The Purpose of Correlations

The intricate world of financial markets is driven by a complex web of interrelationships, where every economic event, decision, or indicator can set off a cascade of effects. One of the fascinating facets of this financial tapestry is the correlations between currency pairs and commodities. These correlations offer valuable insights into how different financial instruments move in concert or discord, providing traders and investors with a roadmap to navigate the ever-shifting landscape of global markets.

In this study, we delve into the intricate web of correlations between currency pairs and commodities, examining both strong and moderate positive correlations. We will explore how these correlations manifest at various time intervals and how they are influenced by key economic indicators such as GDP, interest rates, and unemployment. By gaining a deeper understanding of these relationships, market participants can make more informed decisions and better anticipate the impact of economic factors on their trading strategies. Join us on this journey as we unravel the dynamics that connect the world of currencies and commodities, shedding light on the fascinating interplay between financial instruments in the global marketplace.

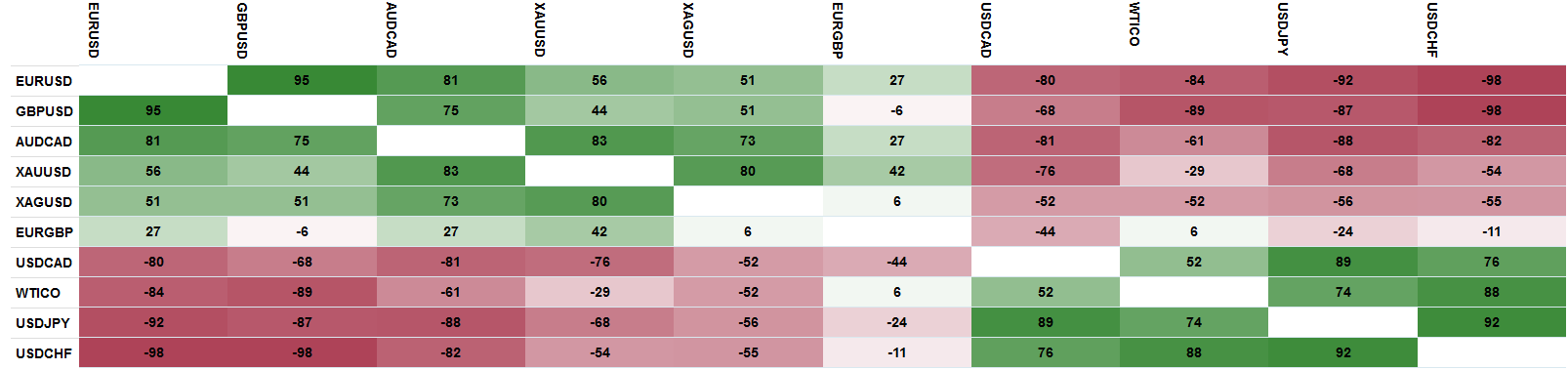

Pairs that exhibit strong Positive Correlations

The strong positive correlations between currency pairs as described indicate that these pairs tend to move in the same direction, which can be indicative of a consistent relationship.

Let’s delve into the relationship bias for each of these pairs with an understanding of key economic indicators such as GDP, interest rates, and unemployment:

- EURUSD and GBPUSD:

- Correlation: Strong positive correlation, especially at the 15-minute, 1-hour, and 4-hour timeframes.

- Relationship Bias: The strong positive correlation between EURUSD and GBPUSD suggests a consistent tendency for these pairs to move together. Traders and investors should be aware that news, events, or economic factors impacting one of these pairs will likely have a similar effect on the other.

- Economic Indicators:

- GDP: Economic growth in the Eurozone and the UK can affect both EURUSD and GBPUSD. Positive GDP growth in either region may strengthen the respective currencies.

- Interest Rates: Decisions by the European Central Bank (ECB) and the Bank of England regarding interest rates can significantly influence EURUSD and GBPUSD. Divergent rate policies can lead to divergence in these pairs.

- Unemployment: High unemployment rates in the Eurozone or the UK can weaken their respective currencies, potentially impacting both pairs negatively.

- EURUSD and AUDCAD:

- Correlation: Strong positive correlation, particularly at the 5-minute and 1-hour intervals.

- Relationship Bias: The strong positive correlation between EURUSD and AUDCAD, especially at shorter timeframes, suggests that these pairs often move together during short-term periods. Traders should be aware of this synchronization when trading these pairs.

- Economic Indicators:

- GDP: Economic performance in the Eurozone, the US, and Canada can affect both EURUSD and AUDCAD. Stronger GDP growth in any of these regions may impact the respective currencies.

- Interest Rates: Interest rate decisions by the ECB, the Federal Reserve (Fed), and the Bank of Canada can influence EURUSD and AUDCAD. Divergent rate policies can lead to different currency movements.

- Unemployment: High unemployment rates in the Eurozone or the US might weaken their respective currencies, potentially affecting both pairs negatively.

