FOMC and the Path for USD

the Federal Open Market Committee (FOMC) has decided to keep interest rates steady, with the possibility of one more rate hike this year. The central bank’s latest economic projections showed one more quarter-point rate hike this year, and they see cuts in 2024, but not as many as they previously did. Job gains have slowed in recent months but remain strong, and the unemployment rate has remained low. Inflation remains elevated, and FOMC officials are closely monitoring the situation. Recent indicators suggest that economic activity has been expanding at a solid pace. However, job gains have slowed in recent months but remain strong. The unemployment rate has remained low, and FOMC officials are closely monitoring the situation.

Inflation remains elevated, and FOMC officials are closely monitoring the situation. The central bank’s latest economic projections showed one more quarter-point rate hike this year. They see cuts in 2024, but not as many as they previously did. Some members of the FOMC, including Chair Jerome Powell, have suggested that rates may have risen far enough to bring inflation down, while others, like Dallas Fed President Lorie Logan, have indicated their preference for another rate hike at the next meeting in June. The FOMC will continue to assess economic and financial conditions and determine the appropriate stance of monetary policy. Investors and analysts will be closely watching the tone of the FOMC statement and any hints about the end of rate increases and the next phase of trying to fully wrangle inflation.

FOMC Impact on Currency Markets:

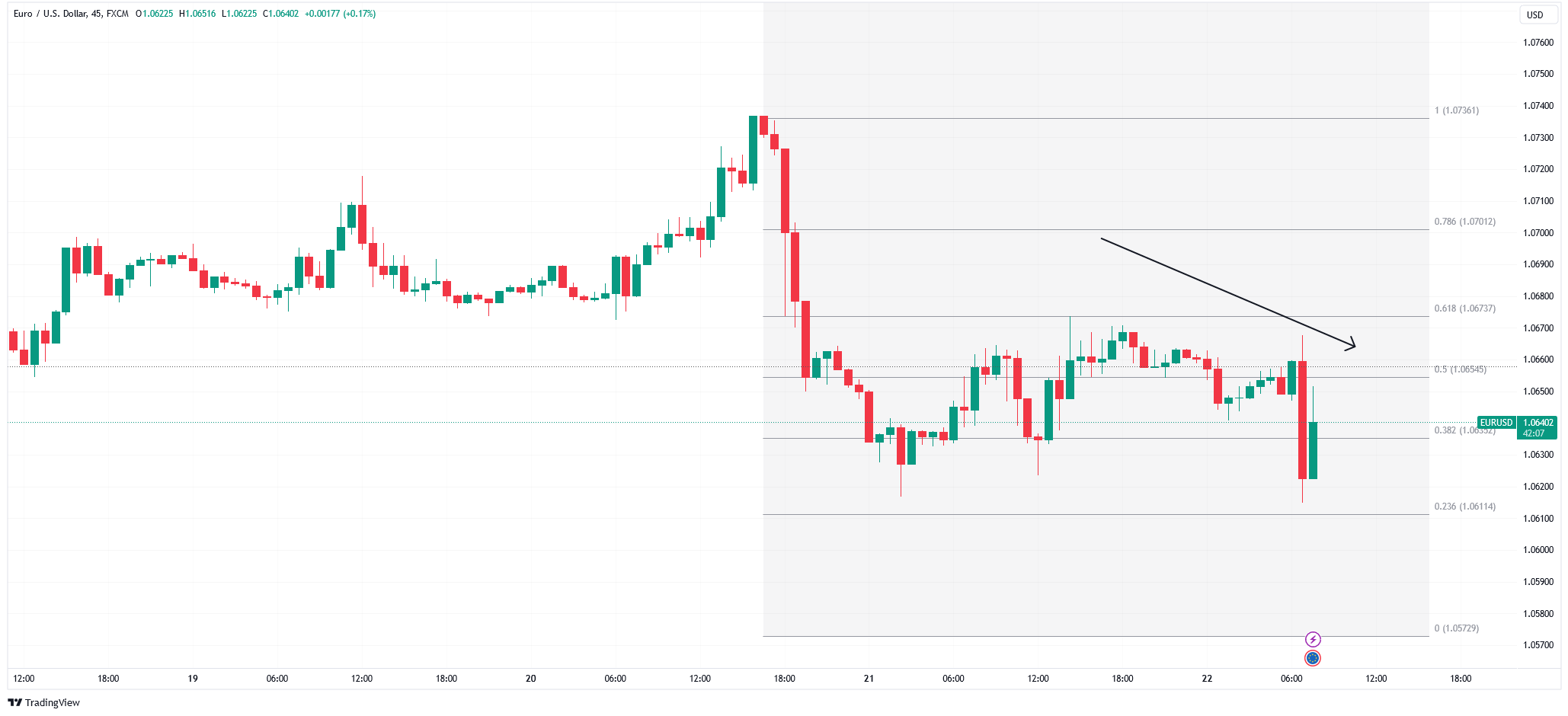

EUR/USD (Euro/US Dollar):

Regarding interest rates the decision made by the FOMC to maintain stability, along with the potential for one rate hike this year may not have an impact on the EUR/USD exchange rate. This is because the market had already factored in this expectation. However if the FOMC indicates an approach towards future rate hikes due to concerns about inflation it could potentially strengthen the USD and result in a decrease in EUR/USD.

