The Main Difference:

Currency ETFs and currency spot prices are two different ways to gain exposure to the foreign exchange market. Currency ETFs are designed to track the performance of a single currency or a basket of currencies against the US dollar or other currencies. They provide investors with a simple and liquid way to invest in foreign currencies, just like investing in stocks or bonds. Currency ETFs can be backed by foreign currency cash deposits or use futures contracts on the underlying currency to replicate the movements of the currency in the exchange market. Some popular currency ETFs include Invesco DB US Dollar Index Bullish Fund (UUP) and WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU).

On the other hand, currency spot prices, or spot exchange rates, represent the current market price for exchanging one currency for another. The spot rate is set by the forex market and fluctuates constantly based on the demand and supply of currencies. Cash delivery for spot currency transactions usually occurs two business days after the transaction date (T+2). Spot rates can be accessed through forex dealers, banks, or online platforms like CMS Prime.

In summary, currency ETFs provide a convenient way for investors to gain exposure to foreign currencies through a managed portfolio, while currency spot prices represent the real-time exchange rates for immediate currency transactions. Both options can be used for different purposes, such as diversifying a portfolio, hedging against exchange rate risk, or taking advantage of currency fluctuations for potential gains.

The risk-return tradeoff between Currency ETFs and Currency Pairs can be analyzed by comparing their respective characteristics and potential returns. Currency ETFs are designed to track the performance of a single currency or a basket of currencies against the US dollar or other currencies, providing investors with a simple and liquid way to invest in foreign currencies. On the other hand, currency spot prices represent the current market price for exchanging one currency for another, and their value fluctuates constantly based on the demand and supply of currencies.

In terms of risk, currency ETFs tend to have lower risk compared to currency pairs due to their diversified nature and the fact that they are managed portfolios. However, this also means that the potential returns from currency ETFs might be lower than those from currency pairs, as the latter can experience more significant price fluctuations.

Risk to Return Characteristics:

When considering specific currency pairs like EUR/USD, GBP/USD, USD/JPY, and XAU/USD, the risk-return tradeoff can vary depending on factors such as market conditions, interest rates, and economic indicators. For example, the USD/JPY currency pair has traditionally had a close correlation with U.S. Treasuries and interest rates in both Japan and the U.S., making it a measure of risk that determines when to buy or sell the USD/JPY in terms of interest rates. Similarly, the risk and return characteristics of other currency pairs can be influenced by various factors, such as economic data, geopolitical events, and market sentiment.

In conclusion, the risk-return tradeoff between Currency ETFs and Currency Pairs depends on the specific investment objectives and risk tolerance of the investor. Currency ETFs generally offer a lower-risk option with potentially lower returns, while currency pairs can provide higher potential returns but with increased risk. Investors should carefully consider their investment goals and risk appetite before deciding which option is more suitable for their needs.

Currency ETFs provide a simplified and managed way to invest in foreign currencies, akin to traditional stocks or bonds. They offer diversification, spreading risk across various currencies, and are often seen as a lower-risk option due to their diversified nature and professional management.

Advantages and Disadvantages:

