion depends on the conservative or moderate or aggressive risk tolerances of the investor.

Conservative investors rarely risk more than 10 to 15 percent of their entire invested capital. These investors seek to preserve capital and are ready to settle for low returns but lower risk. They mostly put their money in low-volatility assets, including bonds, bond funds, and income funds.

However, moderate investors are ready to stake up to 20-30% of their money. They endeavor to strike a balance between risk and return, usually opting for a balanced portfolio including stocks and bonds. This approach helps them to have multiple trades spread their exposure thereby reducing the effect of any single poor performing trade.

Aggressive investors are prepared to risk 30-50% of their total capital. It embraces more risk in the pursuit of greater rewards. This means that there is a high risk scenario that has a bigger payoff, and it usually involves investment in uncertain assets such as stocks, equity funds and ETFs. Market-wise aggressive investors understand the risks of their investment choices.

Therefore, the total percent capital at risk is a measure of the investors risk and investment policy. Investors need to realize their risk tolerance and match it with their financial goals and investment decisions.

Maximum Drawdown Limit

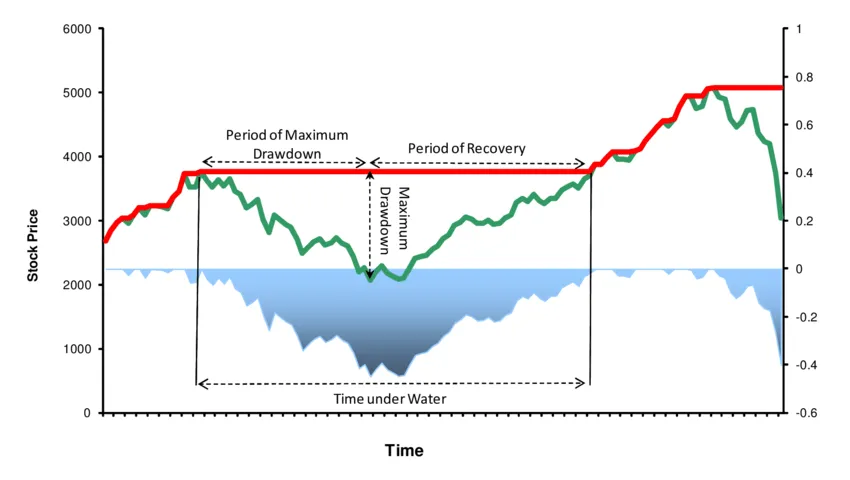

MDD is the biggest downward movement of an investment or trading account from the peak to the bottom point. This is a significant measure for risk measurement and for determining the size of draws downs depending to an investor’s risk. Here are some guidelines for setting maximum drawdown limits based on risk tolerance:

1. Conservative: A maximum drawdown of not more than 10% to 15% of the total trading account. It is most applicable to prudent investors who prefer capital preservation, albeit with smaller profits and less risk.

2. Moderate: A maximum drawdown of around 20 to 25%. This level is suitable for those investors searching for moderately high returns who are ready to tolerate some volatility to their account values.

3. Aggressive:Maximum drawdown above 30% (or more). This is the highest level for experienced traders with a big risk appetite for significant fluctuations of their account balance with an eye on higher potential profits.

It should however be noted that these are general guidelines. Investors should therefore set their maximum drawdown limits depending on their financial goals, risk tolerance and investment strategy Investors set drawdown limits to help manage their risk more effectively and also make wiser decisions in the market environment.

Daily and Monthly Loss Limits

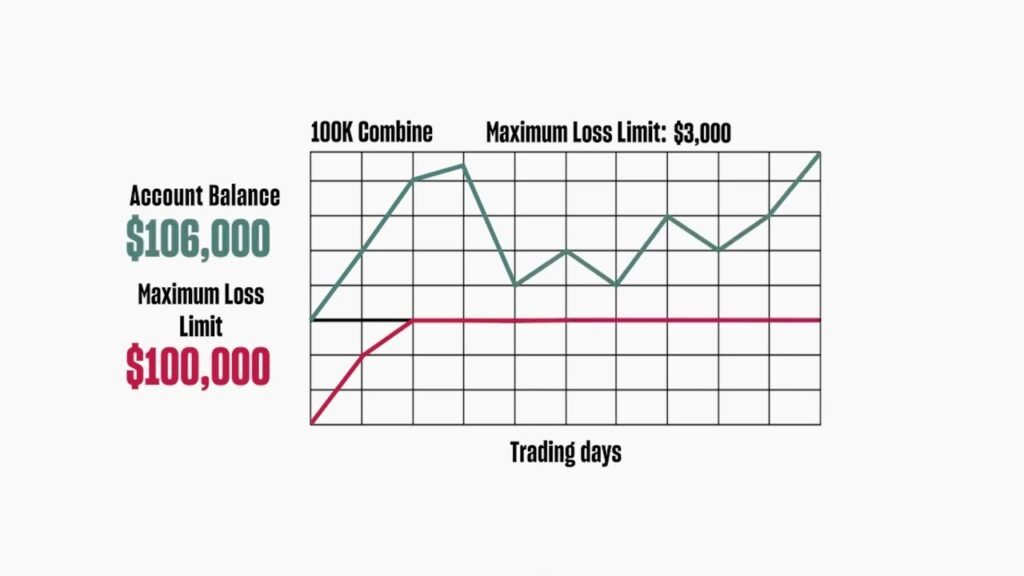

Daily and monthly loss limits are crucial components of a risk management strategy in trading. These limits set a cap on the amount a trader is willing to lose within a specific time frame, helping to prevent substantial losses and maintain trading discipline.

Daily loss limits refer to the maximum amount a trader is willing to lose in a single day. A common guideline is to set this limit at 2% to 3% of the trading capital. For instance, if a trader has a capital of $10,000, a daily loss limit of 2% would mean the trader is willing to lose up to $200 in a single day. This limit helps traders avoid substantial losses on a bad trading day and encourages them to stop trading and reassess their strategy when the limit is reached.

Monthly loss limits, on the other hand, set a ceiling on the acceptable loss for a month. This could be set at around 6% to 10% of the trading capital. For example, with a trading capital of $10,000, a monthly loss limit of 10% would mean the trader is willing to lose up to $1,000 in a month. This limit helps traders manage their risk over a longer period and prevents a series of bad trading days from significantly depleting their trading capital.

In conclusion, setting daily and monthly loss limits is a crucial part of risk management in trading. These limits should be set based on the trader’s risk tolerance, trading capital, and trading strategy, and should be strictly adhered to.

Conclusion

In conclusion, this article underscores the paramount importance of risk management in trading. It provides traders with a comprehensive overview of various risk management techniques and strategies, offering valuable insights to help minimize losses and maximize profits. Key takeaways include the significance of setting maximum loss per trade, total capital at risk, and maximum drawdown limits based on one’s risk tolerance and financial goals. The article also highlights the need for daily and monthly loss limits to maintain discipline and control in trading.

Furthermore, the article emphasizes that risk management is not a one-size-fits-all approach, as traders have varying risk appetites and objectives. It encourages traders to assess their own preferences, trading rules, and readiness for more significant commitments.

Ultimately, successful trading involves striking a balance between risk and reward, and implementing sound risk management practices is a crucial step toward achieving long-term success in the dynamic world of financial markets. By adhering to these principles and avoiding common risk management mistakes, traders can navigate the challenges of trading more effectively and make informed decisions that align with their financial objectives.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.