Gold:

In terms of interest rates the indication of another rate hike this year and possible cuts in 2024 (although fewer than previously anticipated) could exert pressure on gold prices. The reason behind this is that higher interest rates tend to make non interest bearing assets like gold less appealing to investors, which may lead to a decline in gold prices. Nonetheless it’s important to consider that elevated inflation levels might counteract some of this pressure since gold is often seen as a hedge against inflation.

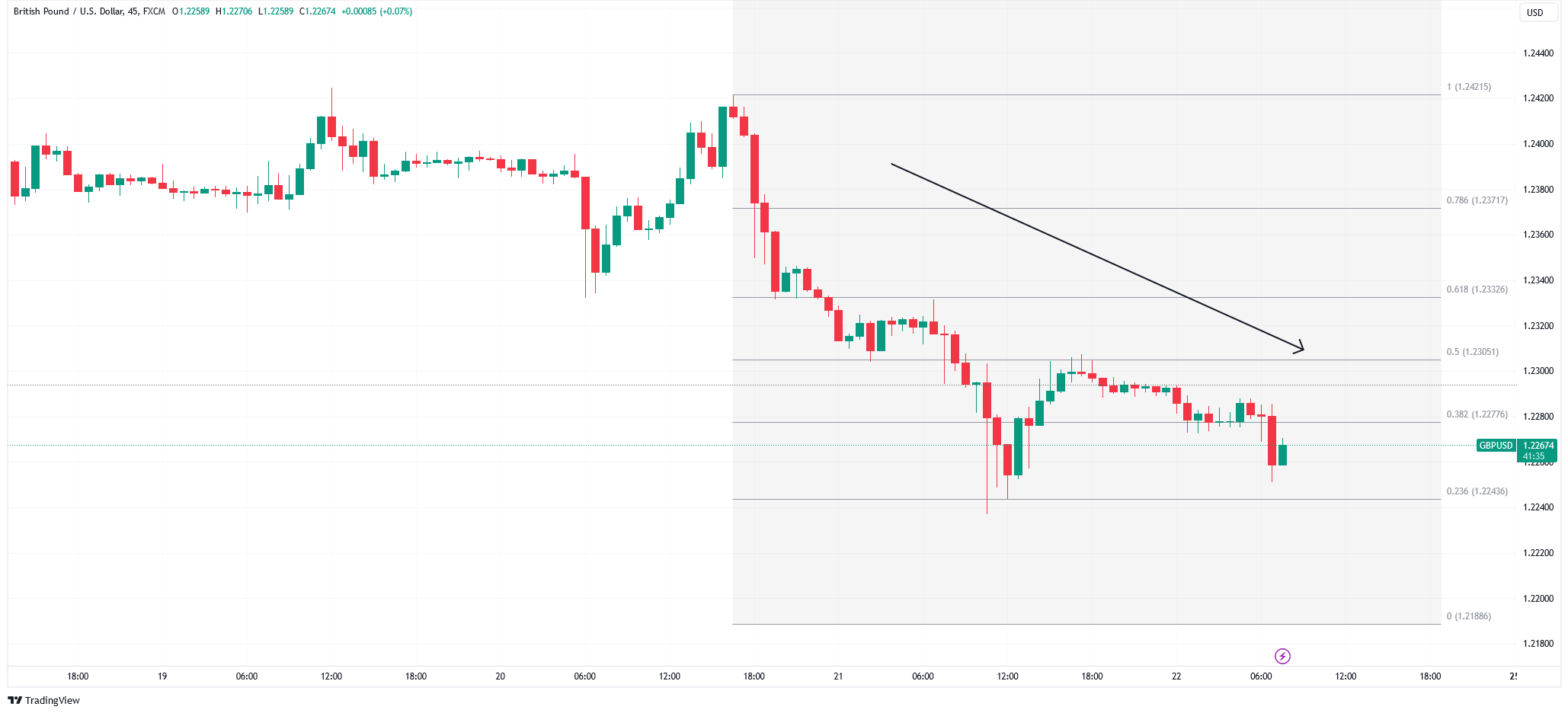

GBP/USD (British Pound/US Dollar):

Similar to EUR/USD, GBP/USD can also be influenced by the FOMCs stance on interest rates. If there are indications of an approach towards rates due to concerns about inflation, from the FOMC it has the potential to strengthen the USD and weaken GBP/USD.