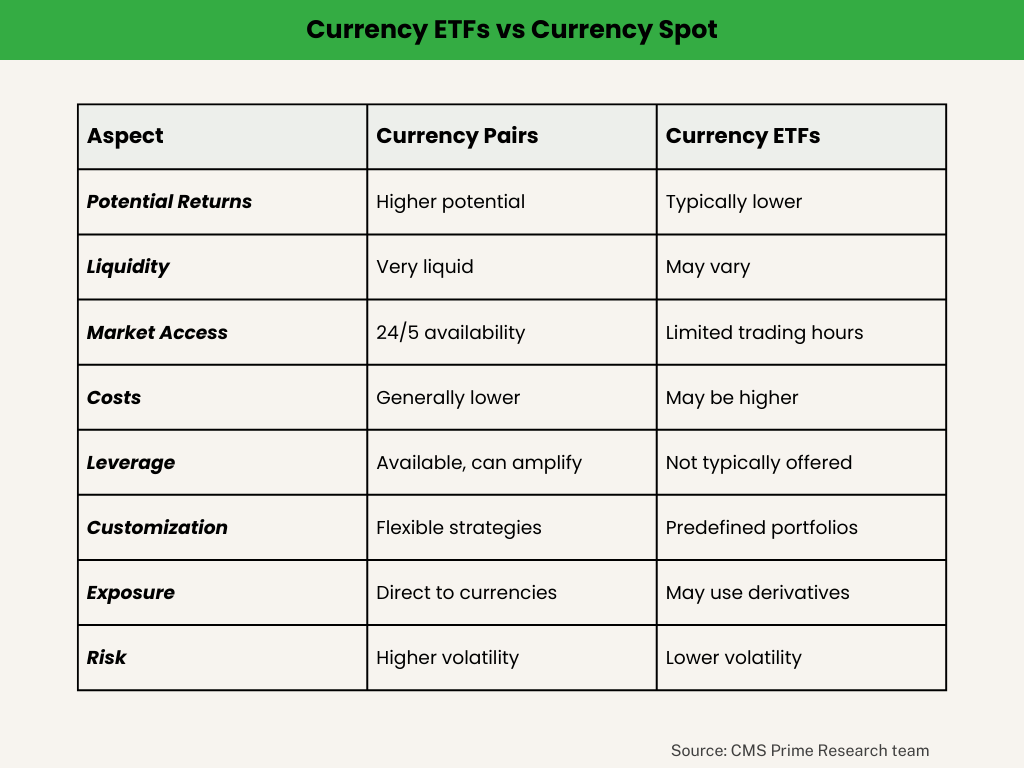

Investing in currency pairs has several advantages compared to investing in currency ETFs:

- Higher potential returns: Currency pairs can experience more significant price fluctuations, which may lead to higher potential returns compared to the more diversified and managed currency ETFs.

- Liquidity: The forex market is the largest and most liquid financial market in the world, allowing for easier trading and lower transaction costs.

- 24/5 market access: The forex market operates 24 hours a day, 5 days a week, providing investors with the flexibility to trade at any time, unlike stock markets or ETFs that have specific trading hours.

- Lower costs: Trading currencies typically involves lower costs compared to trading stocks or ETFs, which can enhance returns for investors.

- Leverage: Forex trading allows for the use of leverage, which can amplify gains (and losses) for investors. This feature is not typically available when investing in currency ETFs.

- Customization: Trading currency pairs allows investors to create their own strategies and take advantage of specific market conditions, while currency ETFs are managed portfolios with predetermined strategies.

- Direct exposure: Investing in currency pairs provides direct exposure to the underlying currencies, whereas currency ETFs may use futures contracts or other derivatives to replicate currency movements.

However, it is essential to note that investing in currency pairs also comes with higher risks due to the increased volatility and potential for significant losses. Investors should carefully consider their investment goals and risk tolerance before deciding which option is more suitable for their needs.

Conclusion:

In conclusion, the choice between currency ETFs and currency pairs is a pivotal decision for investors looking to gain exposure to the foreign exchange market. Each option offers a distinct approach with its own set of advantages and risks, and the decision should be made based on individual investment goals, risk tolerance, and market outlook.

Currency ETFs provide a simplified and managed way to invest in foreign currencies, akin to traditional stocks or bonds. These ETFs are designed to track the performance of a single currency or a basket of currencies against the US dollar or other major currencies. They offer diversification, spreading risk across various currencies, and are often seen as a lower-risk option due to their diversified nature and professional management. However, this diversified approach can also mean potentially lower returns, as currency ETFs may not capture the full extent of price fluctuations seen in individual currency pairs.

On the other hand, currency pairs represent a more direct approach to forex trading. They involve exchanging one currency for another at the prevailing spot exchange rate. Currency pairs can experience more significant price fluctuations, leading to higher potential returns, but they also come with increased volatility and risk. Traders in currency pairs have the flexibility to create their own strategies, leverage their positions, and trade around the clock, thanks to the 24/7 nature of the forex market. However, this freedom also comes with the potential for substantial losses if not managed carefully.

In light of these considerations, investors must carefully assess their investment objectives and risk appetite before deciding which option suits their needs best. Those seeking a more conservative, diversified, and lower-risk approach may find currency ETFs to be a suitable choice. In contrast, investors willing to accept higher volatility and potentially greater returns might opt for currency pairs.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.