- GBPUSD and AUDCAD:

- Correlation: Strong positive correlation, especially at the 15-minute and 1-hour intervals.

- Relationship Bias: The strong positive correlation between GBPUSD and AUDCAD suggests that these pairs often move together, particularly during shorter timeframes. Traders should consider this synchronization when trading these pairs.

- Economic Indicators:

- GDP: Economic growth in the UK and Canada can affect GBPUSD and AUDCAD. Positive GDP growth in either region may strengthen the respective currencies.

- Interest Rates: Interest rate decisions by the Bank of England and the Bank of Canada can influence GBPUSD and AUDCAD. Divergent rate policies can lead to currency divergence.

- Unemployment: High unemployment rates in the UK or Canada might weaken their respective currencies, potentially impacting both pairs negatively.

In summary, strong positive correlations between currency pairs suggest that they tend to move together, indicating a consistent relationship. Understanding this correlation bias can help traders and investors assess the potential impact of economic factors and events on multiple currency pairs simultaneously. However, it’s important to remember that correlation is not static and can change over time, so a comprehensive analysis of other factors is crucial for making informed trading decisions.

Correlations between currency pairs and commodities can vary in strength and direction across different timeframes. Understanding these variations is crucial for traders and investors, as it allows them to anticipate potential movements in these financial instruments more effectively.

Pairs with Moderate Correlations:

The moderate positive correlations between currency pairs at various time intervals suggest that there is a discernible, but not extremely strong, tendency for these pairs to move in the same direction. Let’s delve into each of these relationships with an understanding of key economic indicators like GDP, interest rates, and unemployment:

- EURUSD and XAUUSD (Gold):

- The moderate positive correlation indicates that EURUSD and the price of gold (XAUUSD) tend to move somewhat in sync at various time intervals.

- Economic Indicators:

- GDP: Changes in the Eurozone or U.S. GDP can impact both EURUSD and gold prices. Strong economic growth in the Eurozone or the U.S. might strengthen the respective currencies and potentially suppress gold prices.

- Interest Rates: Central bank interest rate decisions, such as those of the ECB (Eurozone) and the Fed (U.S.), can influence EURUSD and gold. Rising rates might boost EURUSD but could negatively affect gold, which pays no interest.

- Unemployment: High unemployment in either the Eurozone or the U.S. might weaken their respective currencies, potentially benefiting gold as a safe-haven asset.

- EURUSD and EURGBP:

- The moderate positive correlation at the 5-minute and 15-minute intervals suggests that EURUSD and EURGBP sometimes move in tandem during shorter timeframes.

- Economic Indicators:

- GDP: Both the Eurozone and the UK’s GDP can affect these pairs. Positive GDP growth can strengthen their respective currencies.

- Interest Rates: ECB and Bank of England interest rate decisions can impact EURUSD and EURGBP. Divergent rate policies can lead to divergent currency movements.

- Unemployment: High unemployment rates can weaken the Euro and the Pound, potentially affecting these pairs negatively.

- GBPUSD and AUDCAD:

- The moderate positive correlation at the 5-minute interval suggests that GBPUSD and AUDCAD sometimes move together during short-term periods.

- Economic Indicators:

- GDP: UK and Australian GDP growth can affect GBPUSD and AUDCAD. Stronger GDP may lead to stronger currencies.

- Interest Rates: Bank of England and Reserve Bank of Australia interest rates are crucial. Divergent rate moves can lead to different currency movements.

- Unemployment: High unemployment can weaken both the Pound and the Australian Dollar, potentially impacting these pairs.

- XAUUSD (Gold) and XAGUSD (Silver):

- The moderate positive correlation indicates that gold (XAUUSD) and silver (XAGUSD) prices tend to move somewhat together at various timeframes.

- Economic Indicators:

- GDP: Economic growth and industrial demand can influence silver (used in various industries) more than gold. Stronger GDP may have a more significant impact on silver.

- Interest Rates: Interest rates and inflation can affect precious metals like gold and silver. Rising rates may suppress gold, while silver’s industrial uses can lead to divergent movements.

- Unemployment: High unemployment can boost safe-haven demand for both metals, potentially impacting their prices positively.

- EURGBP and USDCAD:

- The moderate positive correlation, particularly at the 1-hour and 4-hour intervals, suggests that EURGBP and USDCAD sometimes move together during medium-term periods.

- Economic Indicators:

- GDP: Eurozone, UK, and Canadian GDP growth can influence these pairs. Stronger GDP can strengthen their respective currencies.

- Interest Rates: ECB, Bank of England, and Bank of Canada rate decisions can impact these pairs. Divergent interest rate policies can lead to currency divergence.

- Unemployment: High unemployment rates can weaken the Euro, Pound, and Canadian Dollar, potentially affecting these pairs negatively.

- USDCAD and USDCHF:

- The moderate positive correlation, especially at the 1-hour and 4-hour intervals, suggests that USDCAD and USDCHF sometimes move together during medium-term periods.