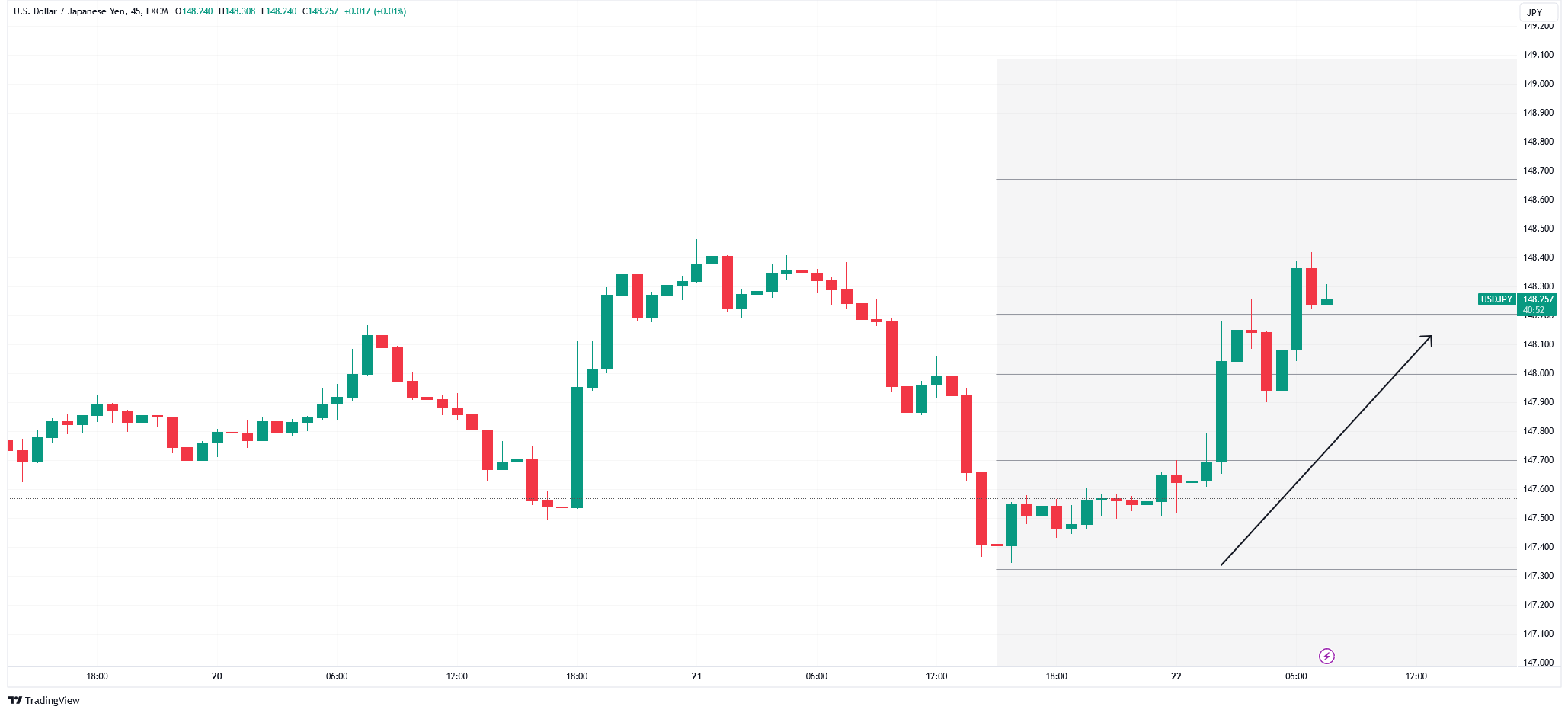

USD/JPY (US Dollar/Japanese Yen);

Considering the FOMCs suggestion of another rate increase, in the year it is possible that we may see a boost in USD/JPY. This could occur because when US interest rates rise it tends to attract investment into the USD potentially strengthening its value, against the Japanese Yen.

Central banks, including the FOMC, Bank of England, and Bank of Japan, wield significant influence over currency markets through their monetary policy decisions, interest rate changes, and economic outlooks

Bank of England and GBP Impacts

Similarly the Bank of England has halted its long run of interest rate hikes as the British economy slows down. The Bank’s Monetary Policy Committee (MPC) voted by a narrow margin of 5-4 to keep the Bank Rate at 5.25%. This decision marks the first time since December 2021 that the Bank of England has not increased borrowing costs.

Despite the recent fall in inflation, the central bank is not taking it for granted and has emphasized that its job is not done. Four members of the MPC – Jon Cunliffe, Megan Greene, Jonathan Haskel, and Catherine Mann – voted to raise rates to 5.5%.

The MPC has also sped up the pace of its program to shrink the huge stockpile of government bonds it bought during the pandemic, planning to reduce it by £100 billion over the next 12 months. This reduction will be achieved through a combination of sales and allowing bonds to mature, bringing the total stockpile down to £658 billion.

Although some investors may assume that the Bank of England’s hiking cycle has concluded, the central bank is keeping the door open for further hikes. The Bank of England will continue to monitor the economic situation and make decisions accordingly.

The announcement that the Bank of England is pausing its interest rate hikes and the Monetary Policy Committee (MPC) has voted to maintain the Bank Rate at 5.25% may have implications, for currency pairs such as EUR/USD and GBP/USD in the ways;

1. GBP/USD (British Pound/US Dollar):

Interest Rates; The decision to halt the rate hikes in the UK could potentially weaken the British Pound (GBP) against the US Dollar (USD). When a central bank stops or slows down its cycle of raising interest rates it might indicate concerns about the economy or a desire to support growth. This can make the currency less attractive leading to a depreciation.

2. EUR/USD (Euro/US Dollar):

Interest Rate Differentials; If the Bank of England pauses its rate hikes while the Federal Reserve in the United States continues to raise interest rates it can create a difference in interest rate levels between these two currencies. This could result in an USD compared to Euro, which may lead to a decline, in EUR/USD.

Diverging interest rate policies between countries can lead to shifts in currency values. When one central bank raises rates while another maintains lower rates, it can attract or repel capital flows, affecting exchange rates.

Bank of Japan Approaches

The Bank of Japan (BOJ) has maintained ultra-low interest rates and pledged to continue supporting the economy until inflation sustainably reaches its 2% target. This decision suggests that the central bank is in no rush to phase out its massive stimulus program. Markets are focusing on comments from Governor Kazuo Ueda’s post-meeting briefing for clues on how soon the bank could start raising interest rates from negative territory.

Inflation in Japan has risen 4.3% in August compared to the previous year, excluding fresh food. The BOJ is trying to prepare markets for a future policy shift, possibly tweaking a monetary policy framework that was designed to combat deflation. A Reuters poll for September showed most economists predicting an end to negative interest rates in 2024. The prospects of a rate hike have helped push Japan’s 10-year government bond yield to a fresh decade-high.

The BOJ faces the challenge of balancing its ultra-easy policy with the need to address rising prices and yields. The central bank will continue to monitor economic conditions and make decisions accordingly. Investors and analysts will be closely watching the BOJ’s actions and statements for any hints of a change in policy direction.

The news regarding the Bank of Japan (BOJ) maintaining ultra-low interest rates and its commitment to supporting the economy until inflation reaches its 2% target can have several potential impacts on the USD/JPY (US Dollar/Japanese Yen) currency pair:

- Interest Rate Differentials: The BOJ’s decision to keep interest rates low and its commitment to an accommodative monetary policy stance can create a divergence in interest rate differentials between the US and Japan. If the Federal Reserve in the United States continues to raise interest rates while the BOJ maintains low or negative rates, this can lead to a stronger US Dollar (USD) compared to the Japanese Yen (JPY). Higher US interest rates can attract capital flows into the USD.

- Market Sentiment: The BOJ’s announcement that it is not in a hurry to phase out its stimulus program suggests that the central bank is prioritizing economic support over tightening policy. This stance can influence market sentiment and potentially lead to a weaker JPY, as it signals that the BOJ is unlikely to raise interest rates in the near term.

- Yield Differential Impact: The mention of rising yields on Japan’s 10-year government bonds due to the prospects of a rate hike could also impact USD/JPY. Higher Japanese yields relative to US yields can make Japanese assets more attractive to investors, potentially leading to a stronger JPY.

- Inflation Expectations: Inflation in Japan rising to 4.3% in August compared to the previous year is a significant development. The BOJ’s commitment to addressing rising prices may influence currency markets, as it suggests that the central bank could eventually consider policy adjustments to combat inflation. However, it will depend on how and when the BOJ chooses to act on these inflation concerns.

Conclusion

In summary, the central banks’ recent decisions and statements from the Federal Open Market Committee (FOMC), Bank of England, and Bank of Japan have underscored their pivotal roles in shaping currency markets. Interest rate differentials, inflation concerns, and economic data continue to be the driving forces behind these central banks’ actions. Investors and analysts closely watch these developments, recognizing that shifts in monetary policy can significantly influence currency values. As global economic conditions evolve, the intricate interplay between central bank policies and currency markets remains a focal point for traders and investors alike.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.