- Economic Indicators:

- GDP: U.S. and Canadian GDP growth can affect USDCAD, while Swiss GDP can influence USDCHF. Stronger GDP can lead to stronger currencies.

- Interest Rates: Federal Reserve (U.S.), Bank of Canada, and Swiss National Bank interest rate decisions can impact these pairs. Divergent rates can lead to currency divergence.

- Unemployment: High unemployment rates can weaken the U.S. Dollar, Canadian Dollar, and Swiss Franc, potentially impacting these pairs negatively.

In summary, moderate positive correlations between currency pairs suggest that they sometimes move together due to shared economic factors. Understanding these correlations can be valuable for traders and investors in assessing potential currency movements, especially when considering economic indicators like GDP, interest rates, and unemployment as part of their analysis. However, it’s important to note that correlation strength can change, and other factors can also influence currency movements, so a comprehensive analysis is essential for making informed trading decisions.

Key economic indicators, such as GDP, interest rates, and unemployment, play pivotal roles in shaping correlations between currency pairs and commodities. By monitoring these indicators, market participants can better gauge the potential impact on both currency pairs and commodity prices.

Strategies for Negatively Correlated Pairs

Strong negative correlations between currency pairs, such as those observed in GBPUSD and USDJPY, as well as EURGBP and EURUSD, can be used to develop trading strategies that take advantage of the inverse relationship between these pairs. Here are some potential trading strategies:

1. Hedging Strategy:

Pairs Involved: GBPUSD and USDJPY, or EURGBP and EURUSD.

Strategy:

Take positions in both pairs simultaneously but in opposite directions (e.g., long GBPUSD and short USDJPY or long EURGBP and short EURUSD). The idea is to profit from the divergence in movement between the two pairs. If GBPUSD is rising and USDJPY is falling, the combined effect can result in more significant gains.

Be aware of transaction costs, spreads, and potential margin requirements when opening and maintaining both positions. Monitor the correlation regularly. Correlations can change, and the strategy’s effectiveness may decrease if the correlation weakens.

2. Divergence Trading Strategy:

Pairs Involved: GBPUSD and USDJPY, or EURGBP and EURUSD.

Strategy:

Identify periods when the two pairs have moved out of sync due to short-term factors or news events. When the correlation suggests an imminent convergence, look for technical or fundamental indicators that signal a reversal or correction in one of the pairs. Take positions based on the expectation that the pairs will converge, meaning one may rise while the other falls. Use technical analysis, such as oscillators, moving averages, or support and resistance levels, to identify potential entry and exit points. Keep an eye on economic events or news releases that might impact one or both pairs.

3. Risk Management:

Pairs Involved: GBPUSD and USDJPY, or EURGBP and EURUSD.

Strategy:

Utilize the negative correlation between these pairs to manage risk effectively. If you have a long position in GBPUSD and a short position in USDJPY (or long EURGBP and short EURUSD), assess your overall risk exposure. The inverse movements can help mitigate potential losses in case one trade goes against you.

Determine appropriate position sizes to balance the risk and reward of your combined positions. Set stop-loss orders to limit potential losses in case the pairs do not behave as expected.

4. Correlation Confirmation Strategy:

Pairs Involved: GBPUSD and USDJPY, or EURGBP and EURUSD.

Strategy:

Use the strong negative correlation as a confirmation tool for existing trade signals. For example, if you receive a buy signal in GBPUSD, check whether USDJPY shows a corresponding sell signal to confirm the trade’s strength. This approach can help filter out potential false signals and increase the reliability of your trades.

Ensure that your trade signals are based on a well-defined trading system or strategy. Be cautious of over-reliance on correlation, as it may not always be a perfect predictor of short-term price movements.

Remember that while strong negative correlations can provide trading opportunities, no strategy is foolproof, and there are risks involved in forex trading. It’s essential to conduct thorough research, perform technical and fundamental analysis, and implement proper risk management techniques to minimize potential losses. Additionally, stay informed about market news and events that may impact these currency pairs and their correlation.

Conclusion

In the intricate world of financial markets, understanding the correlations between currency pairs and commodities is akin to deciphering a code that can unlock valuable insights. This study has shed light on the complexities of these correlations, revealing their varying strengths and influences across different timeframes. As we have explored, economic indicators such as GDP, interest rates, and unemployment play pivotal roles in shaping these relationships, adding layers of complexity to market dynamics. In summary, traders and investors stand to benefit significantly from a nuanced understanding of these correlations. While they offer valuable guidance, it is crucial to remember that correlations are not static; they evolve over time, influenced by a multitude of factors. As such, market participants should use correlations as a part of their broader analytical toolkit, one that includes a comprehensive assessment of market conditions, sentiment, and geopolitical events. By doing so, they can navigate the financial markets with a clearer perspective, making informed decisions that are grounded in a deeper understanding of how currency pairs and commodities interact. In this ever-shifting landscape, where the only constant is change, the ability to decipher these correlations is an invaluable asset, empowering traders and investors to thrive amidst the dynamic currents of global finance.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.